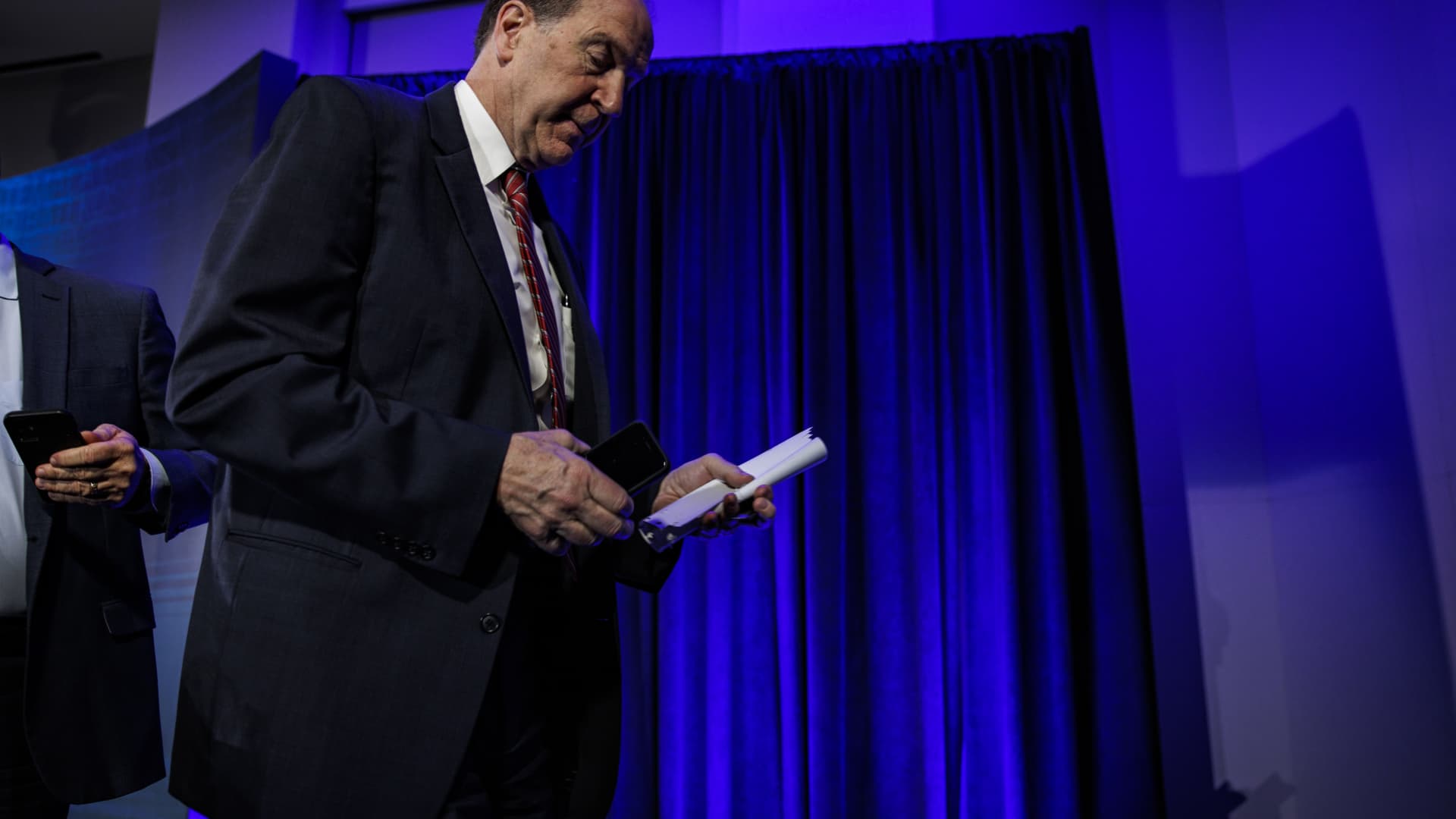

David Malpass, president of the Planet Financial institution Group in Washington, DC, on April 13, 2023

Bloomberg | Bloomberg | Getty Photos

Made economies across the world are dealing with a financial debt dilemma, and that is piling on to other problems in the world economy as central banking institutions continue to grapple with persistent inflation, according to Planet Bank President David Malpass.

Talking to CNBC’s Martin Soong at the G-7 finance ministers and central bank governors’ assembly in Japan, Malpass emphasised that report-significant global credit card debt stages want to be addressed for steadiness.

“The financial debt-to-GDP ratios for the highly developed economies are higher than ever just before,” he claimed, introducing that acquiring international locations are also struggling with a similar situation. “That indicates the economic climate has to perform that a lot harder just to pay again cash that is already been borrowed.”

The Earth Lender has emphasized the require for transparency in addressing rising personal debt in the deal with of a range of world financial issues, together with worry in the banking sector and sticky inflation.

The firm last month chaired the World-wide Sovereign Personal debt Roundtable in Washington D.C. and highlighted its call for information and facts sharing to velocity up the approach of credit card debt restructuring in the earth.

In its 12 months-conclusion report launched in December, the World Lender said the complete exterior financial debt of minimal- and center-earnings nations elevated by 5.6% in nominal phrases to $9 trillion.

For all nations around the world, the Worldwide Institute of Finance approximated earlier this 12 months that the nominal worth of world-wide financial debt ticked reduced from 2020 levels, standing down below $300 trillion in 2022.

“1 of the things for the state-of-the-art economies is to try to discover as steady as an setting so that advancement can occur back that is really essential for the earth at this stage,” Malpass explained to CNBC.

“The danger-less price has absent up from the innovative economies, but the credit spreads have widened for creating international locations as effectively,” he said.

The hazard-free price of return suggests the curiosity level an trader can anticipate to gain on an expense that carries zero threat.

“They[investors] are often likely to opt for the most secure superior economies to start with, so what is still left about is what can flow into the establishing international locations, and it is merely not ample,” Malpass said, introducing that much less-created economies facial area a “double whammy of elevated credit card debt stress costs and not the option to roll it in excess of.”

When requested about his options just after he ways down in June — earlier than April 2024 when his time period expires — he mentioned that he is “discovering selections.”

“We have been so occupied at the lender with items that are genuinely crucial — this financial debt, the expansion initiative, we are in our ultimate quarter of our fiscal yr,” he stated.