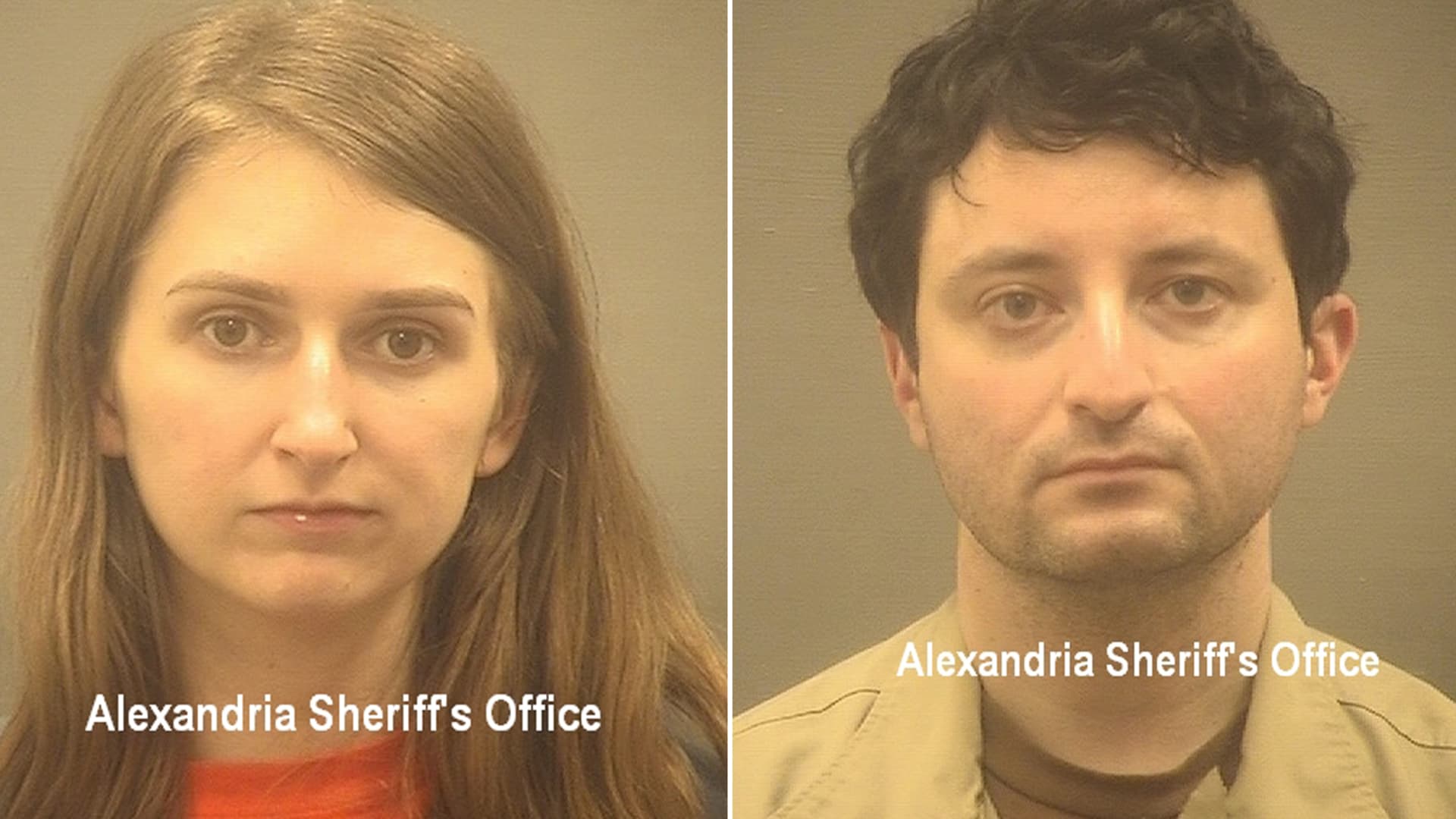

Booking photos for Heather Morgan and Ilya Lichtenstein.

Courtesy: Alexandria Adult Detention Center.

The New York couple charged with trying to launder $4.5 billion in bitcoin stolen in a 2016 hack of Bitfinex appear set to plead guilty in the case.

The couple, Ilya Lichtenstein and Heather Rhiannon Morgan, have been newly charged in the case with a document known as an information, according to a new Washington, D.C., federal court docket entry Friday.

An information is a type of charging document that federal prosecutors typically use when defendants have agreed to plead guilty.

Another docket entry shows that Lichtenstein and the aspiring rapper Morgan have been ordered to appear in court on Aug. 3 for separate arraignments and plea hearings on the information.

The nature of the charge or charges in the information was not made public. It is common for informations to have fewer charges than those originally lodged against defendants, or to have different ones.

Judge Colleen Kollar-Kotelly on Friday ordered prosecutors and defense lawyers to provide plea paperwork to her by Thursday, the docket shows.

That paperwork is to include “charged offense(s) and statutory provision; charge(s) in plea and statutory provision; elements of the offense; copy of the plea agreement; penalties; and [federal sentencing] guideline calculations.”

The couple was originally charged in a criminal complaint when they were arrested in February 2022, and had pleaded not guilty to the charges listed in that document – money laundering conspiracy and conspiracy to defraud the United States.

Morgan, known as “Razzlekhan,” is free on a $3 million bond. Lichtenstein, whose nickname is “Dutch,” has been held in jail since February 2022 without bond after a judge ruled that the Russian emigre was a flight risk.

The U.S. Attorney’s Office in Washington, which is prosecuting the couple, declined to comment. Their defense lawyers didn’t immediately respond to requests for comment from CNBC.

Prosecutors had said weeks after the couple’s arrests that they were in plea negotiations with them.

The couple’s case has been repeatedly continued since their arrests. Until Friday’s new docket entries, they had been scheduled to appear at a status hearing on Monday. That hearing was vacated as a result of the new charging document being filed.

Lichtenstein, 34, and the 32-year-old Morgan are accused of trying to launder the proceeds of 119,754 bitcoin that were stolen from Bitfinex’s platform in August 2016. The couple was not charged in the hack of the Hong Kong-based cryptocurrency exchange.

At the time of their arrests, the Department of Justice said officials had been able to seize more than 94,000 bitcoin involved in the hack, which at that time of the seizure was worth about $3.6 billion. That was the largest financial seizure in DOJ history.

The bitcoin stolen in the hack was worth just $70 million at the time of the theft, but soared in value in the following years.

“Over the last five years, approximately 25,000 of those stolen bitcoin were transferred out of Lichtenstein’s wallet via a complicated money laundering process that ended with some of the stolen funds being deposited into financial accounts controlled by Lichtenstein and Morgan,” the DOJ said at the time of their arrests.

Netflix in early 2022 announced it had commissioned a series on the couple.