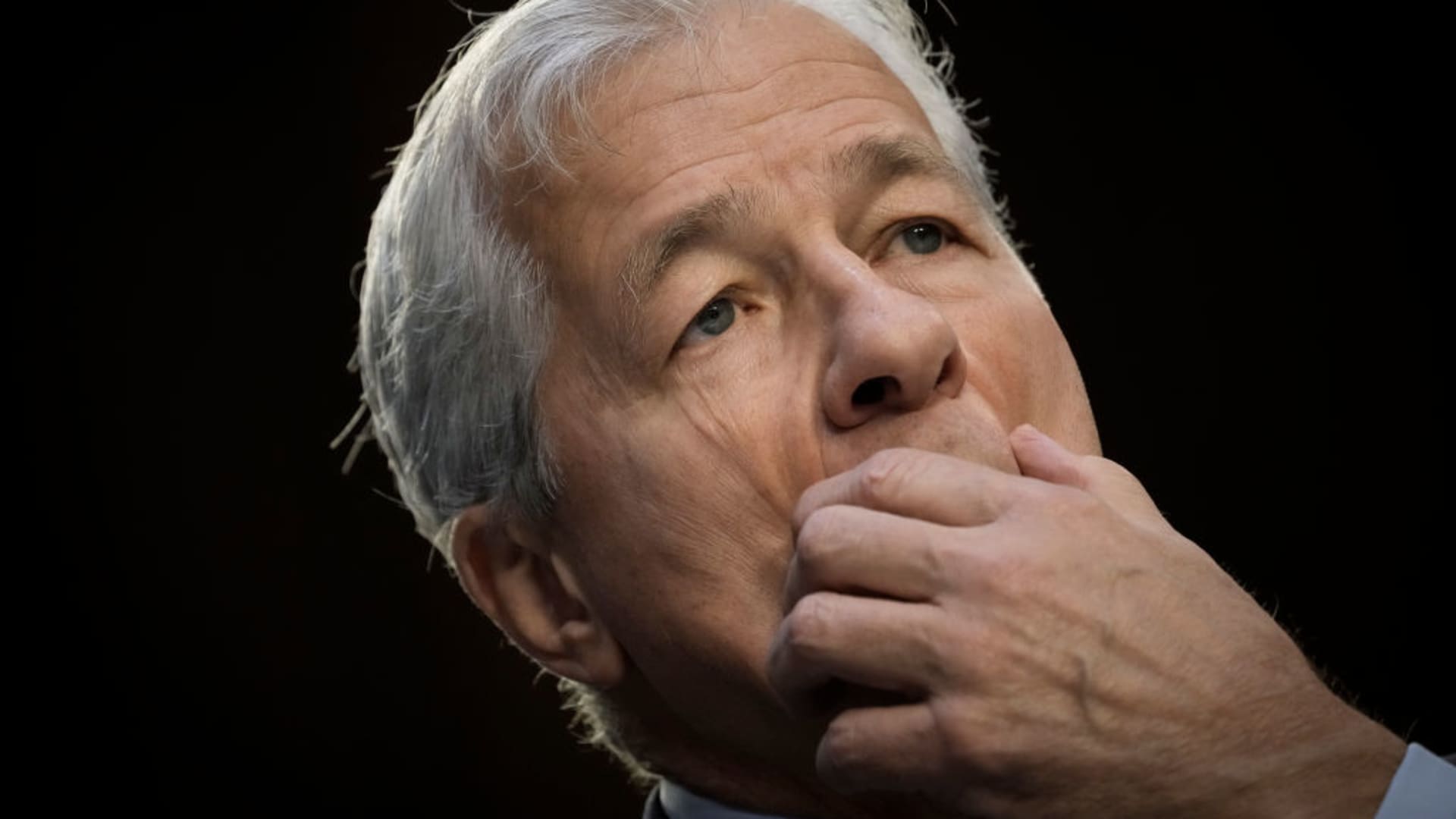

WASHINGTON, DC – SEPTEMBER 22: JPMorgan Chase & Co CEO Jamie Dimon testifies in the course of a Senate Banking, Housing, and Urban Affairs Committee listening to on Capitol Hill September 22, 2022 in Washington, DC. The committee held the hearing for yearly oversight of the nation’s major financial institutions. (Photograph by Drew Angerer/Getty Photos)

Drew Angerer | Getty Photographs Information | Getty Photographs

JPMorgan Chase CEO Jamie Dimon in an job interview Thursday stated he was “so sad” the bank experienced any company romantic relationship with Jeffrey Epstein — but denied the organization is lawfully liable for the useless predator’s sexual intercourse trafficking.

Dimon also said, in the televised interview with Bloomberg, that if JPMorgan experienced recognized every thing that has develop into public in current yrs about its previous buyer Epstein “we would have finished factors in different ways.”

Dimon is scheduled to give a deposition beginning Might 26 for civil lawsuits filed in Manhattan federal court docket by the governing administration of the U.S. Virgin Islands and an Epstein intercourse abuse accuser. The suits accuse JPMorgan of enabling and benefitting from Epstein’s sex trafficking, which integrated sending youthful women to the Virgin Islands to be abused by him and other individuals at his private island there.

Court filings this week present in element that for years, staff members of JPMorgan shared with every single other fears about having Epstein as a customer — nicely before the financial institution terminated its connection with him.

“I am so unhappy that we had any connection to that person in any respect,” Dimon advised Bloomberg on Thursday.

“You know, we experienced leading lawyers analyzing, from the [Securities and Exchange Commission] enforcement, the [Department of Justice], you know, and naturally, had we acknowledged then what we know now, we would have finished issues in another way.”

“But it really is incredibly unlucky, and I have deep regard for these females,” Dimon reported.

“That doesn’t imply we’re liable for the motion of an particular person, but I do have deep regard for them, my heart goes out to them,” he explained.

Epstein, who was a consumer of the lender beginning in 1998 and retained hundreds of thousands of dollars on deposit, pleaded guilty in 2008 to a Florida point out demand of soliciting sexual intercourse from an underage woman. He was sentenced to 13 months in jail.

Inspite of that conviction, Epstein was a customer of JPMorgan right up until 2013.

A mugshot of Jeffrey Epstein launched by the U.S. Justice Section.

Supply: U.S. Justice Section

JPMorgan just lately has tried out to change authorized obligation for its marriage with Epstein to Jes Staley, the former main of financial investment banking at JPMorgan, who had close get hold of with Epstein around the decades when he was a client.

But at a court docket hearing in March, a lawyer for the U.S. Virgin Islands explained to Decide Jed Rakoff, “Jamie Dimon realized in 2008 that his billionaire consumer was a intercourse trafficker.”

“If Staley is a rogue personnel, why isn’t Jamie Dimon?” the attorney, Mimi Liu, mentioned at that listening to.

“Staley knew, Dimon realized, JPMorgan Chase realized” about Epstein’s legal perform, Liu stated. “They broke every rule to facilitate his intercourse trafficking in exchange for Epstein’s wealth, connections and referrals.”

Liu reported the financial institution should have flagged as suspicious dollars transactions and wire transfers by Epstein, which bundled sending hundreds of hundreds of bucks to several women of all ages.

A lawyer for JPMorgan at that listening to denied that Dimon had any “specific know-how” about Epstein, and a lender spokeswoman has explained “Jamie Dimon has no recollection of examining the Epstein accounts.”

Epstein killed himself in a New York jail in August 2019, a thirty day period after getting arrested on federal kid intercourse trafficking expenses.

Due to the fact then, a amount of former buddies and associates of Epstein, amongst them Donald Trump, Monthly bill Clinton and Britain’s Prince Andrew, have been criticized for their interactions with the predator.

Staley stepped down as CEO of Barclays in November 2021 since of his ties to Epstein.

A Nov. 2, 2006, email manufactured community this 7 days in courtroom filings for a person of the lawsuits from JPMorgan highlights the problem a best financial institution formal experienced about Epstein.

The electronic mail was despatched from Ann Borowiec, then-head of investor relations for JPMorgan, to Staley, who was then CEO of JPMorgan’s asset administration division. The message’s topic line is: “Epstein- make sure you simply call me.”

Borowiec began the message by asking Staley, who was on a airplane to Hong Kong, to contact her when he could with regards to an impending meeting her team was scheduled to have, evidently with Epstein.

“Also, obtaining finished a minor because of diligence I have problems on danger mgt with this consumer,” she wrote. “We have a bad observe document internally on possibility….as you know. Is Jeffrey going to remain included here? How are we handling possibility below. Remember to simply call. Thx Ann.”

In January 2011, quite a few decades immediately after Epstein pleaded responsible to the Florida condition scenario and develop into a registered intercourse offender, a JPMorgan govt director named Maryanne Ryan, who was a compliance manager wrote an e-mail to Philip DeLuca, the bank’s compliance director, noting a “speedy response meeting on Epstein, the sleazy PB [private banking] consumer.”

DeLuca replied, “This is the guy who likes younger ladies, proper? Hope they do not cave!!”

A June 2013 e mail chain concerning Ryan and DeLuca has an attachment that detailed elements of the bank’s romance with Epstein “which was previously escalated to the PB reputational danger committee.”

The e-mail notes that in July 2008, PB Threat “referred Jeffrey Epstein to AML [Anti-Money Laundering] Investigations for abnormal funds activity.”

“In the same way, during the system of the transaction activity critique, an open source evaluate of media reports yielded numerous negative media article content alleging connections between Jeffrey Epstein and the prostitution/underage intercourse trade.”

The copied part of the e-mail goes on to say that AML investigations and PB Risk held discussions that “reconfirmed” they had documented Epstein’s adverse history and “marked him significant threat.”

The segment notes that in October 2010, AML Investigations “escalated information tales indicating renewed law enforcement fascination in Epstein and requested a Speedy Reaction contact.”

An e-mail chain with DeLuca on it demonstrates a Fast Response Phone was held in January 2011, just after which Epstein was yet again retained as a consumer but an arrangement was designed that “Catherine Keating and William Langford explain to Jes Staley how the existence of the Epstein romantic relationship could undermine the Human Trafficking Task at present underway within AML investigations.”

That anti-money laundering task was spearheaded by Langford, who prior to becoming a member of JPMorgan in 2006 was a regulatory policy formal at the Treasury Department’s Money Crimes Enforcement Community (FinCEN).

“Langford outlined that he briefed Steven Cutler on the prospective press and optics connected to protecting the Epstein connection whilst at the very same time spearheading the Human Trafficking effort inside of AML,” the email states.

“No adjust in retention,” the electronic mail concludes.