The CEO of bond investing giant TCW Team, Katie Koch, heard what she wished to hear at this week’s CNBC CEO Council Summit. It was not good information, but it matched her view of exactly where the economic climate is headed. Koch, who explained herself as coming into the CEO assembly “in the camp of medium to difficult landing,” claimed she’d been shocked at latest occasions like the Milken Worldwide Conference the place she observed executives had been, in her text, “far too joyful.”

“CEOs are decidedly far more adverse,” she reported of the tenor of discussions she experienced at the CNBC CEO event, “and I consider that it really is a definitely, seriously significant information issue. … men and women are observing real degradation, revenues staying muted and career losses, so that will weigh on the financial system.”

At the identical time, she cited “a key get in touch with on world wide liquidity” which will place further strain on the financial system and a labor sector that is “starting off to crack.”

Which is a view that if not shared exactly notice-for-notice by CEOs on an economic panel at the CNBC CEO Council Summit, did go over a lot of of the well-identified arguments for a downturn that arrived up in discussion on the stage amongst CEOs from Wall Road to the steel industry and logistics sector.

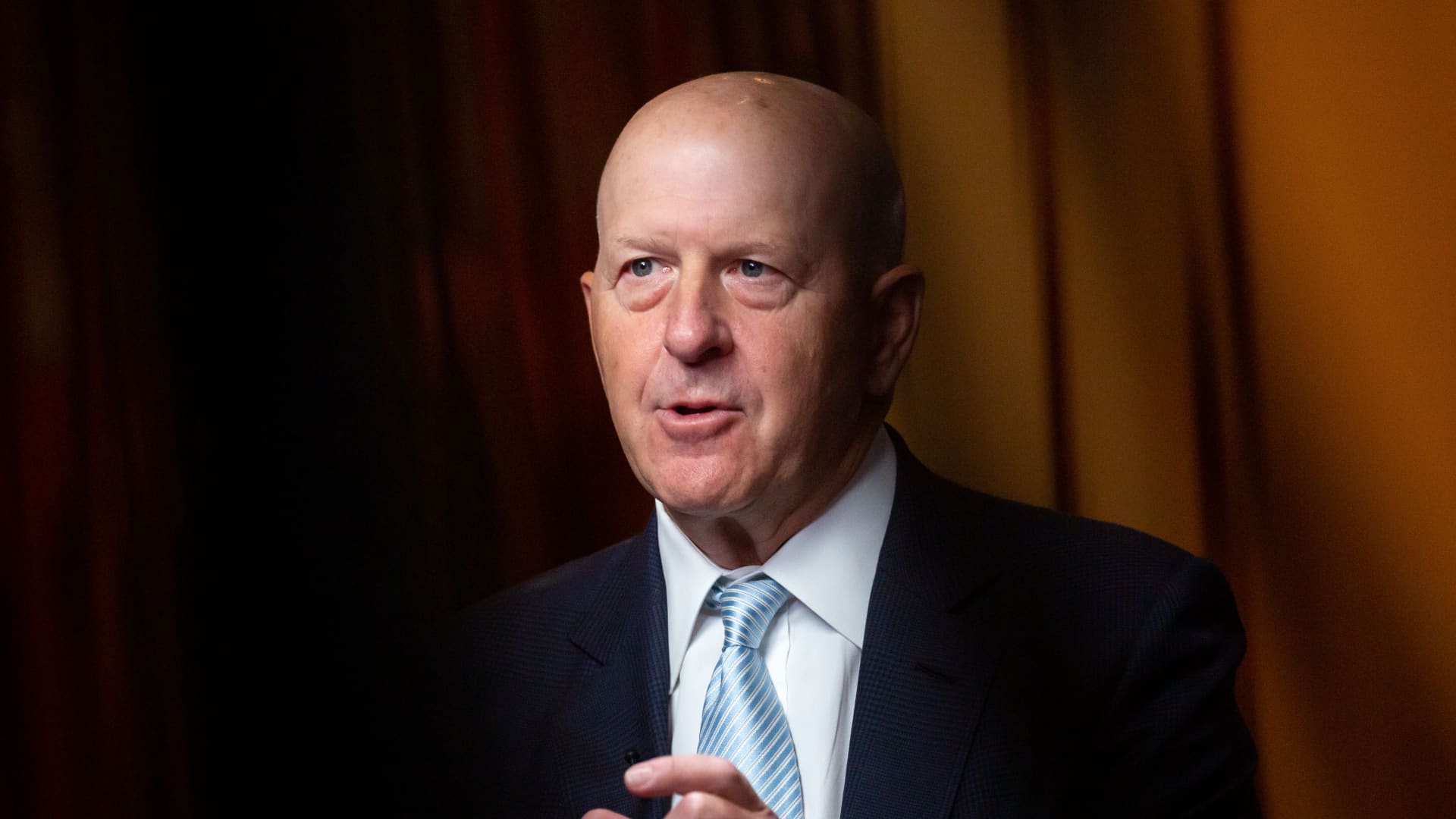

Although Goldman Sachs‘ financial analysis team proceeds to believe that a gentle landing is achievable for the economic system, and Goldman CEO David Solomon explained to fellow CEOs “it’s really hard to have a recession with total employment,” he extra that his individual talks with CEOs strengthen a watch that financial disorders are tightening and that does have “lag results.”

On Wednesday, the latest launch of Fed minutes showed the central bank’s leading officers to be split on the upcoming interest amount move, but exhibiting a tilt toward fewer intense plan.

The Goldman CEO is on file as getting no distinct for-or-versus recession simply call, but he reported, “it’s hard to tighten financial ailments and have inflation and not have an influence on development and some rebalancing of impacts.”

If there is a recession, Solomon states he is eager to make one prediction: it will be a “shallow” a single.

But Solomon, as perfectly as other CEOs, said there is one more wildcard factor in the present-day economic climate that will make whatever occurs subsequent deviate from the financial textbook.

Tamara Lundgren, CEO of Schnitzer Steel, there are two competing forces in the economy that can be noticed in the need for metals. A central financial institution travel to gradual the world wide overall economy, on the one particular hand, but a commodities industry also aligned more time-phrase with what she described as “two amazing industrializing transitions.”

One particular is the changeover to a lower-carbon overall economy which necessitates a remarkable total of metals and minerals, highlighted by copper for electrification. “We seldom see that juxtaposed with significant inflation and tightening credit score conditions and a travel by central financial institutions to sluggish expansion,” Lundgren said.

The other she cited is the rise of generative synthetic intelligence which will have implications for economic production and worker efficiency. Shares of Nvidia soared by as considerably as 25% as it neared a $1 trillion valuation on Thursday following a stellar Wednesday earnings report buoyed by the energy of AI chip demand from customers. Before on Wednesday from the CNBC summit, undertaking capitalist Jim Breyer experienced said Nvidia seems to be “unstoppable” in excess of the future three yrs.

All of the CEOs on the panel spoke about the effect AI and equipment understanding are presently having on their corporations and have experienced in excess of the earlier ten years, but when the Nvidia chip income between big cloud tech players and customer internet organizations are booming, the sectors represented by CEOs at the CNBC summit ended up not talking in terms of substantial new investments to deploy the most up-to-date technology of the know-how just nevertheless. With the hottest generative AI, Goldman is performing through plenty of use conditions and experiments, but “you want to go sluggish and be qualified and considerate and master,” Solomon said.

In recent buying and selling, metals led by copper have plunged in a signal of fears about the international economic climate and the momentum in China’s restoration, but that will come amid extended-time period perception that transitions which include EVs in the auto marketplace will retain the metals selling prices on an upward trajectory.

“The structural demand for metals is really critical,” Lundgren stated, and proper now, the competing forces are contributing to murkiness in the economic outlook. “With tightening in credit history we would typically see some effect on development, and we will see it in office environment development and business construction and warehouse construction … but tempering that will be large design as a result of the IRA and infrastructure payments,” she reported.

The importance of this structural pattern can be viewed from the present-day debt ceiling negotiations to geopolitical and economic rivalry with China.

China is the major person of metals in entire world and China’s financial habits can affect need, Lundgren stated, as it is undertaking proper now, but the focus of China’s regulate of important minerals has develop into evident to the relaxation of environment and has led at the identical time to a focus on growing metals and mining in North The usa.

Citing exploration from Goldman Sachs commodities exploration head Jeffrey Currie, she referenced the “revenge of the outdated financial system” and a instant in time when “decades of underinvestment in mining and metals” has come to be a vital worry for the U.S. and other produced economies that require these supplies for the infrastructure of a very low-carbon overall economy.

“That is why permitting reform is so massive a section of the personal debt ceiling now, a major negotiating merchandise in between Biden and McCarthy,” Lundgren mentioned.

Earlier this week, Exxon Mobil declared it was acquiring into domestic lithium mining in Arkansas, the crucial ingredient in the present generation of EV battery chemistry, while Italian vitality huge Enel reported it was investing more than $1 billion in an Oklahoma-based mostly photo voltaic panel manufacturing plant, 1 of the most significant clear power investments in the U.S. considering that the IRA passed.

Have to have ‘a new name’ for economic downturn

The Congressional Budget Office’s latest rating of clean strength tax breaks estimates they could price at least $180 billion a lot more than originally forecast simply because the company world’s urge for food for linked initiatives is increased than anticipated. Goldman Sachs not too long ago forecast that Inflation Reduction Act provisions could price tag as significantly as $1.2 trillion around the upcoming decade, around a few occasions the federal government forecast.

Lynn Martin, president of the NYSE, stated a person of the places exhibiting continued toughness in a challenging marketplace for preliminary general public choices is vitality transition, from traditional vitality to cleanse electricity businesses.

The Dow’s modern buying and selling downturn has arrive amid stalled talks this 7 days on the debt ceiling, but CEOs at the CNBC occasion ended up a lot more focused on the broader economic image. Recent financial knowledge factors display that inflation is flattening, supply chains are easing up, production is easing up, and demand from customers is slowing with purchaser action down noticeably. The consumer that has been the most resilient, the higher-finish purchaser, is cracking, in accordance to reviews from Saks CEO Marc Metrick at the CNBC CEO Council Summit.

“We are all looking at it,” Lundgren stated, but she additional, “you’ve acquired the other driver, infrastructure resources coming via the method … electric autos and battery and photo voltaic and wind, prolonged-expression structural motorists of desire,” she claimed.

There is a excellent risk of economic downturn, but she added, “Regardless of what this economic downturn is, we may want a new identify for it. I’m not sure record has ever seen this in advance of.”

An increasing amount of massive industrial customers are opening up manufacturing facilities in North The usa, according to Mario Harik, the CEO of logistics company XPO, but the short-phrase financial photograph isn’t really easy to interpret. Inflation is normalizing, but the Fed wants to gradual down on amount hikes as a end result. Wages, which experienced been rising previous calendar year in the mid- to significant-one digits, are now again to “pre-pandemic wage increases,” in accordance to Harik, and the price tag of transportation has arrive down “appreciably,” even if it stays higher than the 2021-2022 ranges.

Harik mentioned Q1 shipments, appeared at on a yr-over-year foundation, were being up in spite of the economy slowing down, but two-thirds of industrials in North The us and Europe are viewing “marginally softer desire than predicted.” Action has picked up a small in April, he mentioned, and suppliers are nonetheless expecting advancement in the 2nd fifty percent of the 12 months. But general, “incredibly blended alerts,” he mentioned.

Solomon expects inflation to be stickier than numerous people today consider as it comes off its peak — rival lender CEO Jamie Dimon at JPMorgan Chase claimed this 7 days that the economic climate really should be well prepared for interest charges to reach as high as 7% — and Solomon also believes we may need to see greater charges in buy to regulate inflation.

He cited “some structural things heading on” related to inflation which will make it hard to “simply” get back again to the Fed’s 2% focus on. Even if the Fed pauses, based mostly on what he sees now in the financial system, Solomon said there is no expectation of charge cuts by the stop of the calendar year, which has been the prevailing view in the bond current market.