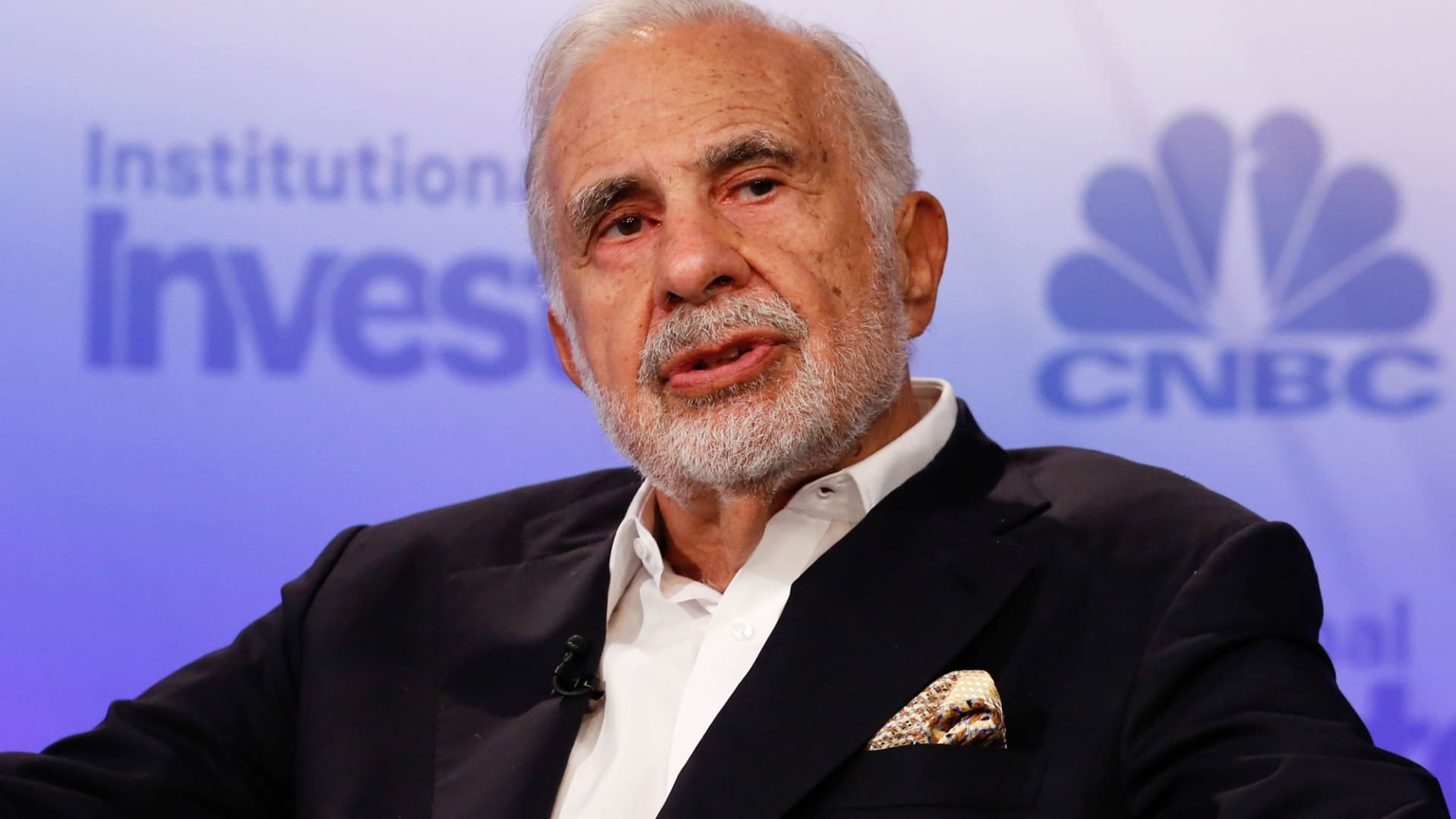

Carl Icahn speaking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Carl Icahn on Friday called Illumina’s first-quarter results “very disappointing” and slammed the DNA sequencing company’s new plans to cut costs.

The activist investor, who owns a 1.4% stake in Illumina, is in a heated proxy fight with the company over its 2021 acquisition of cancer test developer Grail.

Icahn and Illumina have been trading jabs for more than a month.

Icahn is seeking seats on Illumina’s board of directors and pushing the company to unwind the Grail acquisition. He is also calling for the San Diego-based company to oust CEO Francis deSouza “immediately.”

Illumina on Tuesday reported quarterly revenue and earnings that topped Wall Street’s expectations.

But the company also posted net income of $3 million for the quarter, which was down more than 96% from the $86 million it raked in during the same period a year ago.

In an open letter Friday to Illumina shareholders, Icahn accused deSouza of “desperately, hilariously and, most of all, unsuccessfully” trying to spin the “decidedly mediocre” quarterly results during a press tour this week.

Icahn pointed to deSouza’s interview on CNBC’s “Squawk Box” on Wednesday, when the CEO touted strong demand for Illumina’s diagnostic testing services.

“Illumina CEO Francis deSouza seems to believe that he can fool all of the people all of the time,” Icahn wrote.

“Those not skilled in deciphering doublespeak might actually get the impression that Illumina was doing well!” he added.

Icahn also said that the price of Illumina shares fell the more its CEO during this week, “clearly signaling dissatisfaction with the earnings report and dissatisfaction with Mr. deSouza’s transparent attempt to put lipstick on a pig.”

Illumina’s stock is down more than 9% since the company reported earnings. Shares were largely flat Friday after Icahn released his letter.

In that missive, Icahn also took shots at cost-cutting plans Illumina unveiled to improve its shrinking margins. He called those measures “vague” and “extraordinarily unambitious.”

The company on Tuesday said it will enable unnamed “activities” in more cost-effective areas of the world and will use its new NovaSeq X sequencing system to accelerate genomic discoveries, among other efforts.

Those plans will help Illumina reach its adjusted operating margin goals of 24% in 2024 and 27% in 2025, the company said in its earnings release.

Icahn called those margin targets “less than modest.” And he argued that they will “take years to realize, if they are achieved at all.”

The company has projected an estimated 22% operating margin for 2023, down from the 23.8% it reported in 2022.

Illumina reported a negative operating margin of 5.7% for the quarter, down from 15% during the same period a year ago. The company’s gross margins for the period fell to 60.3%, down from 66.6% in the first quarter of 2022.

Illumina did not immediately respond to a request for comment on Icahn’s letter.

Criticism of Grail deal

Elsewhere in his letter, Icahn slammed deSouza’s positive remarks this week about Illumina’s $7.1 billion acquisition of Grail.

DeSouza had told CNBC the deal “makes sense” because Illumina can significantly expand the market for Grail’s early screening test for different types of cancer.

The CEO also touted Grail’s 100% revenue growth during the quarter compared with the same period a year ago.

But Icahn said the deSouza failed to tell the public about an opinion issued earlier this month by the Federal Trade Commission, which said that the deal would stifle competition and innovation.

The FTC also ordered Illumina to divest itself of the acquisition over those concerns.

The European Commission, the executive body of the European Union, also blocked the deal last year over similar concerns.

Illumina is appealing both orders and expects final decisions in late 2023 or early 2024.

Last week, a U.S. federal appeals court said that it will fast-track its review of Illumina’s challenge of the FTC order.

Icahn’s resistance to the acquisition stems from Illumina’s decision to close the deal without getting approval from those antitrust regulators.

Earlier this month he strongly criticized Illumina and its management for finalizing the “reckless deal,” calling it “a new low in corporate governance.”

Illumina has urged shareholders to reject Icahn’s three board nominees during its annual shareholder meeting scheduled for May 25.