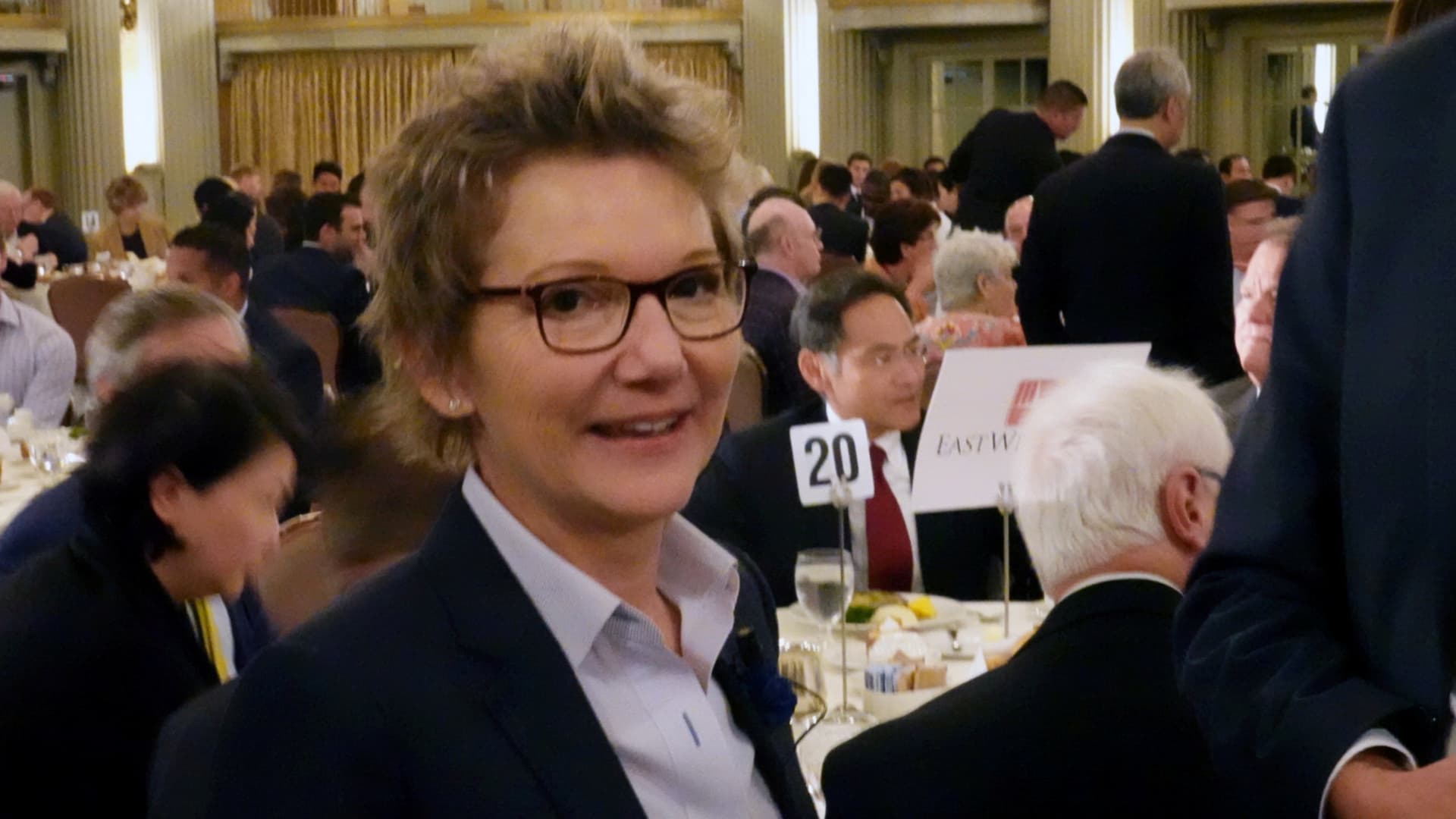

- San Francisco Fed President Mary Daly’s district oversaw the second-largest bank failure in U.S. historical past.

- Fed officers earlier and present explained regional presidents can be a lot more or significantly less involved in checking their largest banking companies, but the essential conclusions about plan and enforcement would have been taken in Washington.

- The failure of Silicon Valley Lender elevated substantial questions about the Fed’s bank supervision and its failure to act additional forcefully on difficulties it experienced formerly determined.