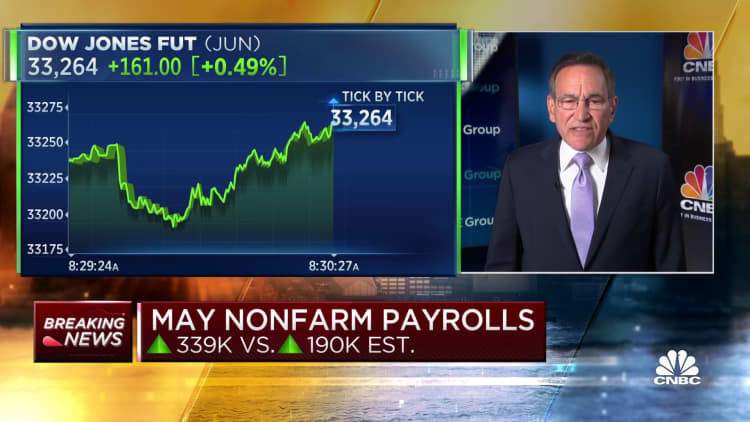

The U.S. economic system ongoing to crank out work opportunities in May possibly, with nonfarm payrolls surging much more than expected in spite of various headwinds, the Labor Office described Friday.

Payrolls in the public and non-public sector improved by 339,000 for the month, greater than the 190,000 Dow Jones estimate and marking the 29th straight month of good task expansion.

related investing information

The unemployment fee rose to 3.7% in Could against the estimate for 3.5%, even even though the labor pressure participation level was unchanged. The jobless rate was the maximum given that October 2022, though continue to near the least expensive since 1969.

Ordinary hourly earnings, a key inflation indicator, rose .3% for the month, which was in line with anticipations. On an yearly foundation, wages amplified 4.3%, which was .1 proportion place under the estimate. The normal workweek fell by .1 hour to 34.3 hours.

Marketplaces reacted positively to the report, with futures tied to the Dow Jones Industrial Average up about 200 points. Treasury yields rose as properly.

“The U.S. labor sector carries on to show grit amid chaos – from inflation to substantial-profile layoffs and growing gas costs,” claimed Becky Frankiewicz, president and main industrial officer of Manpower Team. “With 339,000 position openings, we’re still rewriting the rule e-book and the U.S. labor sector carries on to defy historic definitions.”

May’s choosing leap was virtually accurately in line with the 12-thirty day period ordinary of 341,000 in a job industry that has held up remarkably effectively in an economy that has been slowing.

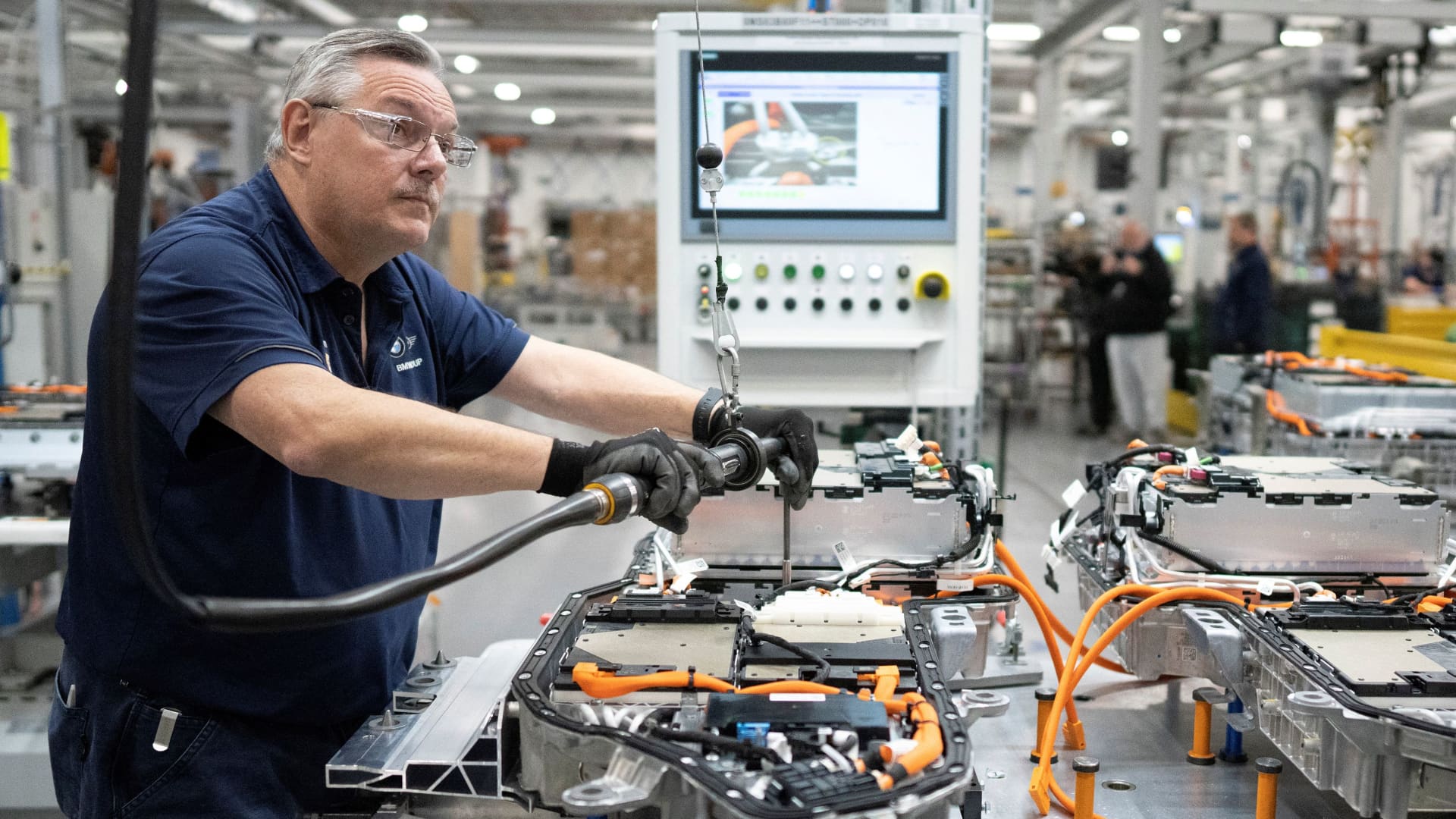

Specialist and organization products and services led career generation for the month with a web 64,000 new hires. Federal government assisted improve the numbers with an addition of 56,000 work, whilst wellness care contributed 52,000.

Other noteworthy gainers integrated leisure and hospitality (48,000), design (25,000), and transportation and warehousing (24,000).

Inspite of the significant work opportunities obtain, the unemployment fee amplified owing in huge aspect to a sharp decrease of 369,000 in self-work. That was aspect of an overall drop of 310,000 counted as employed in the residence survey, which is applied to compute the unemployment price.

An different measure of unemployment that encompasses discouraged staff and those keeping portion-time positions for economic motives edged greater to 6.7%.

May’s work figures arrive amid a challenging time for the economy, with quite a few specialists still anticipating a recession later on this calendar year or early in 2024.

Latest facts has shown that individuals continue to commit, though they are dipping into personal savings and significantly working with credit rating cards to pay out for their purchases. A resilient labor sector also has aided underpin spending, with task openings climbing back again previously mentioned 10 million in April as companies nevertheless locate it difficult to fill open up positions.

One main probable headache seems to have been removed, as warring factions in Washington this week have arrived at a financial debt ceiling offer. The settlement is on its way to President Joe Biden’s desk for a signature following passage in the Property and Senate this 7 days.

There remain other troubles in advance, however.

The Federal Reserve has lifted benchmark desire charges 10 occasions considering the fact that March 2022 in an effort to fight inflation that has not gone away. In current times, some policymakers have indicated a willingness to get a break in June from the succession of hikes as they search to see what effects the plan tightening is possessing on the financial state.

Nevertheless, odds for a June fee hike rose right after the work report. Traders have been pricing in about a 38% prospect of one more quarter-stage raise, according to CME Team knowledge.

Other data details have proven that the manufacturing sector of the financial state is in contraction, however the much larger products and services sector has held in expansion. The ISM producing index introduced Thursday also showed that prices are pulling back again, a good indication for the Fed.