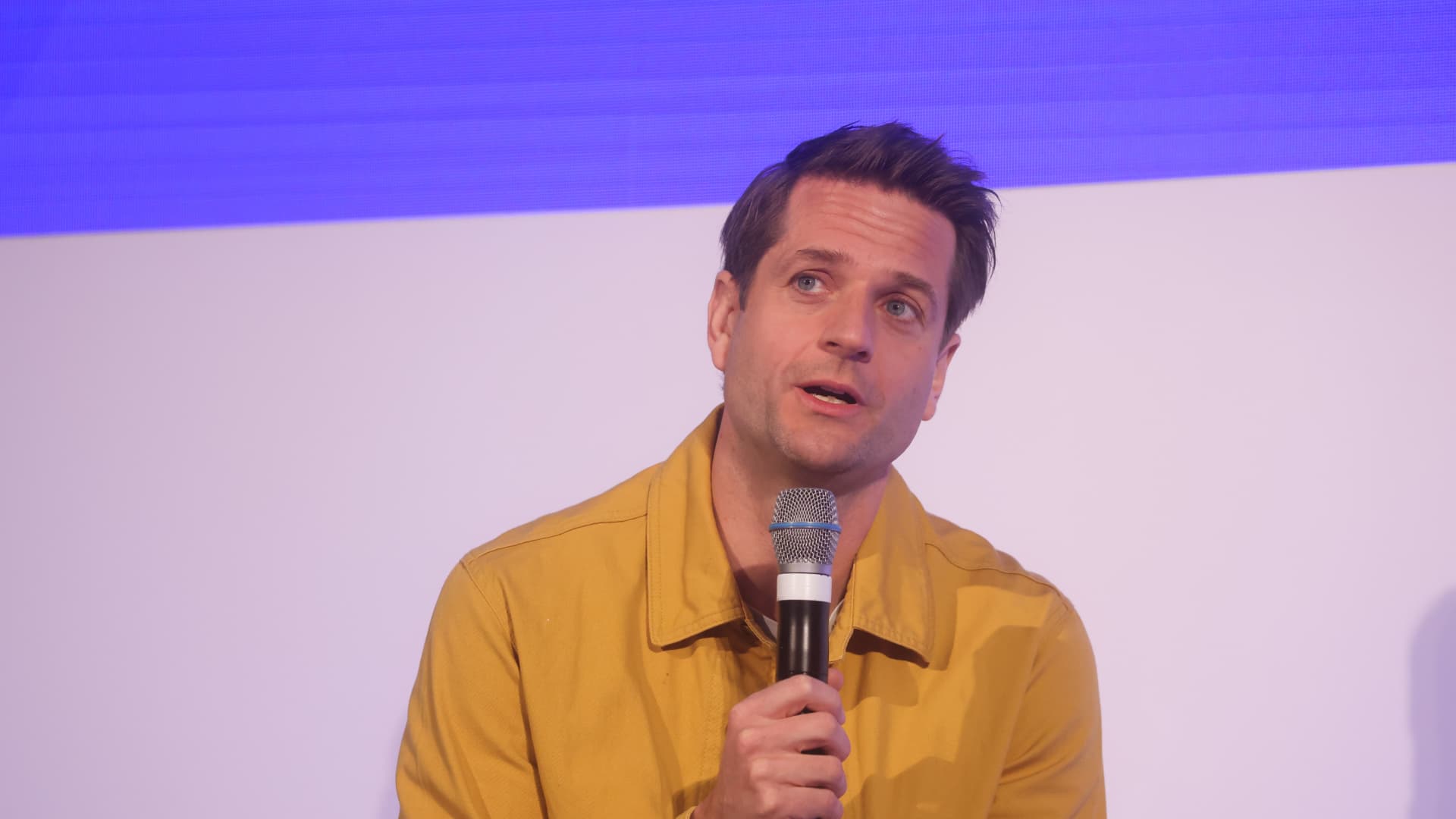

Sebastian Siemiatkowski, CEO of Klarna, speaking at a fintech party in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg through Getty Photos

Klarna, the Swedish invest in now, pay back later fintech corporation, halved its web decline in the 1st quarter, recording a considerable advancement in its bottom line just after a key value-reducing generate.

The business posted a net loss of 1.3 billion Swedish krona ($120.7 million), down 50% from the 2.6 billion krona reduction in the exact same time period a year in the past.

Klarna reported total net working profits of 5 billion Swedish krona, up 22% yr-about-year.

“This quarter we’ve impressively managed to develop GMV and revenue, at the same time as we minimize charges and credit history losses, and also investing ambitiously in AI pushed products,” Klarna CEO Sebastian Siemiatkowski stated in a assertion.

“We are on monitor to attain profitability this yr all whilst revolutionizing shopping and payments via our AI-powered tactic.”

Siemiatkowski earlier instructed CNBC the firm was setting up to realize profitability in the 2nd 50 percent of 2023.

Klarna attributed the most current reduction in losses to a drop in shopper defaults thanks to an improvement in its underwriting, as properly as to diversification into other resources of profits, this kind of as marketing and advertising.

The success demonstrate how Klarna is creating “substantial strides” toward profitability on a regular monthly foundation, the organization reported.

Klarna, which now has more than 150 million consumers, was in April specified a credit history ranking of BBB/A-3 with a stable outlook by S&P International. The scores agency at the time said this reflected Klarna’s “ability to defend its sturdy e-commerce situation in its crucial markets, rebuild profitability,” and “keep a robust capital buffer.”

Early indications sign that Klarna’s deep value-reducing actions are setting up to spend off. The corporation went on a choosing spree in the course of 2020 and 2021 to capitalize on development induced by the Covid-19 pandemic, and was pressured to cut down headcount by about 10% in Might 2022 in response to investor pressure to trim down functions. Regardless of this measure, it nevertheless afterwards misplaced 85% of its marketplace benefit in a funding round past summer season.

Klarna is not by yourself in its troubles. Acquire now, pay out afterwards corporations, which allow buyers to defer payments to a later on day or spend more than installments, have been notably impacted by souring trader sentiment on technological innovation, amid a worsening macroeconomic atmosphere.

AI drive

Extra lately, Klarna has turned its focus toward AI. The corporation revamped its application with a more sophisticated AI advice algorithm to assist its retailers target clients additional properly.

Klarna formerly released the means to combine OpenAI’s ChatGPT into its company with a plugin that lets people question the preferred AI chatbot for procuring inspiration. The organization said it was embedding AI in its enterprise to “boost internal efficiencies and deliver prospects with an even far better support and working experience,” for example as a result of real-time translations in consumer chat.

The firm has now also made a foray into facilitating shorter-term holiday rentals. Earlier this month, Klarna declared a partnership with Airbnb to allow the on line trip rental firm’s clients guide holidays and shell out down the cost in excess of installments.