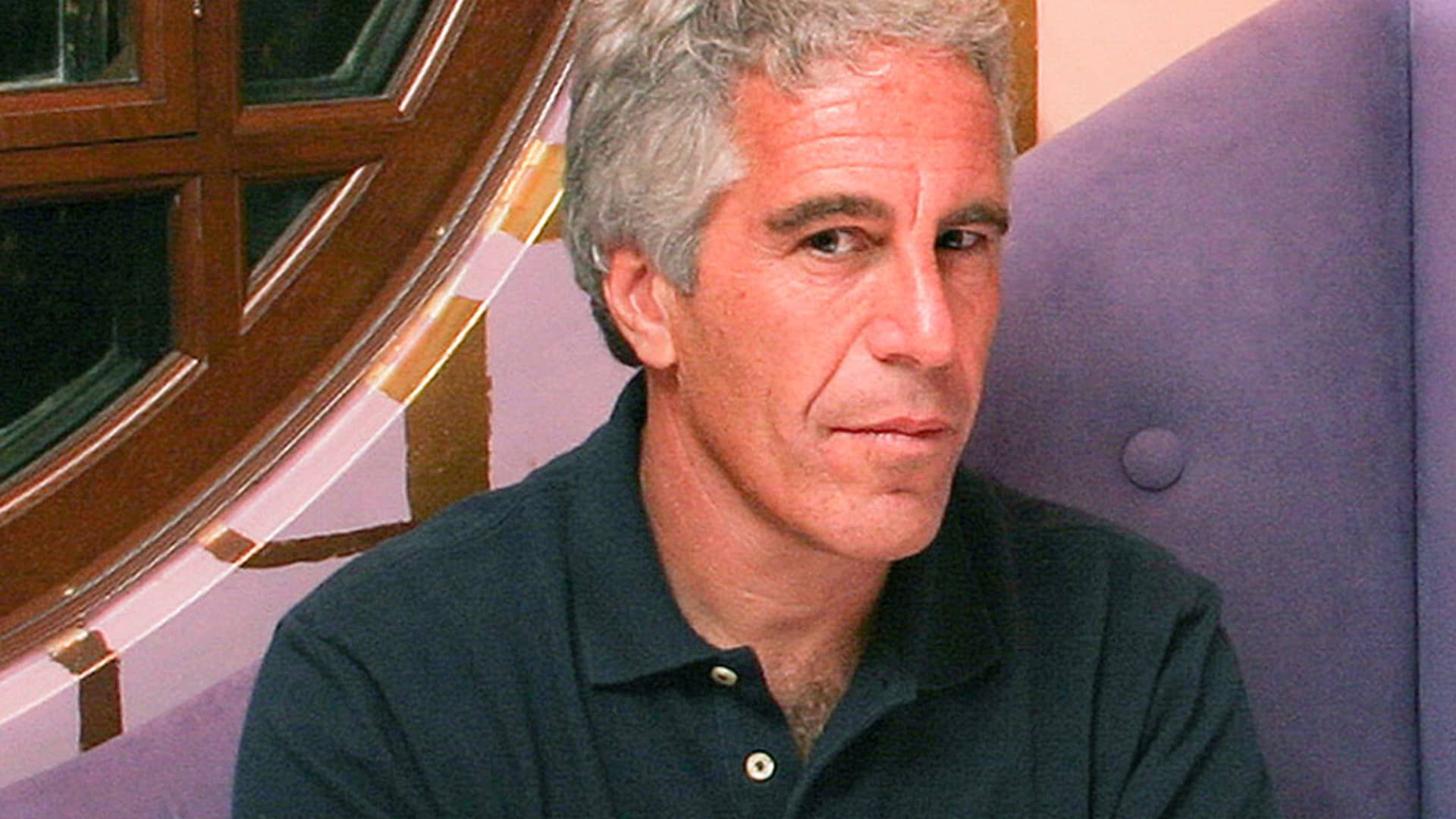

An ‘open house’ flag is displayed outside a single family home on September 22, 2022 in Los Angeles, California.

Allison Dinner | Getty Images

Stress in the banking system turned out to be a boon for the U.S. mortgage market. As investors hid in the relative safety of the bond market, yields moved even lower last week. Mortgage rates followed.

Mortgage demand, consequently, rose 2.9% compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. The string of gains, however, could be short-lived, as rates are now moving higher again.

Last week, the average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($726,200 or less) decreased to 6.45% from 6.48%, with points decreasing to 0.62 from 0.66 (including the origination fee) for loans with a 20% down payment. The rate was 4.8% the same week one year ago.

Applications to refinance a home loan increased 5% for the week but were still 61% lower year over year. The vast majority of homeowners today have mortgages with interest rates far below today’s rate, leaving them little incentive to refinance. Those who want to take out equity are largely opting for second loans, rather than give up the rates they have in a cash-out refinance.

Mortgage applications to purchase a home increased 2% for the week but were 35% lower than the same week one year ago. Buyers are coming back into the market for the traditionally busy spring season but are finding very little available for sale.

“Home-price growth has slowed markedly in many parts of the country, which has helped to improve buyers’ purchasing power,” said Joel Kan, an MBA economist in the release. “While the 30-year fixed rate remained 1.65 percentage points higher than a year ago, homebuyers responded, leading to a fourth straight increase in purchase applications.”

Mortgage rates, however, moved more than 20 basis points higher to start this week, according to a separate survey from Mortgage News Daily. With no more bank failures in the news this week, and no major economic data to influence investors, rates could return to the higher trajectory they were on before the bank issues hit.