Work progress eased in June, using some steam out of what experienced been a stunningly solid labor marketplace.

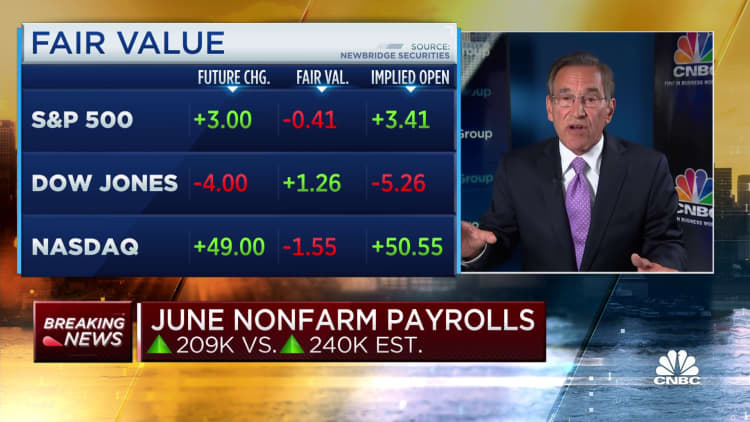

Nonfarm payrolls amplified 209,000 in June and the unemployment level was 3.6%, the Labor Office noted Friday. That as opposed to the Dow Jones consensus estimates for advancement of 240,000 and a jobless level of 3.6%.

The full, when however reliable from a historic perspective, marked a substantial drop from May’s downwardly revised overall of 306,000 and was the slowest month for career creation because payrolls fell by 268,000 in December 2020. The unemployment fee declined .1 proportion level.

Carefully watched wages numbers have been somewhat stronger than anticipated. Typical hourly earnings enhanced by .4% for the thirty day period and 4.4% from a year back.

Occupation development would have been even lighter with no a improve in governing administration careers, which amplified by 60,000, pretty much all of which came from the condition and neighborhood amounts.

Other sectors exhibiting robust gains were health and fitness care (41,000), social assistance (24,000) and design (23,000).

Leisure and hospitality, which had been the strongest task-advancement motor more than the previous 3 years, extra just 21,000 jobs for the thirty day period. The sector has cooled off substantially, showing only muted gains for the previous 3 months.

The retail sector shed 11,000 work opportunities in June while transportation and warehousing saw a drop of 7,000.

There experienced been some anticipation that the Labor Office report could demonstrate a substantially higher than expected number just after payrolls processing company ADP on Thursday documented development in non-public sector positions of 497,000.

Markets moved lessen following the launch of the work report, with futures tied to the Dow Jones Industrial Ordinary off nearly 90 points. Lengthier-dated Treasury yields have been somewhat increased.

“A 209,000 increase in payrolls can barely be described as weak,” said Seema Shah, chief global strategist at Principal Asset Administration. “But just after yesterday’s ADP wrongfooted investors into expecting another bumper careers range, the marketplace may possibly be upset.”

The labor pressure participation price, regarded a essential metric for resolving a sharp divide amongst employee demand from customers and source, held continual at 62.6% for the fourth consecutive month and is continue to down below its pre-pandemic level. On the other hand, the key-age participation rate — measuring those amongst 25 and 54 years of age — rose to 83.5%, its maximum in 21 several years.

A extra encompassing unemployment level that involves discouraged employees and all those holding aspect-time work for financial reasons rose to 6.9%, the highest due to the fact August 2022. At the identical time, the unemployment rate for Blacks jumped to 6%, a .4 share level raise, and rose to 3.2% for Asians, a .3 proportion issue rise.

In addition to a downward revision of 33,000 for the May well rely, the Bureau of Labor Statistics sliced April’s whole by 77,000 to 217,000. That brought the 6-thirty day period ordinary to 278,000, down sharply from 399,000 in 2022.

The positions numbers are deemed a important in figuring out wherever Federal Reserve financial policy is headed.

Policymakers see the sturdy work opportunities sector and the supply-need imbalance as supporting propel inflation that close to this time in 2022 was working at its greatest stage in 41 years.

They are using interest level boosts to test to cool the financial state, but the labor marketplace thus significantly has defied the central bank’s tightening endeavours.

In modern days, Fed officials have supplied sign that more rate hikes are likely even nevertheless they decided in opposition to relocating at the June conference.

Marketplaces broadly anticipate a quarter proportion place boost in July that would choose the Fed’s benchmark borrowing price to a specific vary among 5.25%-5.5%. The outlook was tiny adjusted subsequent the release, with traders pricing in a 92.4% probability of a hike at the July 25-26 assembly.

The June report “implies labor market situations are lastly starting to simplicity much more markedly,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics. “That explained, it is not likely to quit the Fed from hiking fees all over again later on this thirty day period, especially when the downward trend in wage advancement appears to be stalling.”