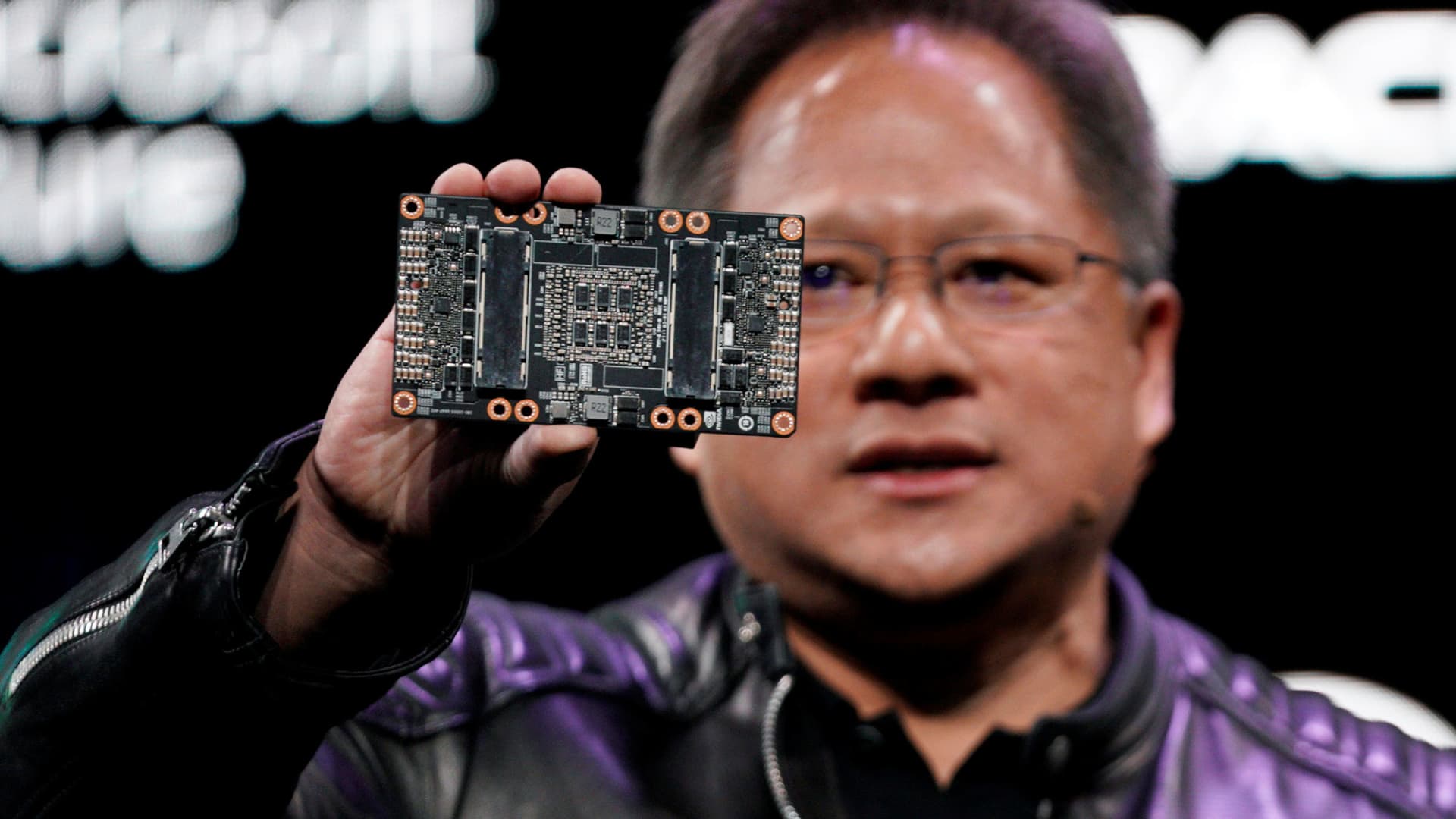

Jensen Huang, CEO of Nvidia, displays the NVIDIA Volta GPU computing system at his keynote handle at CES in Las Vegas, January 7, 2018.

Rick Wilking | Reuters

Nvidia’s gain has buoyed some semiconductor names in Thursday trading, notably companies that focus in AI-favored chips, though pushing down shares of other chipmakers, together with Intel and Qualcomm.

Nvidia shares traded up 25% Thursday, along with a notable 9% obtain in shares of AMD. Both of those Nvidia and AMD focus in so-referred to as “discrete,” or standalone graphics processing models. Meanwhile, shares of conventional pc chip corporations dipped. Intel shares were down about 6% in early morning trading though Qualcomm, which manufactures cell chipsets, slipped about 1.3%.

The huge array of price actions implies a flight away from a classic aim on regular laptop or computer chips and towards GPU makers. GPUs have savored surging company demand from customers as startups and founded tech corporations scramble to make out AI platforms. GPUs are the “brains” powering significant-language models and other AI systems, encouraging to electric power OpenAI’s ChatGPT and Google’s Bard.

“Rather of thousands and thousands of CPUs, you can expect to have a whole lot much less CPUs, but they will be connected to thousands and thousands of GPUs,” Nvidia CEO Jensen Huang advised CNBC.

Traditionally, the reverse has been legitimate. The opportunity inversion might be driving the flight away from CPU names and in the direction of Intel and AMD.

Shares of Taiwan Semiconductor Manufacturing Corporation also rose nearly 11%. TSMC is a critical part of the production system for quite a few semiconductor companies, which style their individual chips but can rely on TSMC to tackle the delicate and specialized producing process.

Marvell and Broadcom, which were up 2% and 3% respectively, benefitted by their publicity to cloud computing and possible AI programs. Marvell associates with names like Google, Meta, and Microsoft Broadcom has been establishing technologies to link AI supercomputers with each other.

The VanEck Semiconductor Index, a ETF basket of chipmaker names that includes Nvidia and Intel, rose 6.4% in Thursday morning investing.

Trading action for Nvidia shares also boomed on Thursday. Just 7 months back, Nvidia shut at a two-12 months low of $112. But on Thursday, together with beating its intraday all-time higher, additional than $15 billion worth of Nvidia shares modified fingers.

And in the to start with 18 minutes of Thursday investing, the chipmakers’ inventory had currently handed its regular entire-day quantity.

CNBC’s Kif Leswing and Robert Hum contributed to this report.