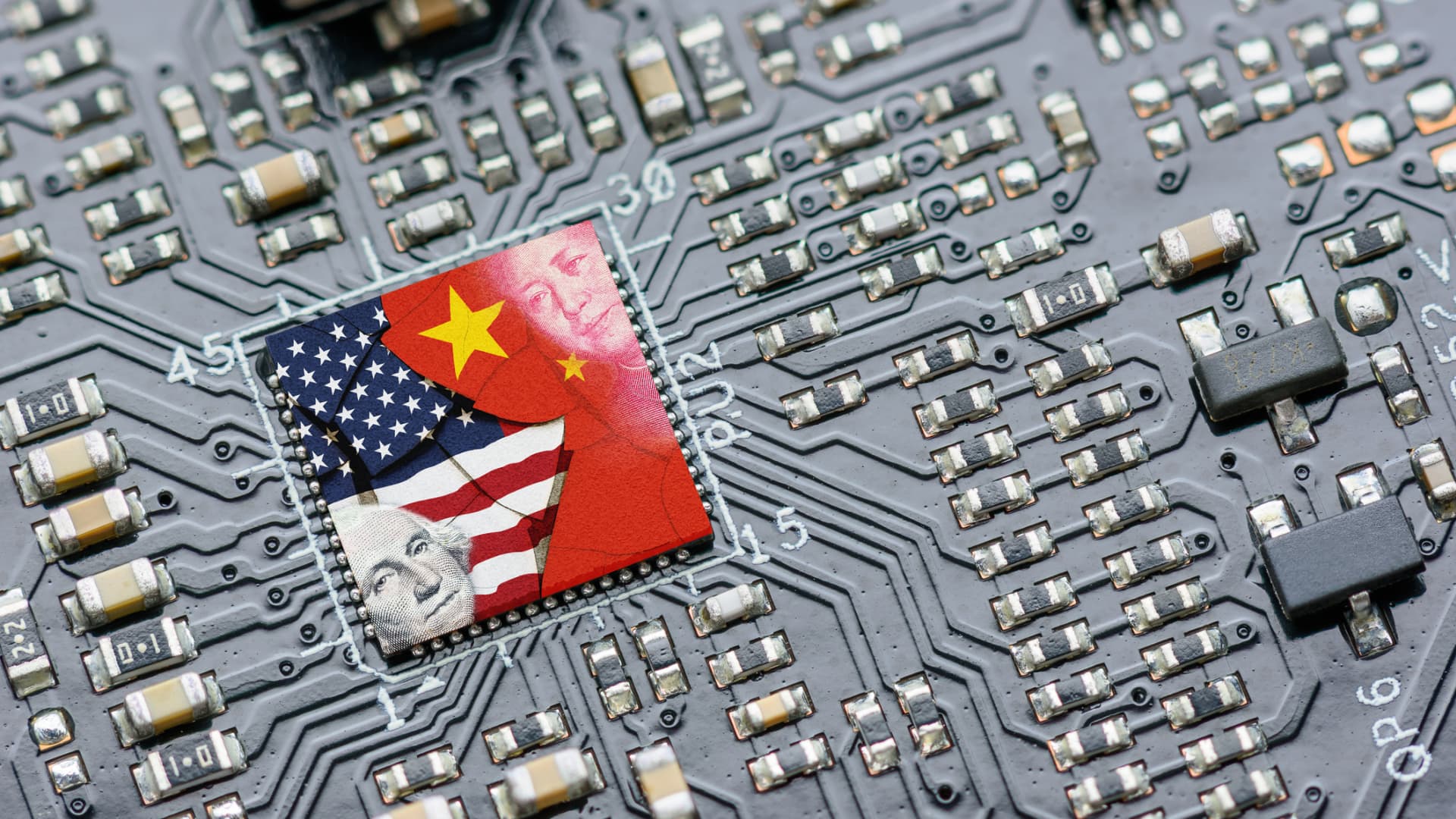

Semiconductors are a critical focus in the technological innovation trade war using place involving the U.S. and China.

William_potter | Istock | Getty Pictures

The Senate overwhelmingly backed legislation Tuesday that would call for U.S. firms to notify the Treasury when investing in highly developed Chinese know-how, on the basis of nationwide protection fears.

Which is a toned-down edition of the preliminary Outbound Financial commitment Transparency Act introduced two yrs ago, which identified as for limiting financial commitment — and attracted a good volume of pushback, according to a Senate aide.

The latest laws, which does not have to have assessment or expenditure curbs, still faces a system prior to it can turn out to be regulation. It is 1 of quite a few steps in a protracted backlog of proposed legislation policymakers on the Hill are rushing to crystal clear ahead of a thirty day period-long recess in August.

The monthly bill will come as President Joe Biden has long been envisioned to challenge an govt purchase that would limit U.S. financial commitment in large-close Chinese tech.

The aide instructed CNBC that this executive get could be additional significantly-reaching than what legislators are equipped to pass at this time.

The White Dwelling did not straight away react to a ask for for remark following business several hours.

The latest legislation handed the Senate 91-6 in a rare bipartisan arrangement, underscoring U.S. worries in excess of China’s development of innovative technologies in an intensifying global battle for technological supremacy.

The monthly bill is an amendment co-sponsored by Sens. Bob Casey, D-Pa., and John Cornyn, R-Texas, and section of the broader Nationwide Defense Authorization Act. The Senate is envisioned to vote on the defense act by the stop of the 7 days.

“When American companies spend in technology like semiconductors or AI in nations around the world like China and Russia, their funds, intellectual house, and innovation can slide into the incorrect palms and be weaponized versus us,” Cornyn mentioned in a assertion.

“This bill would improve the visibility of these investments, which will aid the U.S. acquire the data needed to far better evaluate our national protection vulnerabilities, confront threats from our adversaries, and keep on being competitive on the world wide phase.”

Escalating technological war

In October, the U.S. launched sweeping rules aimed at cutting off exports of key chips and semiconductor tools to China, lobbying significant chipmaking nations to do the similar.

On Sunday, Japan grew to become the newest place to align with the U.S. after tools employed to manufacture semiconductors have been incorporated among the 23 fresh additions to Tokyo’s export command record.

Previous month, the Netherlands, home to ASML, just one of the most significant semiconductor corporations in the planet, declared new export limitations on innovative semiconductor tools. Organizations in the Netherlands will want to use for a license to export particular advanced semiconductor manufacturing equipment overseas, under rules that will occur into outcome on Sept. 1.

U.S. Treasury Secretary Janet Yellen had assured her Chinese counterparts two months ago that any curbs on U.S. outbound investments would be “clear” and “pretty narrowly focused.” It was not apparent whether she was referring to distinct legislation or an executive get.

Just days ahead of Yellen’s Beijing go to, China experienced responded by slapping export curbs on chipmaking metals and their compounds — which China’s Ministry of Commerce claimed to have given the U.S. and Europe progress notice of.