Traders work on the ground of the New York Inventory Trade on April 26, 2023 in New York Metropolis.

Michael M. Santiago | Getty Visuals

Investors appeared earlier what appeared to be a weak initially-quarter GDP report Thursday and instead centered on the for a longer period-term potential customers for economic progress, interest fees and inflation.

The 1.1% annualized enhance for the very first quarter would have been much better experienced it not been for an inventories drag, while a more robust-than-predicted inflation reading through may well have been entrance-loaded to the early component of the 12 months and not consultant of where charges are heading.

“The knowledge are location the Fed up nicely for up coming week’s assembly,” LPL main economist Jeffrey Roach claimed. “As progress and inflation gradual, the Fed can legitimately transition to a pause and then possibly an outright minimize in costs by the end of the year if the financial system deteriorates.”

Following the launch, traders solidified the likelihood for a quarter percentage stage curiosity charge boost when the Federal Reserve fulfills up coming 7 days. Even so, markets also nonetheless assume at the very least 50 percent a issue worthy of of amount cuts prior to 12 months-conclude and then substantially additional aggressive reductions by 2024, according to the CME Group’s FedWatch tracker.

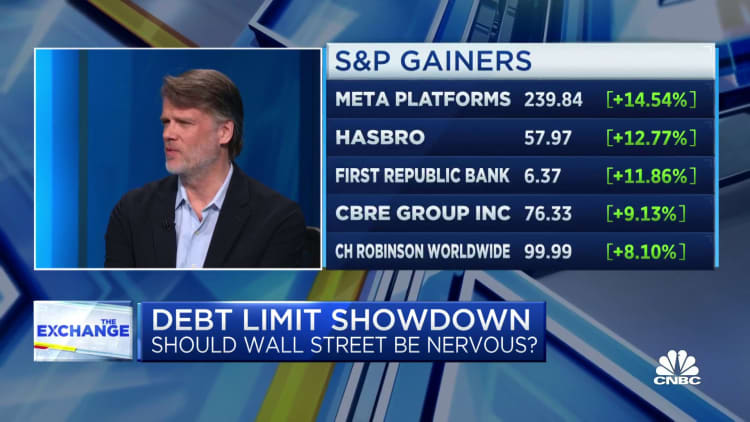

Shares rose sharply, with the Dow Jones Industrial Normal up far more than 500 points heading into the ultimate hour of buying and selling Thursday.