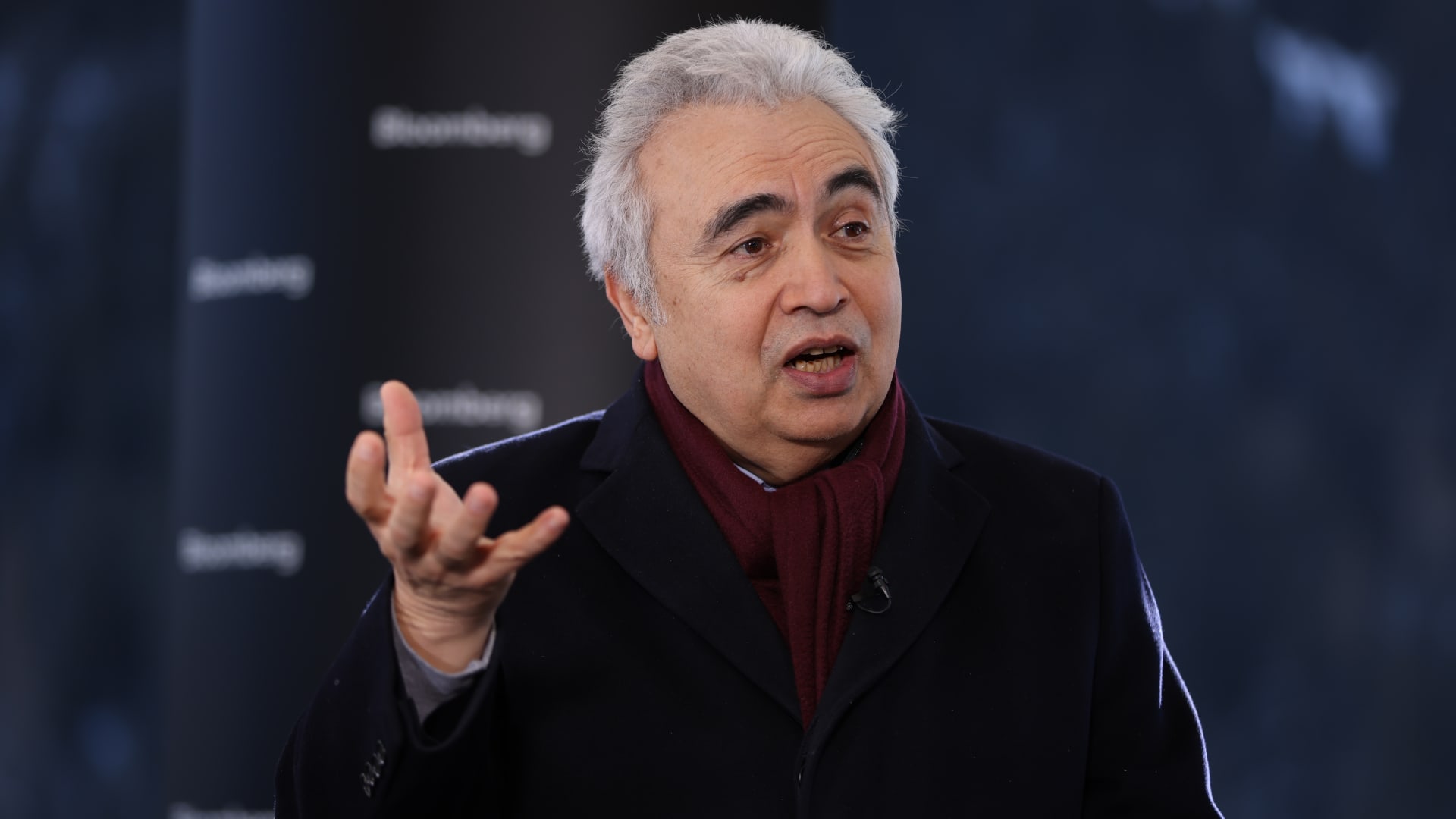

Fatih Birol, government director of the Worldwide Vitality Agency (IEA) at the Entire world Economic Discussion board (WEF) in Davos, Switzerland.

Bloomberg | Getty Images

The Intercontinental Electrical power Agency’s executive director explained Friday that the most important uncertainty experiencing international energy marketplaces is the extent to which China rebounds from its extended closure.

At this time, oil marketplaces are “well balanced,” Fatih Birol told CNBC’s Hadley Gamble at the Munich Stability Conference. But producers are awaiting signals on forthcoming need from the world’s 2nd most significant financial system and premier crude oil importer.

“For me, the most significant reply to the electricity markets in the up coming months to appear is [from] China,” Birol claimed, noting a significant drop-off in the country’s oil and fuel demand from customers for the duration of its pandemic lockdowns.

In its most current every month Oil Marketplace Report printed Wednesday, the electricity agency reported it anticipates international oil demand from customers will select up in 2023, with China accounting for a significant part of the projected enhance.

Oil deliveries are expected to increase by 1.1 million barrels a working day to strike 7.2 million barrels a working day over the class of 2023, with whole demand from customers reaching a report 101.9 million barrels a day, the IEA famous.

If it can be a incredibly solid rebound, there might be a want that oil producers will enhance their production.

Fatih Birol

executive director, International Electricity Company

“China’s financial system is rebounding now,” Birol famous. “How solid this edge will be will decide the oil and gas industry dynamics.”

He additional, “If it is a very potent rebound, there could be a will need that oil producers will enhance their generation.”

The IEA main said that OPEC+ countries, as very well as other major oil manufacturing nations these kinds of at the U.S., Brazil and Guyana, were being poised to ramp up output to meet up with that demand from customers, should really it be required.

Requested no matter whether President Joe Biden’s Inflation Reduction Act (IRA) — with its package of funding aimed at incentivizing clear energies — could stymy creation improves in the U.S., Birol reported this was not likely.

“I consider it’s further than the government’s policies. There is massive, enormous revenue to be designed,” he explained, citing document income posted by global oil and gasoline firms in the earlier year.

IRA the ‘most important’ local climate action given that Paris 2015

Birol insisted that the IRA was participating in a vital function in accelerating the international clean up energy changeover, when again hailing it as the “one most significant climate motion considering the fact that the Paris agreement [of] 2015.”

The IEA head stated that the international strength crisis, prompted by Russia’s invasion of Ukraine, was “supercharging” the changeover to thoroughly clean energies.

He added that he expects other international locations and regions will before long unveil similar clean up electrical power financial investment deals.

“I’m certain, quicker or later, Europe will come with a similar electrical power package,” he said.

“We are coming into a new industrial age: the age of cleanse vitality technologies manufacturing,” he remarked, citing wind, solar and nuclear strength systems. “People will be the critical terms for the following a long time to occur.”

— CNBC’s Elliott Smith contributed to this report