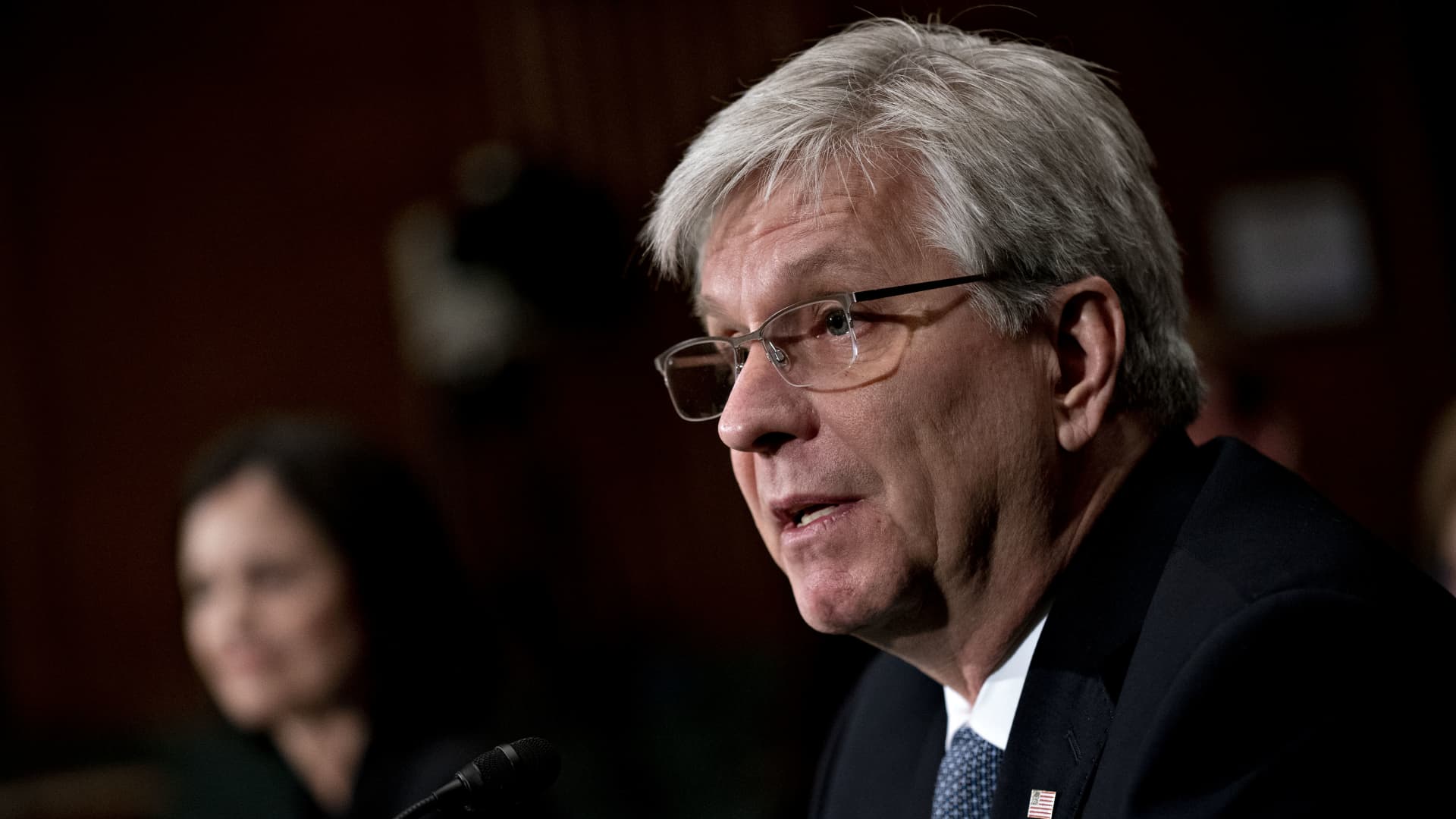

Christopher Waller, U.S. President Donald Trump’s nominee for governor of the Federal Reserve, speaks all through a Senate Banking Committee affirmation listening to in Washington, D.C., U.S, on Thursday, Feb. 13, 2020.

Andrew Harrer | Bloomberg | Getty Photos

Federal Reserve Governor Christopher Waller on Wednesday talked tricky on inflation, warning that the struggle is not above and could final result in larger desire prices than marketplaces are anticipating.

Speaking to an agribusiness convention in Arkansas, Waller stated the January careers report, displaying nonfarm payroll development of 517,000, indicated that the employment market place is “strong” and could fuel client expending that would maintain upward stress on inflation.

relevant investing information

For that reason, he mentioned the Fed wants to retain its present-day approach of action, which has observed eight curiosity level hikes because March 2022.

“We are seeing that exertion start off to fork out off, but we have farther to go,” Waller instructed the Arkansas State College Agribusiness Conference in well prepared remarks. “And, it could possibly be a extended fight, with fascination rates increased for longer than some are currently anticipating. But I will not wait to do what is essential to get my occupation accomplished.”

The reviews occur a week immediately after the level-environment Federal Open Industry Committee approved a quarter percentage level raise that took the benchmark borrowing level to a target array of 4.5%-4.7%, the optimum considering that Oct 2007.

Markets have been taking some encouragement off recent remarks from Fed Chairman Jerome Powell, who has mentioned that he is viewing disinflationary indicators. Inflation hit a 41-year peak previous summer, forcing the Fed off its insistence that the selling price raises ended up “transitory” and into the current tightening posture.

But Waller reported he sees inflation however too significant although he expects just average economic expansion this calendar year. He did take note that wage details is “relocating in the suitable direction,” but not plenty of for the Fed to reduce fees.

“Some believe that inflation will arrive down really rapidly this yr,” he mentioned. “That would be a welcome outcome. But I’m not seeing signals of this rapid decrease in the economic info, and I am organized for a for a longer period combat to get inflation down to our target.”

Marketplaces currently hope the Fed to approve two extra charge improves — a quarter-point every single at the March and Could conferences, in accordance to CME Team facts. They then expect a quarter-place lower by the close of the calendar year as the economy slows and possibly drifts into recession.

Waller did not specify his watch on the place charges are headed, indicating only he sees tight financial coverage lasting “for some time,” a phrase utilised continuously by Powell and other Fed officers.