A symbol for Chinese ride-hailing platform Didi is illuminated outside company headquarters on Jan. 21, 2022 in Hangzhou, China.

Shen Longquan | Visual China Team | Getty Photographs

Chinese experience-hailing huge Didi International on Saturday claimed a 19% calendar year-on-12 months tumble in 2022 income, as the country’s Covid lockdowns and a regulatory crackdown took a toll.

In its first yearly report considering the fact that it delisted from the U.S. previous year, Didi claimed its whole revenue fell to 140.79 billion yuan ($20.37 billion) mostly “due to the outcomes of Covid-19 pandemic outbreaks in the second and fourth quarter of 2022” which strike its China business.

China imposed stringent Covid constraints across the region last 12 months that had hammered its financial system. It lifted people limitations in December previous year.

Net reduction attributable to Didi Global narrowed to 23.78 billion yuan in 2022, review with the internet loss of 49.34 billion yuan in 2021, helped by variables this kind of as financial investment gains, the report mentioned.

Its China mobility business swung to a reduction in 2022, although Didi stated it has returned to advancement this year, citing a quick restoration in travel throughout China right after the ending of Covid curbs.

In March, Didi’s every day transactions for China Mobility jumped 42% from the very same period previous year, to an average of 28.2 million.

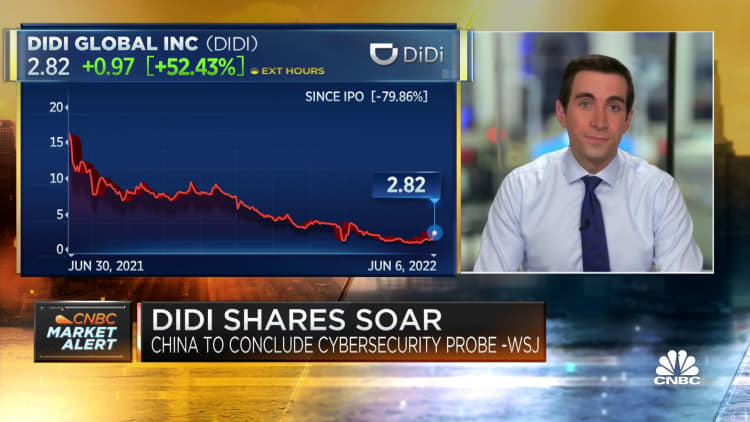

China lifted a 18-thirty day period ban on Didi before this 12 months soon after a much more than one particular 12 months extensive regulatory crackdown on the organization thanks to cyberspace protection violations. The corporation delisted from the U.S., dozens of its app were being banned from key application outlets, and it paid the biggest regulatory penalty imposed on a Chinese tech firm.

Its net decline for 2022 incorporated the $1.2 billion wonderful.