CNBC’s Jim Cramer explained on Friday that this 7 days was the most up-to-date illustration of the marketplace absent mad following a Federal Reserve meeting.

But based on past market reactions to the central bank’s former fee hikes, this week’s activity may perhaps establish not to be that meaningful in the extensive operate, he stated.

linked investing news

The preliminary reaction to the Fed’s moves is “pretty much generally a head pretend,” Cramer claimed.

The market had a huge response this week pursuing the Fed’s latest go, Cramer observed — with a tough provide-off on Wednesday, adopted by a smaller comeback on Thursday and a chaotic session Friday. While newfound turmoil in the European financial sector dragged down stocks early Friday, they recovered immediately after all those markets closed.

Subsequent the central bank’s quarter stage level hike on Wednesday, there have been nine boosts in just in excess of a year.

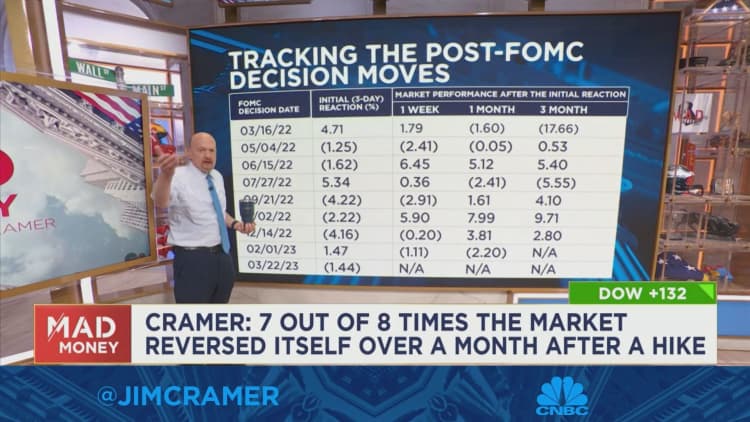

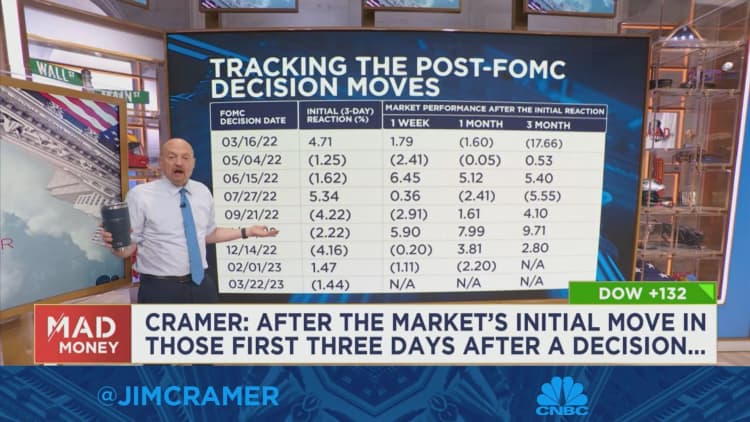

The sector has tracked a pattern in which — soon after the to start with a few days subsequent a Fed final decision — it will typically go in the opposite way the following month, Cramer said.

When seeking at the past eight amount hikes this cycle, the market place reversed direction around the subsequent thirty day period seven out of 8 moments. (There is not adequate info to operate an investigation on the February price hike.)

The only exception was the second 1 that transpired in early Could. That prompted a difficult market-off that lasted many times, and markets were being basically flat in the thirty day period that adopted.

Generally, when you zoom out a few months, the preliminary market moves — irrespective of whether they are constructive or damaging — tend to reverse on their own every time, Cramer stated.

The sample is way too frustrating to disregard, Cramer explained.

To be certain, it stays to be observed whether that exact same sample will hold this time, or regardless of whether the negative original reaction to the Fed’s shift this week will reverse by itself.

This time, with new emergencies cropping up nearly just about every day, specifically in the banking sector, it “feels hazardous” to forecast a rally over the upcoming 3 months, Cramer explained.

But the bottom line is, we have been right here right before, he stressed.

“So, consider a deep breath, drink some tea and remember that the preliminary reaction to the Fed’s amount hikes has been erroneous each time in excess of the earlier yr,” Cramer reported.