HONG KONG, CHINA – JUNE 05: A pedestrian walks by an electronic display exhibiting the numbers for the Cling Seng Index on June 5, 2023 in Hong Kong, China. (Image by Chen Yongnuo/China News Service/VCG through Getty Photographs)

China News Assistance | China News Support | Getty Photos

Investors will now be equipped to trade chosen Hong Kong stocks in each the Hong Kong dollar and Chinese yuan in the so-called dual counter plan that introduced Monday.

The newly launched “HKD-RMB Dual Counter Design” will see an first 24 providers begin presenting yuan counters to allow for investors in Hong Kong to trade in the yuan, in addition to the Hong Kong forex. Corporations on the record include tech heavyweights like Tencent, Alibaba and Baidu.

The dual counter design covers securities listed in both Hong Kong greenback and renminbi counters only. The Hong Kong Exchange explained all shares of the same securities in the two diverse investing counters will be “absolutely interchangeable involving counters.”

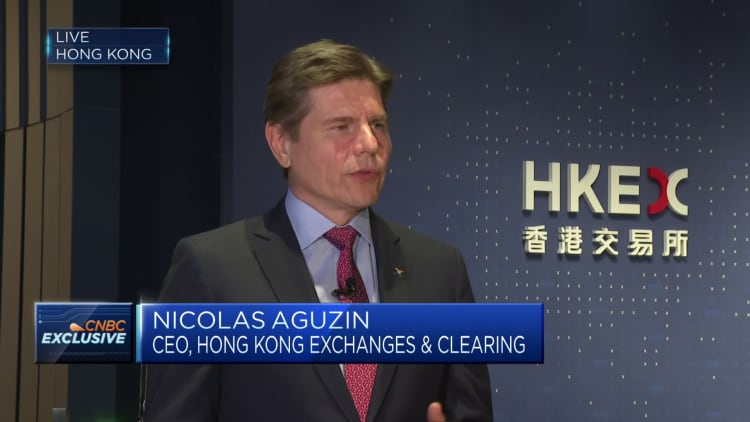

In an unique job interview on CNBC’s “Squawk Box Asia,” Hong Kong Exchanges and Clearing CEO Nicolas Aguzin stated the go was aimed at supplying traders more solutions for investments, as very well as a lot more diversification options.

“This system is aimed at quantity one, producing confident that we give far more choices to investors. Quantity two, that we go on aiding on the internationalization of the renminbi.” Thirdly, he said it “solidifies” Hong Kong’s position as a yuan trading hub.

The HKEX CEO mentioned that the preliminary batch of 24 businesses make up about 40% of the common day by day investing quantity in the Hong Kong.

“We would anticipate that to continue expanding,” he additional. “And around time, I imagine a wonderful vast majority of the shares in our markets will be taking part in this program.”

With trading volumes in Hong Kong at a 4 yr minimal, Aguzin reported he expects an raise in turnover from the new dual join product, noting there are “a great deal” of yuan deposits in Hong Kong. As these kinds of, “you’re tapping a liquidity pool that is in renminbi that will now be ready to devote immediately,” he pointed out.

The essential objective is to simplify the southbound circulation of investments from the mainland, Aguzin reported.

Investments from the mainland are presently carried out by way of the Southbound Stock Connect, which lets mainland traders to purchase Hong Kong stocks in Hong Kong pounds.

Stock Connect is a mutual market place entry plan that permits traders in mainland China to trade and settle shares in Hong Kong by using exchanges and clearing dwelling in their dwelling industry, and vice versa.

Aguzin highlighted that it’s “pretty inconvenient for the mainland traders, [and] the simple fact that they will 1687154527 be equipped to transact in an quick foundation in renminbi, which is a huge change.”

He foresees additional financial commitment move from the mainland, specially from retail buyers.

“A person of the issues of Hong Kong is it’s only 7 million individuals. So it is really pretty limited in phrases of retail. But the mainland, 1.4 billion people today, that’s a good deal. And a large amount of that can come via Inventory Connect and assist liquidity in our industry.”

The dual counter model will originally focus on the choices at buyers holding offshore yuan, and at some point, empower mainland traders to trade yuan shares listed in Hong Kong using onshore yuan, Reuters reported.

Even though there is no organization day for when investments by way of Inventory Hook up will be capable to obtain the twin counter product, Aguzin claimed this will take a small little bit of time, and the HKEX is doing the job carefully with regulators and other stakeholders to make positive everything will be in put just before producing an announcement.

Not the initially test

This is not the initially time that these kinds of a plan is staying launched in Hong Kong.

In 2012, the Hong Kong trade released a related plan identified as the “twin tranche, twin counter” design, which permitted the issuer to give and listing two tranches of shares in both the Hong Kong greenback and Chinese yuan.

As with present day dual counter model, shares of the two RMB tranche and the HKD tranche have been of the exact same course, and shareholders less than these two tranches are envisioned to be dealt with similarly.

In accordance to Bloomberg, that scheme unsuccessful to choose off when only a single corporation took it up.

The change this time is that there is a “twin counter market maker software” — aimed at delivering liquidity to the yuan counter and reducing selling price discrepancies involving the Hong Kong greenback and yuan counters.

Aguzin stated there are currently 9 of these market place makers that have signed up, and he thinks this “should really motivate a ton of activity and [make] absolutely sure that the marketplaces are actually stabilized in each marketplaces.”