A evaluate the Federal Reserve watches closely to gauge inflation rose a lot more than anticipated in January, indicating the central bank has more work to do to convey down costs.

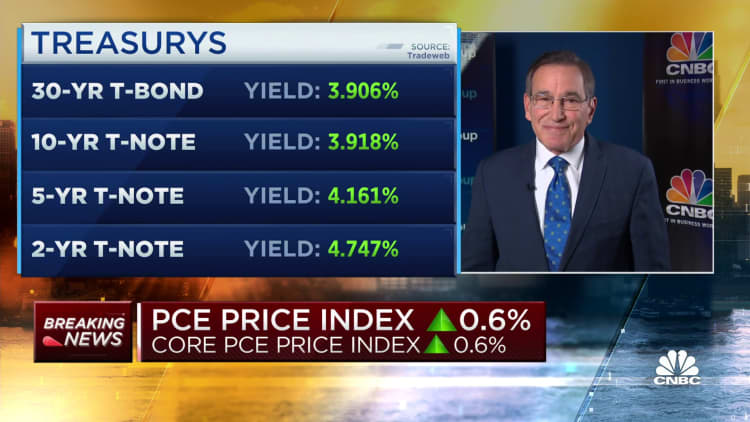

The particular consumption expenditures value index excluding meals and electricity improved .6% for the month, and was up 4.7% from a yr in the past, the Commerce Division reported Friday. Wall Road experienced been expecting respective readings of .5% and 4.4%. The main PCE gains have been .4% and 4.6% in December.

Like the unstable food stuff and electricity components, headline inflation improved .6% and 5.4% respectively, compared to .2% and 5.3% in December.

Marketplaces fell next the report, with the Dow Jones Industrial Ordinary off all over 500 details in morning trading.

“This morning’s strong inflation data continued the latest spate of marketplace-unfriendly news. This could maintain the coverage fee better for lengthier than the current market experienced hoped, which in change will probably strain earnings,” said Matt Peron, director of analysis at Janus Henderson Buyers. “Although we do see signs that inflation will eventually reasonable, larger premiums for longer will just take a toll.”

Shopper spending also rose extra than expected as selling prices increased, leaping 1.8% for the month vs. the estimate for 1.4%. Private profits increased 1.4%, bigger than the 1.2% estimate. The own preserving charge also was up, mounting to 4.7%.

All of the figures counsel inflation accelerated to get started the new calendar year, putting the Fed in a posture where it probable will continue on to raise desire charges. The central lender has pushed benchmark rates up by 4.5 share details because March 2022 as inflation hit its optimum stage in some 41 years.

“Plainly, tighter financial coverage has but to fully impression customers and demonstrates that the Fed has additional function to do in slowing down mixture demand from customers,” stated Jeffrey Roach, main economist at LPL Money. “The Fed may possibly however make a decision to hike by .25 [percentage points] at the subsequent conference, but this report usually means that the Fed will most likely carry on hiking into the summer time. Marketplaces will most likely continue to be choppy all through these months the place higher charges have however to materially neat purchaser paying out.”

The Fed follows the PCE steps more intently than it does some of the other inflation metrics mainly because the index adjusts for shopper shelling out habits, these as substituting lessen-priced items for a lot more high-priced kinds. That provides a more correct perspective of the price tag of residing.

Policymakers have a tendency to emphasis far more on core inflation as they imagine it offers a far better prolonged-run watch of inflation, however the Fed officially tracks headline PCE.

Much of January’s inflation surge arrived from a 2% increase in electrical power charges, in accordance to Friday’s report. Foods selling prices amplified .4%. Merchandise and providers the two rose .6%.

On an once-a-year foundation, foodstuff charges rose 11.1%, though vitality was up 9.6%.

Before Friday, Cleveland Fed President Loretta Mester famous in a CNBC interview that there has been some progress designed but “the level of inflation is nevertheless as well superior.”

A nonvoting member of the charge-environment Federal Open up Market Committee, Mester has been pushing for much more aggressive raises. She claimed she’s not sure if she’ll again advocate for a 50 % proportion stage raise at the March FOMC meeting.

In the wake of Friday’s information, current market pricing enhanced for the chance of a half-point, or 50 basis point, enhance future thirty day period, to about 33%, in accordance to CME Group details.