Crucial Factors

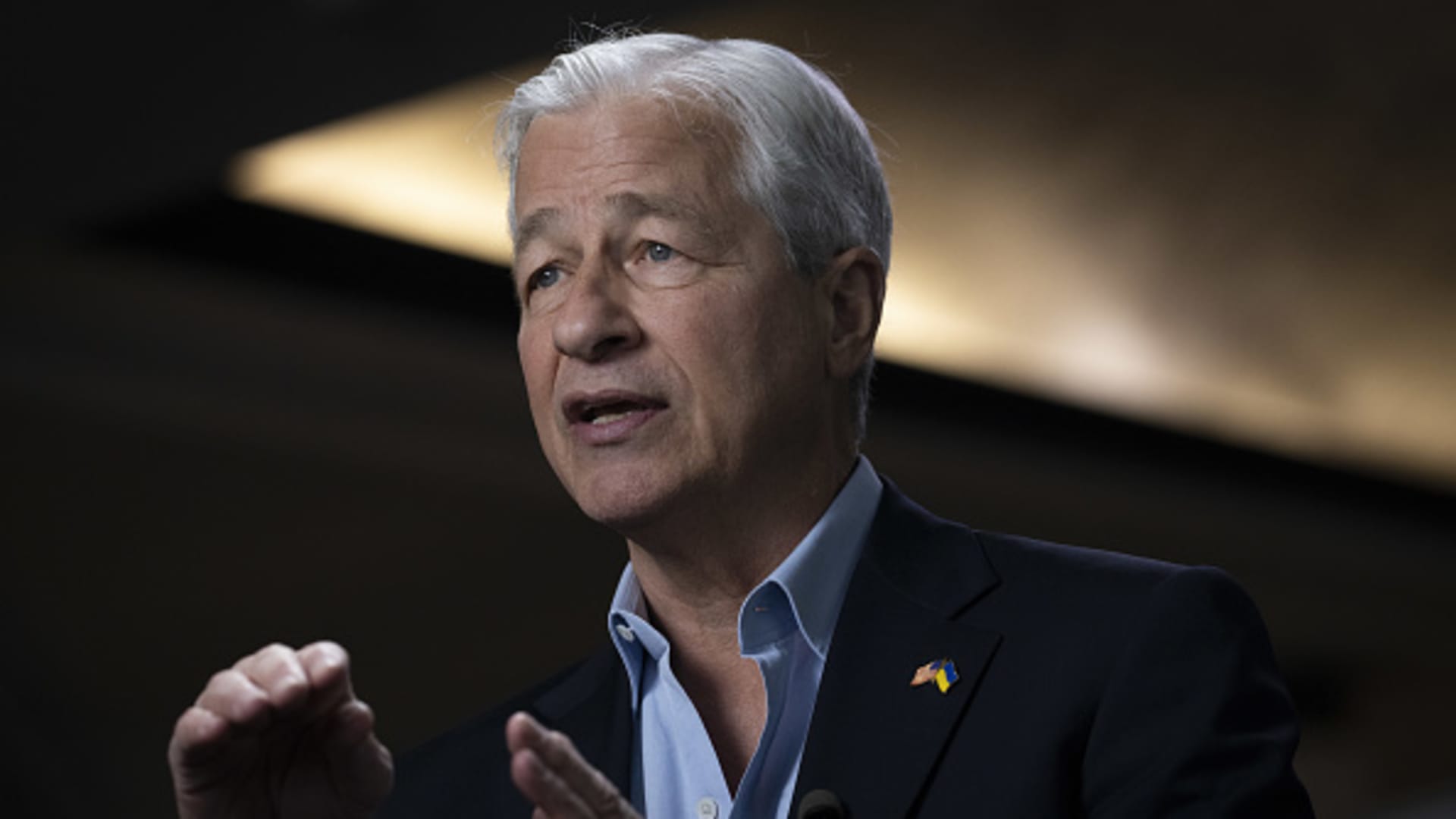

- Jamie Dimon, the veteran JPMorgan Chase CEO and chairman, will be deposed in excess of his bank’s one-way links to disgraced previous financier Jeffrey Epstein, according to a man or woman with information of the make a difference.

- Dimon agreed to be interviewed less than oath, at an undetermined date in the future, for two civil lawsuits tied to the convicted intercourse offender Epstein, the source mentioned.

- Before this month, JPMorgan sought to lay any blame from the episode on a former senior govt.