Turkey’s President Recep Tayyip Erdogan has named former economic system main Mehmet Simsek as his new treasury and finance minister.

Source: Globe Economic Discussion board

In the unveiling of his new cupboard, Turkey’s President Recep Tayyip Erdogan named previous financial state main Mehmet Simsek as his new treasury and financial system minister, major to some optimism that the nation will now forge a new economic route.

Simsek was recognised for his sector friendly policies, and subsequently went on to develop into the country’s deputy key minister from 2015 to 2018 after his stint as Turkey’s finance minister.

Erdogan, whose victory in the 2023 presidential election suggests an extension of his rule into a third 10 years in electricity, has improved most of his cupboard customers with exception of the well being and lifestyle ministers.

Simsek generating a new workforce in the crucial financial state portfolio would indicate that he will have “rather robust control in excess of broader economic plan,” BlueBay Asset Management’s Senior EM Sovereign Strategist Timothy Ash stated by using e-mail. “The Turkish financial system has a prospect of pulling again from the brink,” he continued.

Goldman Sachs’ analysts in the same way hold the watch that the new appointment could convey about a higher prospect of far more orthodox policies.

“We imagine the choice of Mehmet Simsek as the new treasury and finance minister will increase the chance that monetary coverage will change towards a much more orthodox route,” Goldman wrote in a report dated June 3.

Turkey’s monetary coverage now spots an emphasis on the pursuit of development and export competitiveness relatively than taming inflation. Defying classic monetary procedures, Erdogan endorses the unconventional check out that boosting fascination prices boosts inflation, placing the central financial institution on a price-reducing cycle amid surging inflation.

The Turkish lira has been on a important depreciation lower in new decades, in element owing to Erdogan’s procedures and his influence more than the country’s central lender. This fall has enhanced considering the fact that the second round of the presidential elections, sliding to fresh lows subsequent Erdogan’s re-appointment.

The lira was buying and selling at 21.1023 in opposition to the greenback on Monday early morning, soon after starting the calendar year at approximately 18.6935.

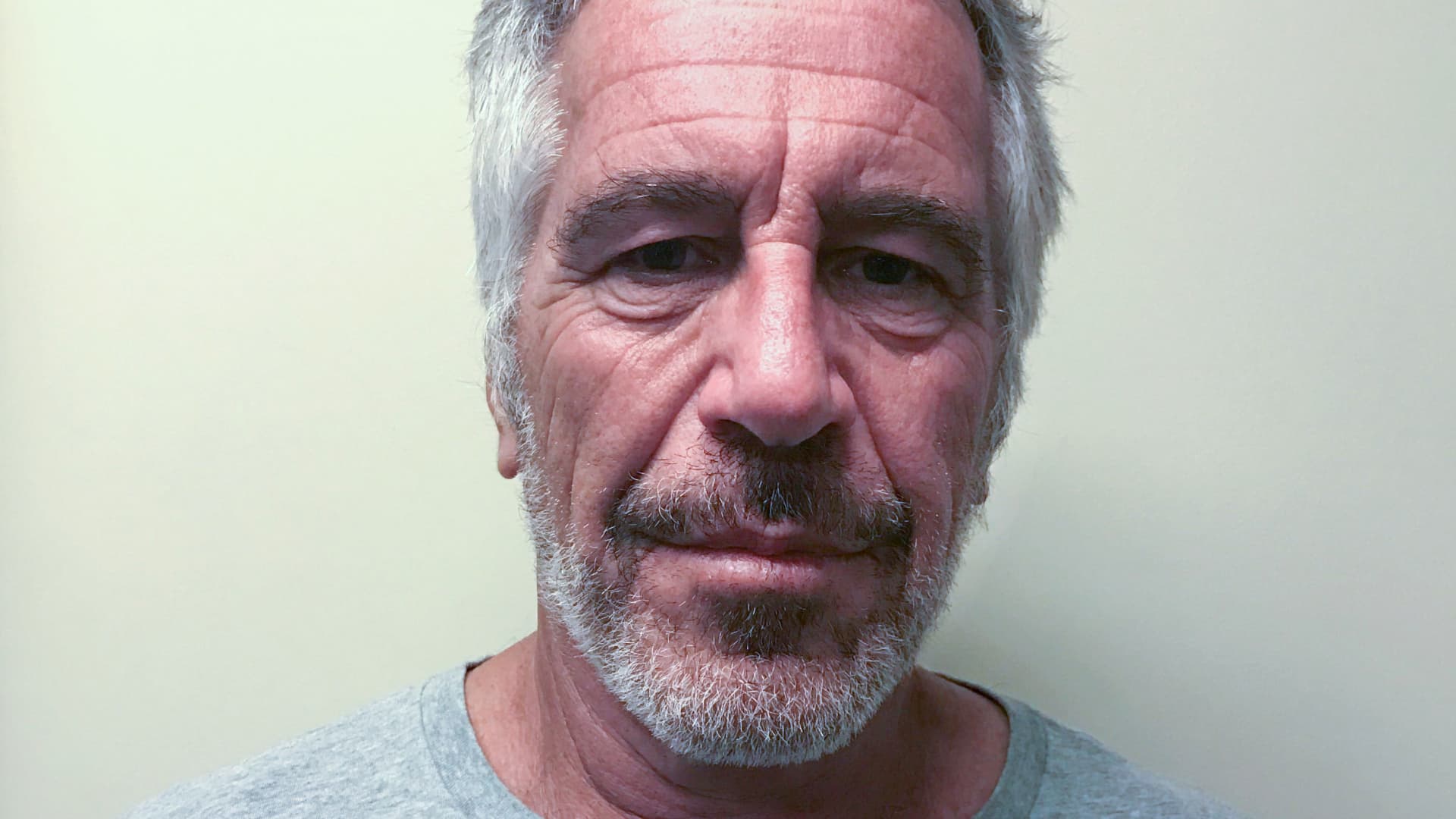

Turkish President Recep Tayyip Erdogan’s new Cabinet at the Cankaya Palace.

Anadolu Company | Anadolu Company | Getty Images

Goldman Sachs forecasts that the currency still has area to weaken more to further lows: 28 against the dollar in 12 months, in contrast to a prior estimate of 22.

“We revise our USD/Consider forecasts better to 23.00, 25.00 and 28.00 in 3-, 6- and 12-months (compared to 19.00, 21.00 and 22.00, previously),” the expense bank’s analysts wrote.

Wolfango Piccoli, the co-president of study agency Teneo thinks that Simsek’s return will “at greatest” produce a partial re-adjustment of Turkey’s present-day economic policy. Piccoli included that a remarkable U-turn that embraces an outright common financial plan strategy is unlikely.

“It is also unclear for how prolonged Erdogan may tolerate a far more pragmatic stance on the financial entrance,” he reported in a research note dated June 2. “To Erdogan, Simsek is the trick he employs right until the marketplaces give Turkey some respite.”