Amazon Website Expert services symbol at the Web Summit in Lisbon.

Henrique Casinhas | Sopa Illustrations or photos | Lightrocket | Getty Visuals

The cloud-computing market keeps rising as organizations go an escalating selection of workloads out of their personal info facilities, but executives from the primary cloud distributors mentioned this week that customers are searching for approaches to trim prices.

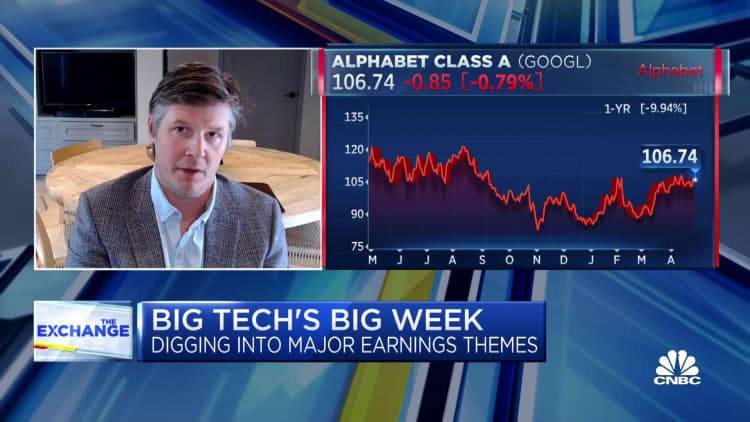

The consequence is slowing profits advancement at the cloud divisions operate by Amazon, Microsoft and Google. And for Amazon Website Services, the leader in the place, it usually means a slimmer operating margin and significantly less earnings for its father or mother company.

linked investing information

It truly is a phenomenon that started in 2022, as fears of a recession strike the economic climate. AWS observed deceleration in the third and fourth quarters, and very last quarter Microsoft finance main Amy Hood spooked analysts with comments about a slowdown in December that she anticipated to persist.

Amazon finance chief Brian Olsavsky was the bearer of undesirable information for investors on Thursday, when he mentioned that in April, AWS earnings development experienced slumped by about 5 percentage factors from the initial-quarter development amount of practically 16%. The company’s inventory value slid in reaction.

Amazon CEO Andy Jassy claimed “what we’re looking at is enterprises continuing to be cautious in their paying out in this uncertain time.”

At Google, cloud progress slowed to 28% from a 12 months earlier in the 1st quarter from 32% in the prior time period. The deceleration occurred even as Google’s cloud phase achieved profitability for the to start with time on document.

“We observed some headwind from slower growth of intake with prospects seriously on the lookout to optimize their costs provided that macro weather,” stated Ruth Porat, Alphabet’s finance chief, on Tuesday’s earnings contact.

Sundar Pichai, Alphabet’s CEO, mentioned the slowdown is easy to understand.

“We are leaning into optimization,” he claimed. “This is an significant minute to assistance our shoppers, and we consider a lengthy-time period look at. And so it really is absolutely an location we are leaning in and striving to help buyers make progress on their efficiencies the place we can.”

The businesses continue being optimistic that cloud will continue to be a potent market for tech, as enterprises nevertheless have a very long way to go just before they will be totally getting edge of the gains.

“People sometimes forget that 90-plus percent of global IT spend is still on-premises,” Jassy mentioned.

And Hood pointed out that pretty shortly the economical comparisons will be towards quantities from the position final calendar year when the market was softening.

“When you start to anniversary that, you do see that it will get a small little bit a lot easier in terms of the comps year-above-calendar year,” Hood claimed.

Watch: Ongoing deceleration in IT spending not mirrored in tech earnings