Marc Benioff, co-founder and CEO of Salesforce, speaks at the Globe Financial Discussion board in Davos, Switzerland, on Jan. 18, 2023.

Stefan Wermuth | Bloomberg | Getty Visuals

Salesforce shares soared 14% in extended trading on Wednesday immediately after the cloud program maker beat Wall Street estimates on earnings and issued a better-than-expected forecast.

Here is how the business did:

- Earnings: $1.68 for each share, modified, vs. $1.36 for each share as envisioned by analysts, according to Refinitiv.

- Revenue: $8.38 billion, vs. $7.99 billion as envisioned by analysts, in accordance to Refinitiv.

Salesforce’s income grew 14% calendar year in excess of 12 months in the quarter, which finished on Jan. 31, in accordance to a assertion. The business documented a decline of $98 million, as opposed with a loss of $28 million in the yr-in the past quarter.

In January Marc Benioff, Salesforce’s co-founder and CEO, said the firm would slash 10% of its workforce, symbolizing above 7,000 men and women, and that restructuring strategy led to $828 million in prices in the course of the quarter.

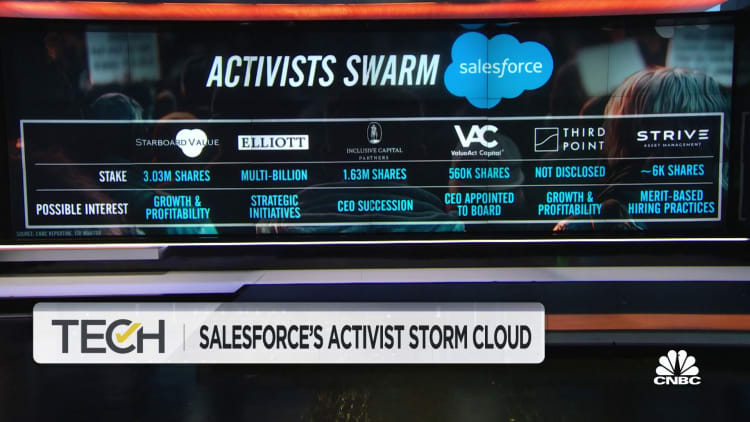

Profitability has develop into a better precedence at Salesforce, which in current months has been having pressured by an inflow of activist investors, which include 3rd Place, Elliott Administration and Starboard Price. The corporation declared the addition of ValueAct Money CEO Mason Morfit to its board. At the stop of the quarter Bret Taylor, who ran Salesforce as co-CEO along with Benioff, stepped down.

For the fiscal 1st quarter, the business named for modified earnings in the range of $1.60 to $1.61 for every share and earnings of $8.16 billion to $8.18 billion. Analysts surveyed by Refinitiv had been on the lookout for $1.32 in adjusted earnings per share and $8.05 billion in income.

Salesforce sees modified earnings for each share for the total year of $7.12 to $7.14 and revenue of $34.5 billion to $34.7 billion. Analysts polled by Refinitiv had predicted $5.84 in modified earnings per share and $34.03 billion in profits.

The company mentioned it was growing its share buyback program to $20 billion after saying its to start with repurchasing motivation, with up to $10 billion allotted for that intent, in August.

Salesforce shares have risen 26% so considerably this year, excluding Wednesday’s after-several hours transfer, outperforming the S&P 500 index, which has acquired 3% more than the same time period.

Executives will explore the final results with analysts on a meeting contact commencing at 5 p.m. ET.

This is breaking information. You should test back for updates.

Observe: Proxy fight possible in retailer for Salesforce