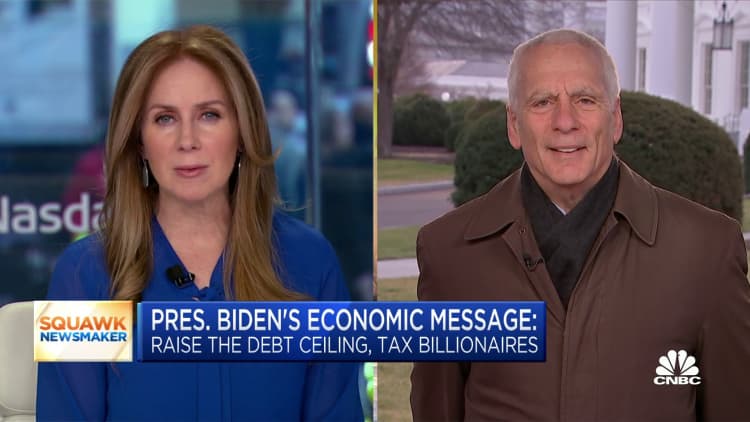

A prime White Home economist defended tax proposals aimed at the wealthiest Us residents outlined by President Joe Biden during his second State of the Union deal with Tuesday evening.

Jared Bernstein, a member of the White Property Council of Economic Advisors, explained Biden’s tax proposal will concentrate on big businesses and the wealthiest Us residents though shielding taxpayers who earn $400,000 a year or significantly less from tax hikes.

“The days of the leading 1% paying out fewer than lecturers and nurses … people have acquired to be powering us as we inject fairness into the tax code to realize fiscal rectitude,” Berstein reported in an job interview on CNBC’s “Squawk Box” on Wednesday.

Biden signed into law a 15% bare minimum tax on businesses earning more than $1 billion in revenue beneath the Inflation Reduction Act. A 1% excise tax on the worth of stock buybacks, which can empower big firms to steer clear of paying out taxable dividends, was also handed underneath the act.

All through his State of the Union, Biden urged Congress to go his so-named billionaire’s tax, which proposes to impose a minimal 20% tax on households with a internet worth of in excess of $100 million — a 12 share point maximize from an average of 8% they at the moment pay out.

Bernstein also defended the president’s tax amount on funds gains, which he in the beginning proposed in 2021. If enacted, the 48.6% level with a 3.8% web expense income on long-time period capital gains and experienced dividends would rate amongst the greatest in the developed entire world.

The tax amount would utilize to all those earning above $1 million. The prime 1% of earners paid out 42.3% of all federal taxes in 2020, according to the Tax Basis, which puts to dilemma whether or not the wealthiest Americans spend decreased taxes than instructors and firefighters.

“You known as it a prosperity tax on unrealized gains,” Bernstein explained of the capital gains tax proposal. “In simple fact, what it really is, or at least the way we see, it is a prepayment or withholding tax on future funds gains.”

“If you are a rich person or a corporation and you’re having to pay a tax price significantly less than 15% on your company profits, or a lot less than 20% on your earnings, like … capital gains, well, then we’re going to change that and that is injecting fairness into this act,” he stated. “It is disallowing wealthy tax cheats to evade the code, and it allows to obtain the form of fiscal accountability that this president wishes to make on in the rest of his very first term.”

Bernstein also addressed the ongoing credit card debt ceiling discussion and explained that while Biden is inclined to negotiate on fiscal matters, he won’t negotiate when it will come to boosting the federal debt restrict, specially if cuts to Medicare and Social Stability are on the table.

“We want to see what the Republican strategy is,” he mentioned. “And I believe if Republicans are true to their word and using Social Safety and Medicare off the desk … and military services shelling out off the table, that implies they would have to slash 85% of what is remaining. Which is not reasonable.”