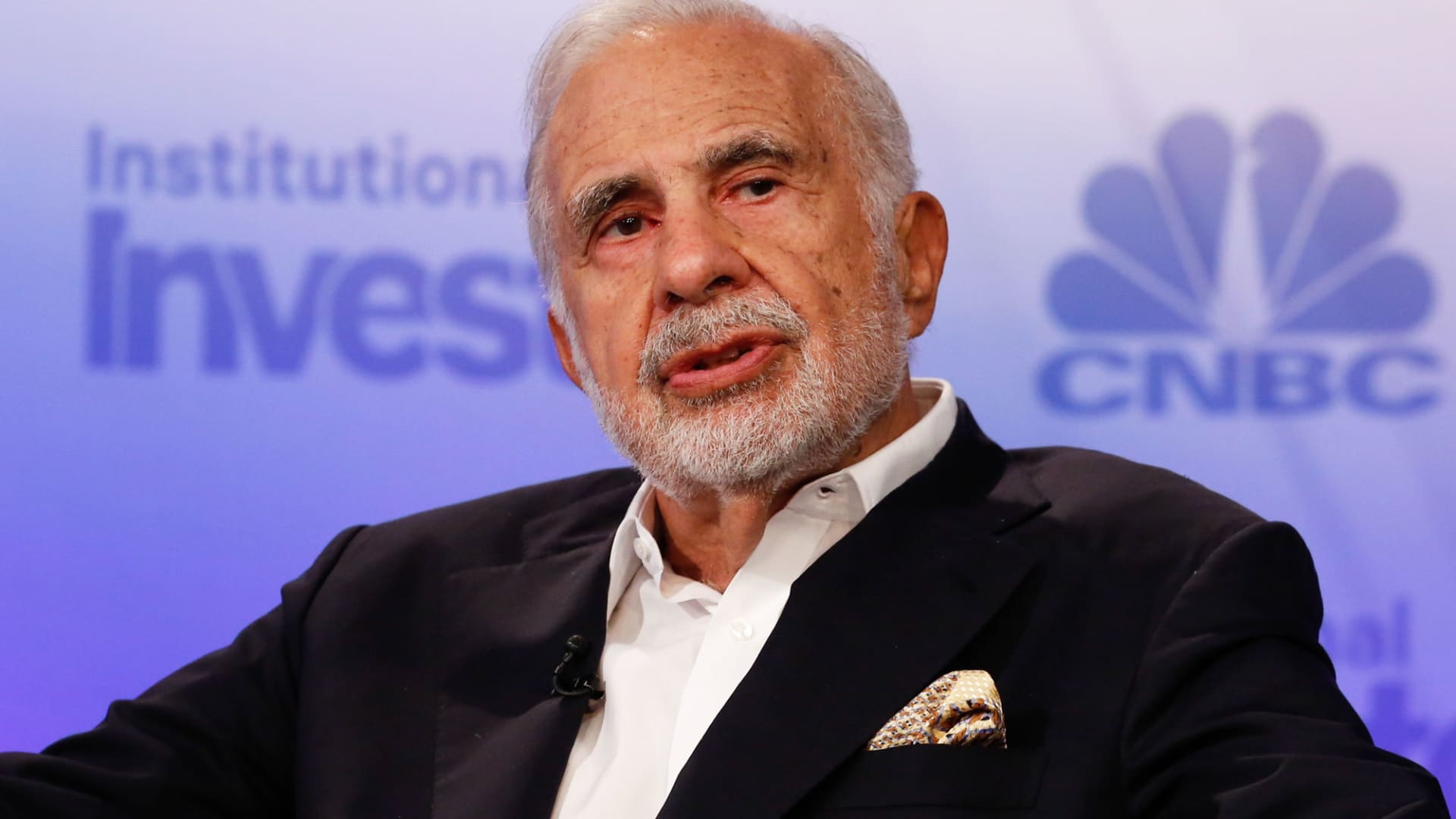

Carl Icahn speaking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Carl Icahn released his letter to McDonald’s shareholders on Thursday, calling out compensation among the company’s top ranks and Wall Street firms for their ESG investing policies.

It’s the latest development in Icahn’s animal-welfare battle with the fast-food chain over the treatment of pregnant pigs. The billionaire corporate raider is pushing to add two board seats with nominees who share his belief that McDonald’s should require all its U.S. suppliers move to “crate-free” pork. Icahn is waging a similar battle with Kroger, as well.

Icahn began his letter by challenging asset management firms for what he called “the biggest hypocrisy of our time.” He said large Wall Street firms, banks and lawyers are capitalizing on environment, social and corporate governance investing for the profits without supporting “tangible societal progress.”

“The reality is that if the ESG movement is to be more than a marketing concept and fundraising tool, the massive asset managers who are among McDonald’s’ largest owners must back up their words with actions,” he wrote.

McDonald’s top three shareholders are The Vanguard Group, the asset management arm of State Street, and BlackRock, according to FactSet.

Icahn also called compensation for McDonald’s management “unconscionable” and said the board was condoning multiple forms of injustice.

“Perhaps if the Company’s executives applied the same effort to getting their suppliers to become completely gestation crate-free as they do to obtaining rich compensation packages, we would not be having this election contest,” Icahn wrote.

McDonald’s later Thursday responded to Ichan’s letter citing what it called “hypocrisy” in his own campaign and saying it “only sources approximately 1% of U.S. pork production.”

“Despite McDonald’s progress on our commitment to source from producers who do not use gestational crates for pregnant sows, Mr. Icahn has asked for new commitments,” the company said in a written response. “What Mr. Icahn is demanding from McDonald’s and other companies is completely unfeasible.”

McDonald’s says its U.S. pork supply will be “crate free” by the end of 2024, marking a two-year delay to a 2022 deadline it set a decade ago. The company has blamed the Covid-19 pandemic and African Swine Fever outbreak for the postponement.

Icahn said in his letter that McDonald’s should have prioritized the issue earlier so it could stick to its initial pledge.

The burger chain expects that by the end of this year, 85% to 90% of its pork will come from sows not housed in gestation crates during pregnancy.

McDonald’s said in a regulatory filing that it expected to spend about $16 million in the proxy fight. Icahn questioned even the company’s decision to spend that much money.

“How many pigs would be spared the torture of gestation crates if the $16 million were spent on that, instead of on third parties retained by McDonald’s to solicit your votes ‘for’ re-electing two of 12 Board nominees who have presided over a multi-year failure to achieve the Company’s stated goals in promoting animal welfare in McDonald’s’ supply chain?” he wrote.

McDonald’s shareholders will vote on whether to elect Icahn’s nominees, Leslie Samuelrich and Maisie Ganzler, during the company’s annual meeting on May 26.

Shares of McDonald’s are up 10% over the last 12 months, giving the company a market value of roughly $190 billion.