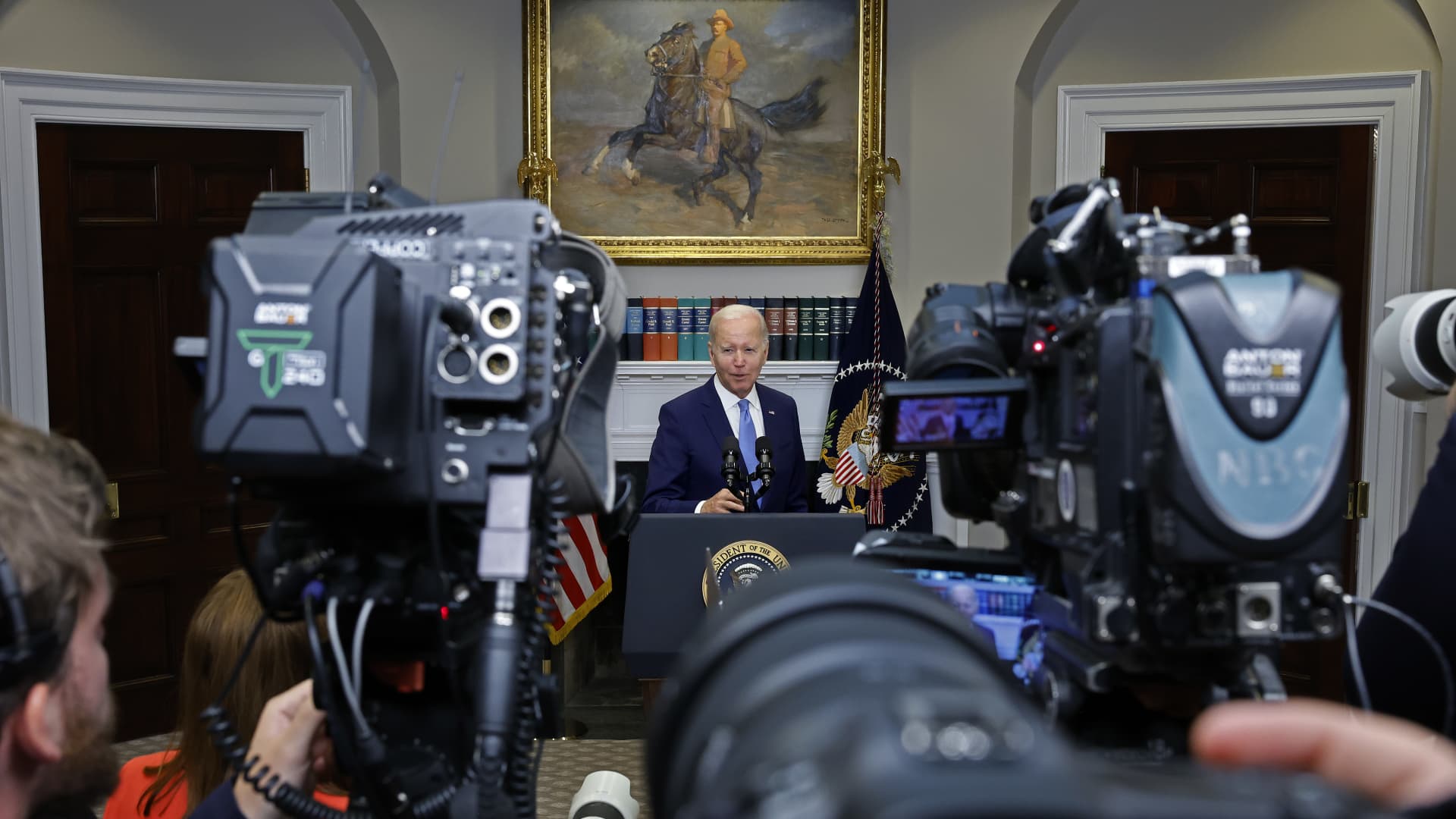

President Joe Biden provides a short update of the ongoing negotiations above the personal debt restrict in the Roosevelt Area at the White Household on Might 17, 2023 in Washington, DC.

Chip Somodevilla | Getty Pictures News | Getty Visuals

This report is from modern CNBC Everyday Open up, our new, international marketplaces newsletter. CNBC Every day Open provides investors up to velocity on all the things they need to know, no make a difference where they are. Like what you see? You can subscribe listed here.

The superior information: Biden will satisfy McCarthy in individual afterwards nowadays to examine the personal debt ceiling, after a pause in negotiations over the weekend. The bad: There is certainly no telling how the talks will commence.

What you will need to know currently

- U.S. President Joe Biden and Household Speaker Kevin McCarthy will meet up with at the White Residence Monday to resume negotiations over the credit card debt ceiling, NBC Information noted. About the weekend, conversations halted, with McCarthy telling reporters talks couldn’t resume until Biden returned from the Team of Seven summit in Japan.

- U.S. shares slipped Friday as traders apprehensive about delays to a deal on the financial debt ceiling, opposite to their optimism before in the week. Asia-Pacific marketplaces opened the 7 days greater. China’s Shanghai Composite inched up .1% as shares of Chinese chipmakers rose soon after the region barred operators of crucial infrastructure from purchasing goods from U.S.-based mostly chip competitor Micron.

- PRO Analysts think stocks can rise even higher in the next half of the year — if 3 ailments are achieved. Financial details coming out this 7 days, including May’s PMI Composite, minutes of the Fed conference and GDP figures, will make it clearer if marketplaces can rally.

The base line

The Writers Guild of America could be on strike now, but we you should not deficiency gripping drama — in the kind of the U.S. personal debt ceiling negotiations.

It is really a very good factor marketplaces were being shut in excess of the weekend, or they’d probably have fallen on McCarthy’s feedback that talks could not resume right until Biden returns to the country. Traders were being previously spooked on Friday after their optimism evaporated when Republican negotiators walked out of the dialogue. The S&P 500 slid .14%, the Dow Jones Industrial Common misplaced .33% and the Nasdaq Composite fell .24%.

To be certain, individuals were not big drops, suggesting traders imagined Washington would inevitably attain a deal — as it always has in the earlier. Fed Chair Powell’s remarks that fees might not want to be large also cheered buyers. The CBOE Volatility Index, which steps investors’ anticipations of the place the S&P will transfer in the following 30 days, traded at 16.8 Friday. Which is pretty close to its 52-week low, indicating balance and relaxed.

Indeed, the big indexes experienced a superior week. The S&P included 1.65% and the Nasdaq rose 3% for the 7 days — their very best functionality considering that March.

However, that was in advance of McCarthy cranked up the rhetoric on personal debt ceiling negotiations. The superior information is that Biden will meet up with McCarthy in man or woman later on today. The bad: There is certainly no telling how talks will commence.

Detours and divisiveness are maybe inevitable when it arrives to White Property negotiations across the political spectrum. We can only have faith that the U.S. is not going to plunge its very own overall economy, and the financial entire world, into chaos. That is a circumstance that belongs on television, not the true environment.

Subscribe here to get this report despatched immediately to your inbox every early morning ahead of marketplaces open.