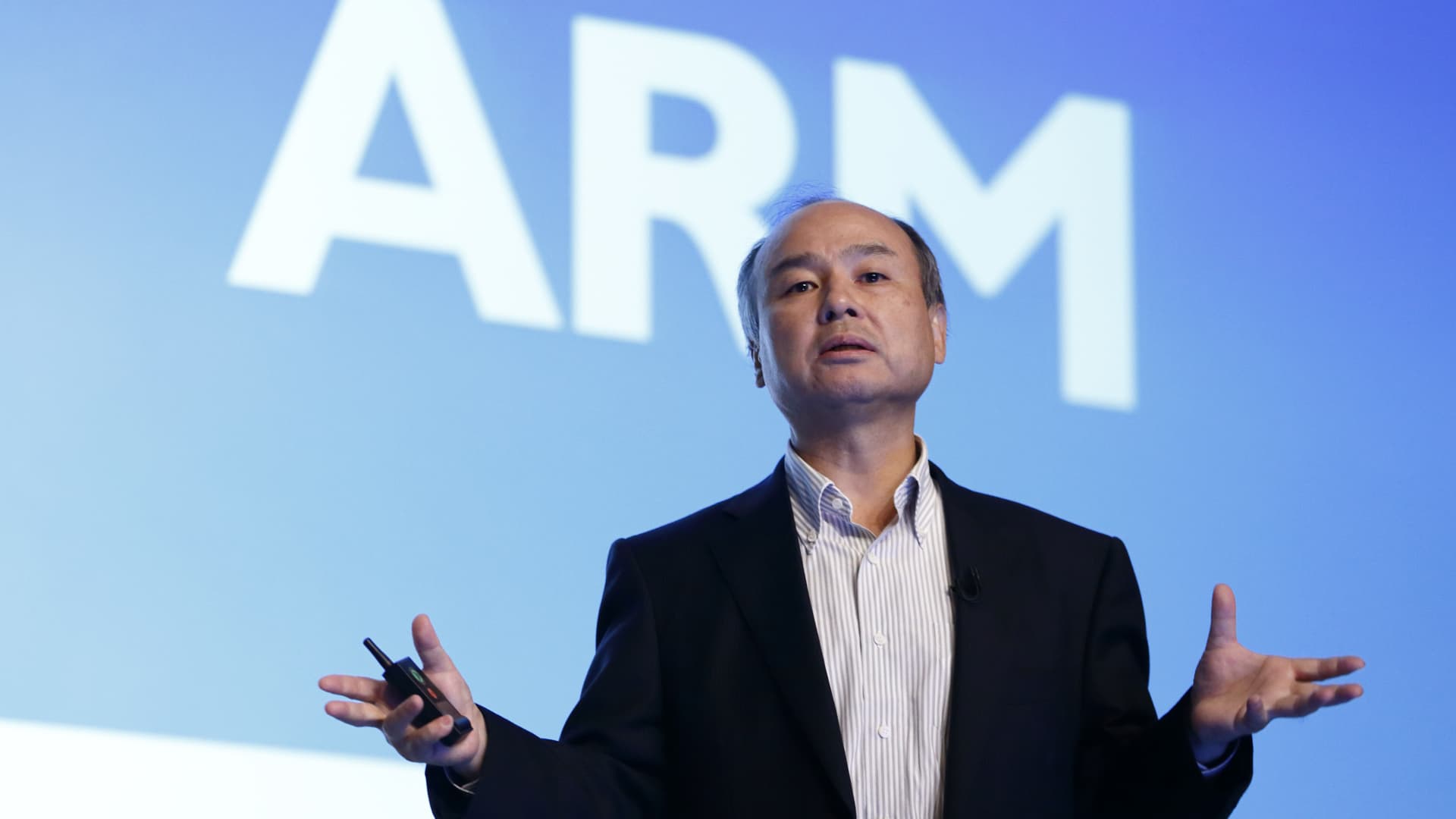

Billionaire Masayoshi Son, chairman and chief government officer of SoftBank Group Corp., speaks in front of a monitor exhibiting the ARM Holdings emblem through a news meeting in Tokyo on July 28, 2016.

Tomohiro Ohsumi | Bloomberg | Getty Visuals

SoftBank Team Corp’s chip maker Arm has submitted with regulators confidentially for a U.S. inventory sector listing, Arm claimed on Saturday, placing the phase for this year’s largest preliminary community presenting.

The IPO registration exhibits that SoftBank is urgent in advance with the blockbuster giving in spite of adverse sector problems, soon after saying in March that it planned to listing Arm in the U.S. stock sector.

U.S. IPOs, excluding listings for distinctive purpose acquisition organizations, are down about 22% to a whole of just $2.35 billion calendar year-to-date, according to Dealogic, as inventory marketplace volatility and financial uncertainty put lots of IPO hopefuls off.

Arm ideas to market its shares on Nasdaq later on this yr, in search of to increase among $8 billion and $10 billion, people today acquainted with the issue reported. In a statement, which verified an before Reuters report on the planned IPO, Arm said the dimension and cost vary for the providing has not nevertheless been determined.

The resources cautioned that the exact timing and measurement of the IPO are issue to market place problems and questioned not to be discovered due to the fact the make any difference is confidential.

SoftBank and Arm declined to comment.

There are signs that the IPO sector is starting to thaw. Johnson & Johnson is making ready to list its purchaser health business enterprise Kenvue in New York future week, hoping to raise about $3.5 billion.

SoftBank has been concentrating on a listing for Arm due to the fact its offer to sell the chip designer to Nvidia for $40 billion collapsed previous yr due to the fact of objections from U.S. and European antitrust regulators.

Given that then, Arm’s organization has fared much better than the broader chip field thanks to its concentrate on details center servers and private desktops that make better royalty payments. The firm reported sales were up 28% in its most current quarter.

Arm’s IPO is expected to strengthen the fortunes of SoftBank, which is battling to switch close to its big Vision Fund, which has been strike by losses owing to the declining valuations of lots of of its holdings in technological know-how startups.

Previously this calendar year, Arm rebuffed a campaign from the British govt to record its shares in London and mentioned it would go after a flotation on a U.S. exchange.

Arm’s IPO preparations are getting led by Goldman Sachs, JPMorgan Chase & Co, Barclays and Mizuho Money Group.