Federal Reserve Chair Jerome Powell mentioned Friday that stresses in the banking sector could necessarily mean that fascination prices won’t have to be as high to command inflation.

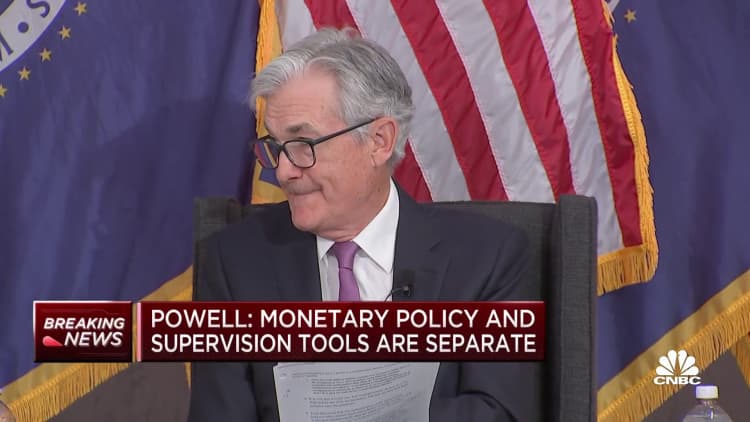

Talking at a monetary conference in Washington, D.C., the central financial institution leader observed that Fed initiatives made use of to offer with challenges at mid-sized financial institutions have mainly halted worst-scenario eventualities from transpiring.

But he noted that the issues at Silicon Valley Bank and other individuals could however reverberate through the financial state.

“The money steadiness tools helped to quiet disorders in the banking sector. Developments there, on the other hand, are contributing to tighter credit situations and are possible to weigh on economic development, employing and inflation,” he said as portion of a panel on financial coverage.

“So as a result, our policy charge could not have to have to rise as considerably as it would have or else to achieve our objectives,” he added. “Of study course, the extent of that is hugely unsure.”

Powell spoke with markets primarily expecting the Fed at its June assembly to take a break from the series of amount hikes it commenced in March 2022. On the other hand, pricing has been unstable as Fed officials weigh the affect that coverage has experienced and will have on inflation that in the summer months of last 12 months was jogging at a 41-12 months high.

On harmony, Powell claimed inflation is nevertheless also high.

“Several people today are at this time enduring superior inflation, for the initial time in their life. It is not a headline to say that they definitely you should not like it,” he reported throughout a discussion board that also showcased former Fed Chairman Ben Bernanke.

“We think that failure to get inflation down would, would not only lengthen the discomfort but also increase in the end the social expenses of having back to selling price security, triggering even greater damage to households and businesses, and we intention to stay clear of that by remaining steadfast in pursuit of our aims,” he added.

Powell characterised recent Fed coverage as “restrictive” and mentioned long run decisions would be knowledge-dependent as opposed to getting a pre-established program. The Federal Open up Market Committee has elevated its benchmark borrowing amount to a focus on of 5%-5.25% from around-zero in which it had sat considering the fact that the early days of the Covid pandemic.

Officers have pressured that charge hikes operate with a lag of a 12 months or additional, so the coverage moves have not entirely circulated by means of the economic system.

“We haven’t produced any decisions about the extent to which further plan funding will be proper. But specified how considerably we’ve appear, as I famous, we can pay for to glimpse at the details and the evolving outlook,” Powell explained.

Financial plan in substantial aspect has been geared in the direction of cooling a hot labor marketplace in which the recent 3.4% unemployment rate is tied for the most affordable degree considering that 1953. Inflation by the Fed’s chosen measure is jogging at 4.6%, well above the 2% lengthy-variety target.

Economists, including people at the Fed itself, have very long been predicting that the charge hikes would pull the economic system into at minimum a shallow economic downturn, probably later on this year. GDP grew at a considerably less-than-anticipated 1.1% annualized pace in the initial quarter but is on monitor to speed up by 2.9% in the second quarter, according to an Atlanta Fed tracker.

Powell spoke the same working day that the New York Fed introduced exploration showing that the long-assortment neutral desire fee — one particular that is neither restrictive nor stimulative — is fundamentally unchanged at extremely lower levels, inspite of the pandemic-period inflation surge.

“Importantly, there is no proof that the period of very reduced purely natural premiums of curiosity has ended,” New York Fed President John Williams stated in ready remarks.