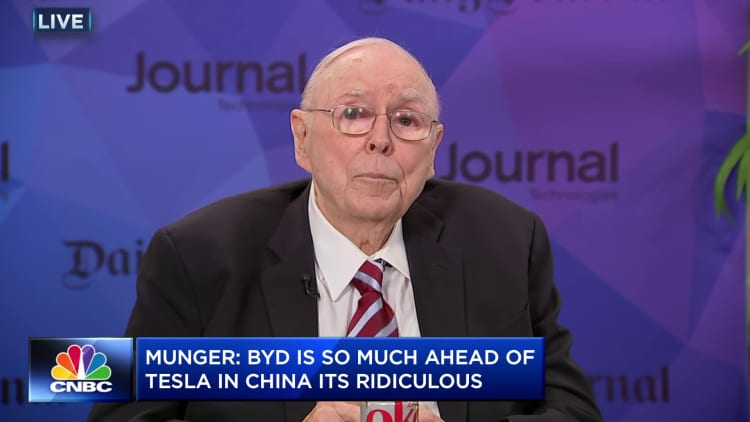

Charlie Munger said Wednesday that Tesla pales in comparison to BYD in China, contacting the Chinese electric powered auto maker his favored stock at any time.

“I have hardly ever helped do nearly anything at Berkshire [Hathaway] that was as excellent as BYD and I only did it as soon as,” the 99-yr-aged trader said at the Each day Journal’s digital annual assembly Wednesday. Berkshire preliminary financial commitment is now “worthy of about $8 billion or perhaps $9 [billion]. Which is a quite excellent rate of return,” mentioned Warren Buffett’s longtime financial commitment companion.

BYD has been a lucrative guess for Berkshire , which 1st bought about 220 million shares in September 2008. The stock has jumped much more than 600% in the past 10 several years amid the huge progress in electric powered vehicles. Berkshire has really been trimming its BYD stake in the earlier 12 months as the stock has develop into more and more pricey.

“At the latest rate of BYD inventory, small BYD is really worth a lot more than the complete Mercedes corporation. It can be not a cheap stock, but on the other hand, it really is a extremely remarkable organization,” Munger stated.

Munger, Berkshire’s vice chairman and a Everyday Journal board member, credited Li Lu, founder of Seattle-based mostly asset supervisor Himalaya Capital, for introducing him to BYD. Munger also claimed BYD CEO Wang Chuanfu is abnormal, contacting him a genius and a workaholic.

Asked if he would favor Tesla or BYD as an investment decision, Munger reported the solution is effortless.

“Tesla previous year diminished its costs in China 2 times. BYD elevated its costs. We are direct competition. BYD is so substantially in advance of Tesla in China … it’s just about absurd,” Munger stated.

BYD recently mentioned it expects report modified yearly earnings for 2022 of 16.3 billion yuan ($2.4 billion), about 1,200% previously mentioned 2021.

“BYD past year built extra than $2 billion just after taxes in the auto organization in China. It really is extraordinary what is transpired,” Munger said. “If you rely all the manufacturing place they have in China to make vehicles, it would amount of money to a huge proportion of the Manhattan island, and no one experienced at any time heard of them a few many years ago.”

The longtime investor called Tesla CEO Elon Musk gifted — and peculiar. He beforehand claimed what Musk accomplished in the car business enterprise was a “minor miracle.”

“I don’t purchase him, and I will not brief him,” Munger said Wednesday.