A current market stall in Madrid, Spain. Analysts digest the most recent inflation numbers out of the euro zone.

Europa Push Information | Europa Press | Getty Photographs

Inflation in the euro zone dropped appreciably in March as electrical power selling prices continued to fall, though main charges picked up to an all-time substantial.

Headline inflation in the 20-member bloc arrived in at 6.9% in March, according to preliminary Eurostat figures unveiled Friday. By comparison, in February, headline inflation stood at 8.5%.

The main reason for this 1.6 proportion position slide was the fall in power expenditures.

Nonetheless, you will find other pieces of the inflation basket that continue to be stubbornly high. Food items price ranges contributed the most to the overall inflation looking through of March.

Main inflation — which excludes volatile electrical power, food stuff, alcoholic beverages and tobacco charges — rose a bit from the previous month. It attained an all-time report of 5.7% in March, from 5.6% in February.

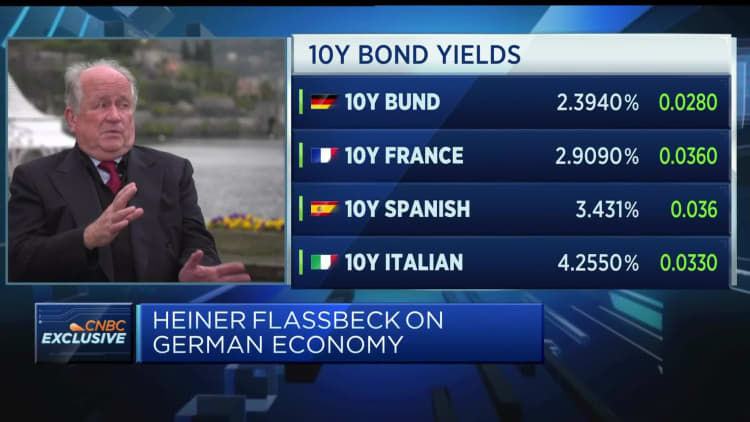

Fascination charges in sight

These figures do not give robust plenty of evidence that the European Central Financial institution might contemplate pausing its amount-mountaineering cycle, which started out back again in July.

“Policymakers at the ECB will never read through way too a lot into the fall in headline inflation in March and will be additional concerned that the main fee hit a new file significant,” Jack Allen-Reynolds, deputy chief euro zone economist at Capital Economics, stated in a observe on Friday.

He additional that the ECB is very likely to hold boosting premiums in spite of the fall in the headline figure.

ECB Member Isabel Schnabel said Thursday that headline inflation has started off to decrease, but main inflation is proving sticky.

When final year’s energy rate boosts spread rapid throughout the financial state, they are taking lengthier to dissipate, “and it can be not even very clear regardless of whether it’s going to be entirely symmetric in the feeling that everything is even going to drop out at all,” she mentioned at an occasion Thursday, according to Reuters.

The ECB lifted costs by 50 foundation points in March, bringing its major benchmark level to 3%. Even so, it did not give any indicator of opportunity charge selections in the months in advance.

The latest banking turmoil has elevated questions about whether central banks have been also intense in relocating curiosity premiums to deal with inflation. ECB Chief Economist Philip Lane has mentioned that extra price hikes will be needed to handle significant inflation if the banking instability dissipates.