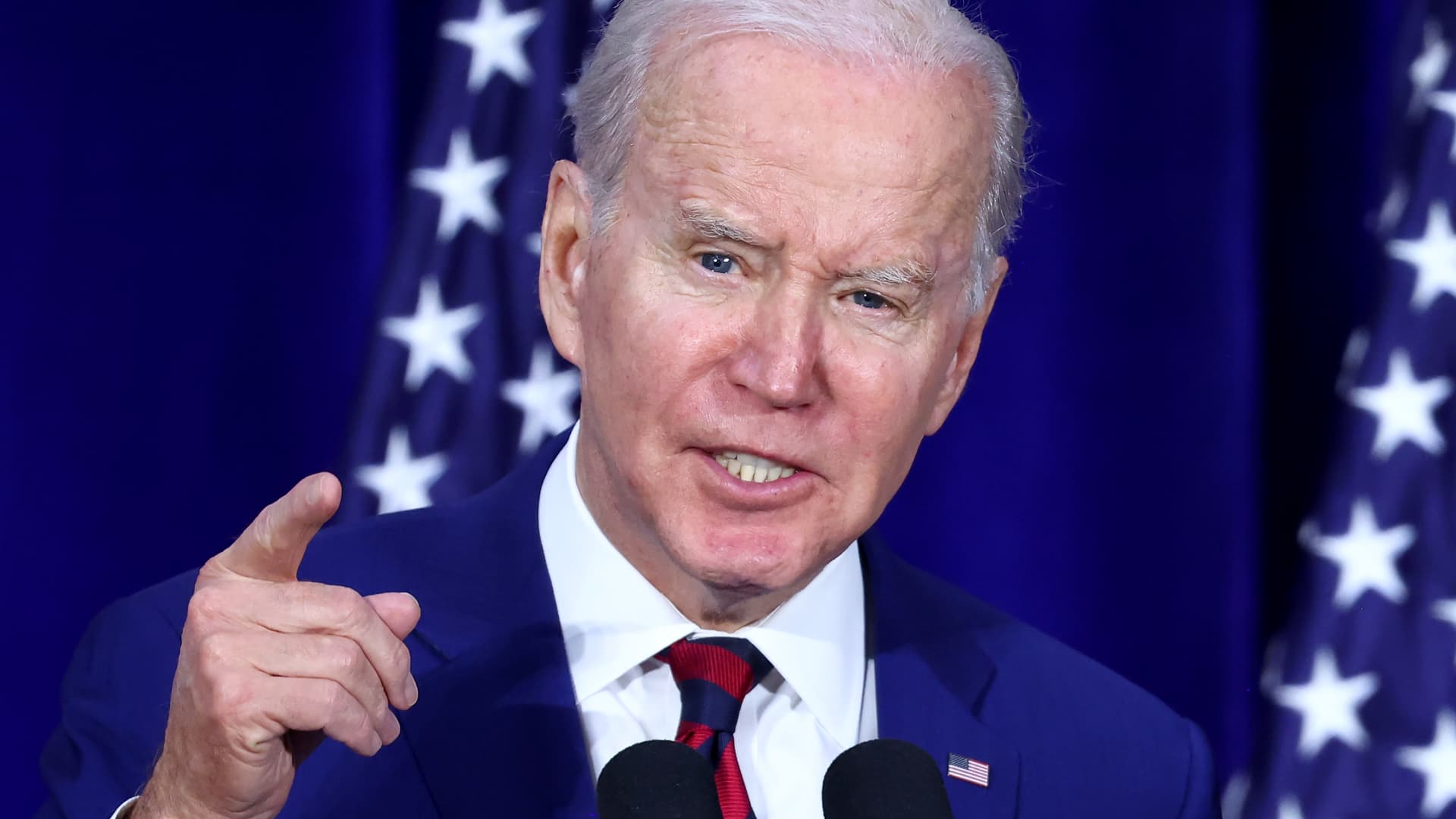

U.S. President Joe Biden provides remarks at the Boys and Women Club of West San Gabriel Valley on March 14, 2023 in Monterey Park, California.

Mario Tama | Getty Visuals

President Joe Biden called on Congress to give regulators much more authority to claw again pay and penalize executives at distressed banks “whose mismanagement contributed to their establishments failing.”

“No one is previously mentioned the legislation – and strengthening accountability is an crucial deterrent to avert mismanagement in the foreseeable future,” Biden mentioned in a statement Friday. “When banking institutions are unsuccessful because of to mismanagement and excessive chance having, it really should be much easier for regulators to claw again compensation from executives, to impose civil penalties, and to ban executives from operating in the banking industry once more.”

Biden noted his powers to maintain executives accountable had been constrained by the regulation and asked Congress move in.

“Congress need to act to impose harder penalties for senior lender executives whose mismanagement contributed to their institutions failing,” Biden claimed.

The nation’s top rated financial institution regulators on Sunday declared the Federal Deposit Insurance policy Corp. and Federal Reserve would fully address deposits at both failed banking companies, Silicon Valley Bank and Signature Bank, and rely on Wall Road and massive money establishments — not taxpayers — to foot the bill. Signature Lender in New York, which was shuttered Sunday over comparable systemic contagion fears as SVB, had been a well-known funding supply for cryptocurrency firms.

The president stressed the actions taken in excess of the weekend ended up needed to prevent further more economic fallout but did not use taxpayer funds.

“Our banking program is far more resilient and stable now simply because of the steps we took,” Biden explained. “On Monday morning, I instructed the American persons and American corporations that they should really come to feel self-assured that their deposits will be there if and when they have to have them. That proceeds to be the case. “