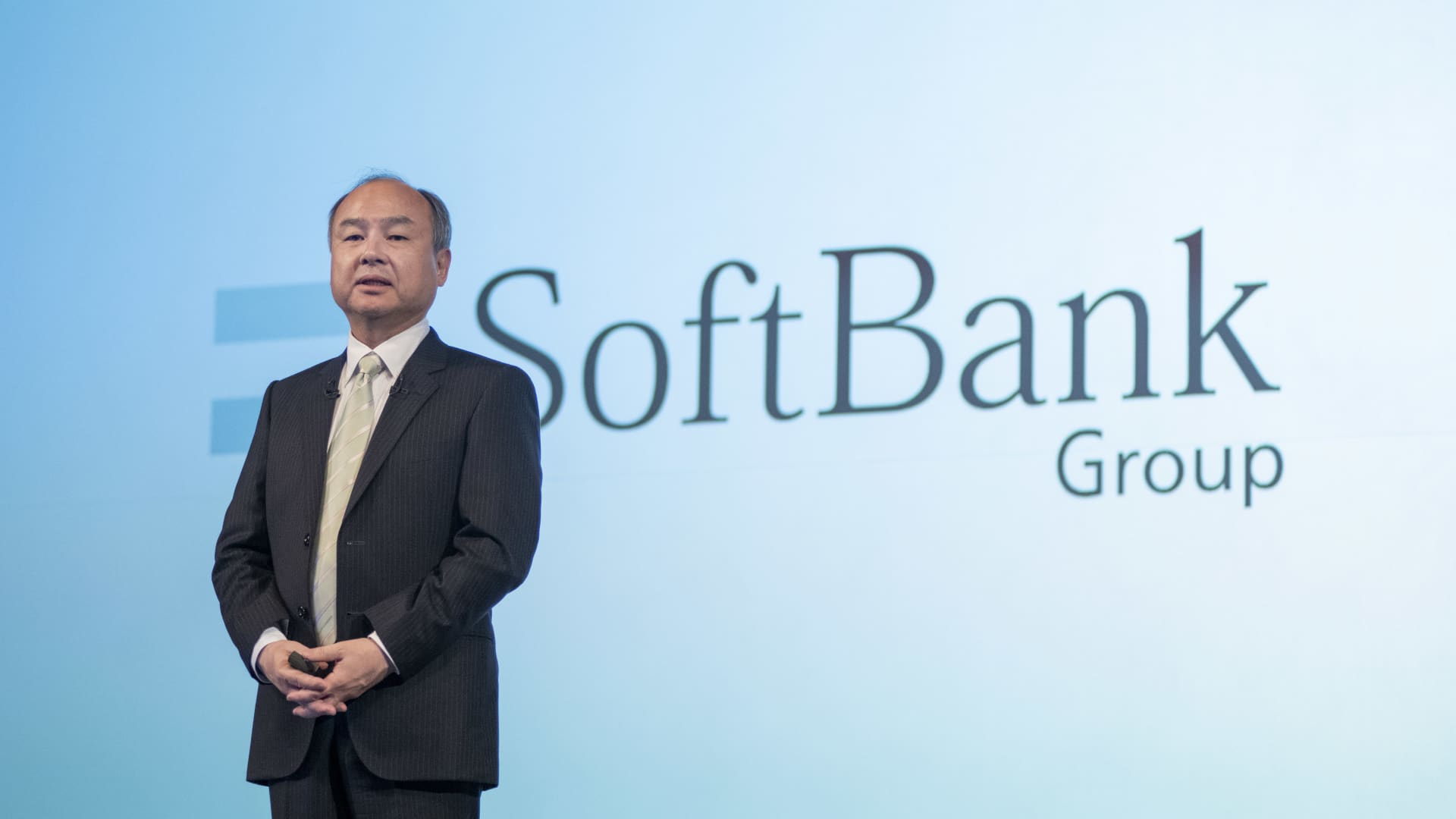

Masayoshi Son, CEO of SoftBank, has been weighing up many solutions for chipmaker Arm following Nvidia walked absent from purchasing the corporation.

Alessandro Di Ciommo | Nurphoto | Getty Illustrations or photos

SoftBank offered a sharp rebuke on Wednesday to S&P World Ratings, following the agency downgraded the Japanese giant’s credit rating score.

“Around the previous yr, our rigorous defensive fiscal management has strengthened our economic placement as hardly ever ahead of,” SoftBank explained. “It is incredibly regrettable that our fiscal soundness was not thoroughly assessed, and we will continue on our dialogue with S&P.”

S&P Global Scores on Tuesday slice SoftBank’s score to “BB” from “BB+” — in which it deems a firm’s credit score rating as “speculative grade” or “junk.”

SoftBank shares shut down 2.3% in Tokyo on Wednesday.

SoftBank has turned alone into just one of the world’s most significant tech traders in excess of the previous few years, putting billions of bucks into some of the greatest technology companies, like Uber, through its two Vision Funds. SoftBank primarily invests in businesses that are not publicly outlined.

Provided the slump in technological know-how shares amid globally growing fascination fees, the Vision Fund phase posted a record 4.3 trillion Japanese yen ($3.1 billion) reduction for the fiscal calendar year finished Mar. 31, as business enterprise valuations plunged.

SoftBank has been slicing its stake in Chinese e-commerce Alibaba, which it has held for more than two decades and made the Japanese firm’s founder Masayoshi Son his fortune. The intention is to shore up SoftBank’s harmony sheet, as the firm’s administration has pledged to perform “protection” and be a lot more prudent with its expenditure system.

S&P Global Rankings nevertheless argues that SoftBank’s Vision Money have a significant exposure to unlisted organization shares, which are additional risky, as a end result of advertising Alibaba inventory that are listed in the two the U.S. and Hong Kong.

“Ongoing income of shares in China-primarily based Alibaba Team Holding Ltd … previously a significant asset for the business, have eroded the proportion of outlined belongings in its portfolio,” S&P claimed. “Additionally, the technologies stocks in which the firm has primarily invested have been depressed for a prolonged period of time.”

SoftBank argues that S&P is not getting into account its dollars place, which rose to 5.1 trillion yen in the fiscal yr finished Mar. 31, as opposed to 2.3 trillion in the identical interval of 2022.

“It really should be famous that S&P’s assessment of the proportion of shown assets excludes income and deposits, etc. (JPY 5.1 trillion), which are the most liquid assets,” SoftBank claimed.

Arm listing in concentration

SoftBank in 2016 acquired British chip designer Arm — which last thirty day period confidentially submitted for a listing in the U.S.

Heading public with Arm would be a “good element” for SoftBank, S&P observed, but it has not incorporated this advancement in its evaluation simply because the timing and valuation of the enterprise keep on being “unsure.”

SoftBank claimed it has “strongly urged S&P to take into account an update the moment the proposed original community featuring of Arm is finished.”

S&P also mentioned that SoftBank is aiming for “disciplined fiscal management even in a hard operating atmosphere,” which carries on to “underpin the firm’s creditworthiness.”

In the long run, the damaging components outweighed the positives, the scores company said.

“We hence downgraded the firm. The volatility of its expense portfolio and rising asset danger generate the negatives for the group. In the meantime, money administration capacity a significant degree of dollars and holdings of shares in Arm, which could be mentioned, are positives.”