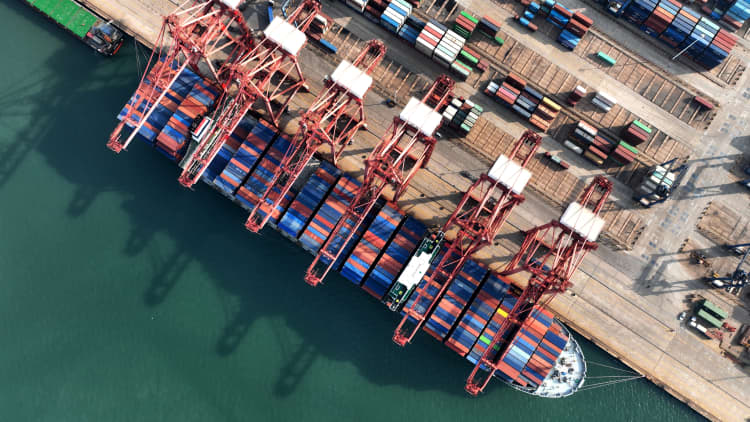

Cargo ships dock at the container terminal in Lianyungang Port, East China’s Jiangsu province, Dec 7, 2022.

CFOTO | Long run Publishing | Getty Visuals

The Covid hangover of inventories carries on to be a big headache for retailers and the logistics corporations which make revenue moving their merchandise. As peak retail trade get time nears — July is the official start out of the back again-to-faculty and vacation order inventory build that runs as a result of October — executives in the shipping market are keeping a watchful eye on get exercise.

Holiday getaway orders are customarily imported starting in August, with the production orders for these things built by stores as considerably as 6 months in advance. During that timeframe this 12 months, the U.S. client was going through record inflation and retail discretionary shelling out conduct was defined by a a lot more discerning shopper.

Inflation is coming down for, among other explanations, the Federal Reserve rate hikes cooling the financial system, but there is concern inside of the logistics industry that curiosity price coverage kills as well significantly demand from customers. In the notes from the most modern Fed conference launched on Wednesday, there was division among the central lender officials on whether a pause in hikes was merited at its decision in June, but there was a tilt in the minutes in the direction of pausing.

“If the Fed moves ahead with a different pair of level hikes notwithstanding the development we’re observing with disinflation and cooling inflation, that could have a true negative impression as it relates on desire,” explained James Gagne, SEKO Logistics CEO.

Nevertheless, category by classification, demand amounts fluctuate. Gagne said cosmetics, for illustration, appears to be to be in much greater condition than house enhancement.

“I feel it can be genuinely tricky to consider in the in close proximity to term given how significantly operate People have performed on what we connect with home improvement assignments in the last 24 to 36 months and then most likely provided exactly where desire prices may possibly even now go, we see a resurgence in the property enhancement classification,” he explained.

Dwelling Depot’s current quarterly released very last week showed its very first earnings skip due to the fact May 2020 and its most significant income skip because November 2002 with the organization citing “broad-centered tension throughout the company,” as perfectly as “more softening of demand from customers relative to our expectations, and ongoing uncertainty regarding client desire.”

SEKO executives said they are looking at people trade down in the products, but as considerably as which types will be the significant winners this peak year, it is far too soon to know.

“The pig in the python has still to go by way of when it relates to stock” reported Hans Hickler, president of Americas for SEKO Logistics.

How sticky inflation will affect holiday getaway buying

Wall Road CEOs you should not expect inflation to drastically decline, even if the Fed now has it underneath command. In new responses, JP Morgan Chase CEO Jamie Dimon has claimed to hope Fed charge hikes to access as substantial as 6% to 7% and Goldman Sachs CEO David Solomon reported he expects inflation to be “stickier and a lot more resilient.”

“If we foresee that inflation stays higher and we have uncertainties, men and women are heading to spend less and that impacts the general absolute figures and it truly is likely heading to be a decrease peak period,” said Tim Scharwath, CEO of DHL World wide Forwarding. But he included that even if peak year is lower this calendar year, there is however a opportunity it can be far better than 2022, nevertheless that’s not a substantial bar to obvious.

“It would be great if this year’s peak period could be a bit superior than ’22 looking at there was no peak last 12 months,” Scharwath explained. “So when the comparisons appear in for the second 50 percent of the yr and the numbers go up even a tiny and they cross that line in excess of 2022, I feel we are going to all be pleased.”

A peak season rebound would be a improve to earnings of logistics firms.

Both equally DHL And SEKO Logistics convey to CNBC they have not witnessed “peak period” bookings in the June or July information but they are cautiously optimistic for the next 50 % of the calendar year. Even however the common peak season starts in August, holiday break orders can commence arriving in June and July.

“The first fifty percent of the year has been muted,” Gagne explained. “Each business will see a diverse restocking function. Some companies are burning via inventory many others are not. It all relies upon on the commodities. People are paying on experiences.”

Hickler said SEKO is closely viewing the timing of orders.

“We are spending consideration to see if there is a condition exactly where anyone waits right up until the previous minute to get their products and solutions on the shelves for the holiday seasons and that could be another problem,” Hickler said. “But we will not see that taking place but. But it can be unquestionably some thing we’re watching.”

If orders did start to arrive in later on and in bunches, that could produce a container surge and provide chain delays.

Beneficial alerts from again-to-university orders

Alan Baer, CEO of OL United states, claims that although the sector and logistics business want a return to normalcy in the offer chain, a conventional peak season could be skipped this yr and not return until finally the third quarter of 2024.

“The compounding result of economic uncertainty, tightening credit rating benchmarks, and inventory overhang will guide to a muted, if any, peak period in the TransPacific Eastbound trade,” Baer said. “Volumes for now have ticked greater, on the other hand, until finally corporations see more powerful engagement from consumers, the long term ordering sample will keep on being underneath-development for the equilibrium of 2023.”

Every person is banking on a trade rebound later this year, according to Drew Wilkerson, CEO of RXO, the fourth-largest North American freight broker, but it stays unsure. “The hope for absolutely everyone is we would start out to see a pickup in the again fifty percent of the yr, but with just about every passing working day expectations get pushed into 4Q. With any luck , not Q1,” Wilkerson said.

Comparable to commentary from DHL, RXO is expecting a more robust peak period this calendar year because there was no peak year final calendar year. “I think getaway volumes will be extra in line, in 2018, 2019, possibly a bit behind that,” Wilkerson reported.

He included that again-to-university orders can deliver a go through on the buyer expectations among the vendors ahead of the holidays, and so much, which is sending a beneficial signal.

“Our discussions with purchasers for again-to-university are likely on now,” Wilkerson explained. “We are observing a good deal of clothing, and other back-to-university merchandise orders possibly on par to marginally up as opposed to very last yr. Previous calendar year it was up mainly because extra youngsters have been going back again to university in individual.”