Examine out the businesses building the most significant moves midday.

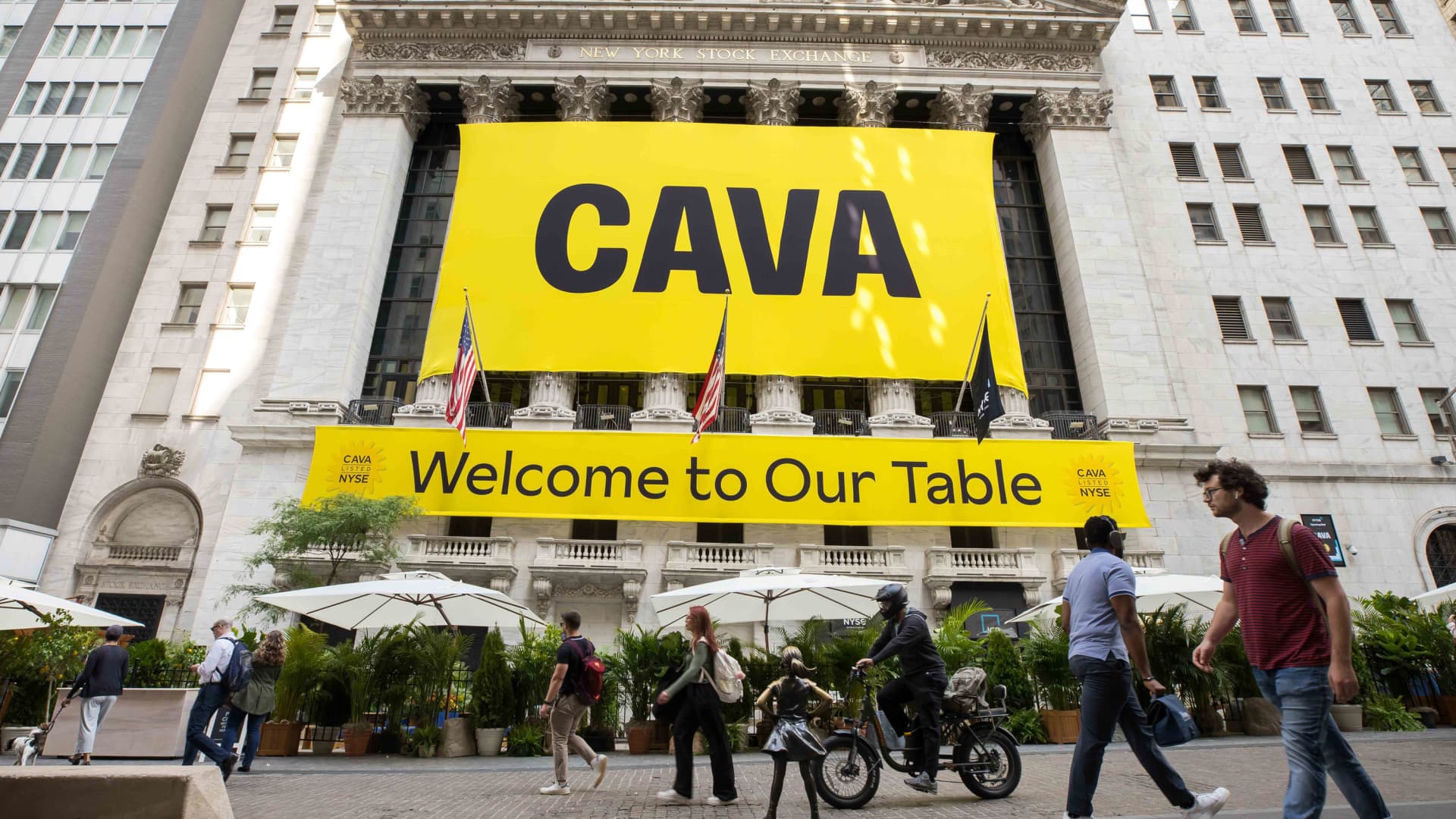

Cava Group — Shares soared 91% in midday buying and selling during its initially day as a community business. Cava Team priced its original public supplying at $22 for every share and commenced investing Thursday at $42 for every share.

SkyWest — The airline inventory acquired 5.7% soon after being upgraded by Deutsche Bank to invest in from keep. The Wall Road company reported it thinks there will be “substantial improvement” in the company’s return on invested cash in excess of the upcoming two to 3 decades. Deutsche Lender also upgraded Allegiant, which was up 1.4% in midday trading.

Domino’s Pizza — The pizza chain received 6.2% following Stifel upgraded the inventory to get from keep. The business reported shipping gross sales must stabilize even further whilst carryout income select up in the subsequent year.

Kroger — Shares dropped 3%. On the firm’s earnings get in touch with Thursday, Kroger CEO Rodney McMullen reported, “The economic setting is far more drastically impacting our spending budget-mindful buyers.” The corporation reaffirmed equivalent sales, devoid of gasoline, and modified earnings-for each-share guidance for the complete 12 months. Kroger also posted revenue that arrived in a bit beneath Wall Street’s anticipations. Profits for the initially quarter ended up $45.17 billion, in contrast with analysts’ forecast of $45.26 billion, according to FactSet.

Focus on — Shares of the significant-box retailer jumped practically 3% following Bernstein reiterated its outperform rating on the stock. The Wall Street agency explained investors must buy the weak spot in Goal shares, which are down 15% more than the previous month.

Lennar — Shares of the homebuilder rose extra than 3% Thursday. Lennar claimed superior-than-expected results for the fiscal second quarter Wednesday night. The organization claimed it created $3.01 in earnings per share on $8.05 billion in profits. Analysts ended up expecting $2.33 in earnings for every share on $7.22 billion of profits, according to FactSet. The company’s earnings were boosted by gains on technological know-how investments, but Lennar still would have overwhelmed expectations excluding that reward. Lennar also hiked its full-year steering for household deliveries.

SoFi Technologies — The economical technological innovation inventory slid 4.2% subsequent a downgrade by Oppenheimer to carry out from outperform. The Wall Avenue organization explained it was bullish lengthy phrase, but believes the inventory cost has been seeing appreciation considerably more robust than expert in the broader current market.

AutoZone — The inventory additional 3% just after the automobile elements retailer licensed the repurchase of an supplemental $2 billion of the company’s popular inventory late Wednesday.

Corning — Shares attained 2% soon after Citi upgraded Corning to obtain from neutral. The Wall Street firm also boosted its value concentrate on to $40 from $36, suggesting upside of additional than 20% from Wednesday’s near. Citi reported it has “better conviction” in the glass maker’s margin restoration opportunity.

John Wiley & Sons — Shares sank about 16% in midday trading. The enterprise documented modified earnings for every share for the fiscal fourth quarter of $1.45, up from $1.08 for each share a 12 months in the past. On the other hand, revenue declined, coming in at $526.1 million, in contrast with $545.7 million last year. Administration also introduced a restructuring approach, divesting its noncore schooling enterprises.

Coinbase — The stock fell 1% after Mizuho questioned if traders were being shifting to Robinhood. Mizuho reiterated its underperform ranking on the crypto platform in a take note to purchasers.

Patterson-UTI Power, NexTier Oilfield Methods — The two firms agreed to merge in an all-stock deal with an company value of $5.4 billion. Shares of Patterson-UTI Electrical power rallied nearly 11% though NexTier Oilfield Remedies received 4%

T-Cellular — T-Cell popped 3.9% all through midday buying and selling. Morgan Stanley reinstated the telecommunications inventory as a leading select, indicating T-Cell is very well-positioned to get gain of marketplace volatility with a solid buyback program.

— CNBC’s Yun Li, Alex Harring, Jesse Pound and Sarah Min contributed reporting.