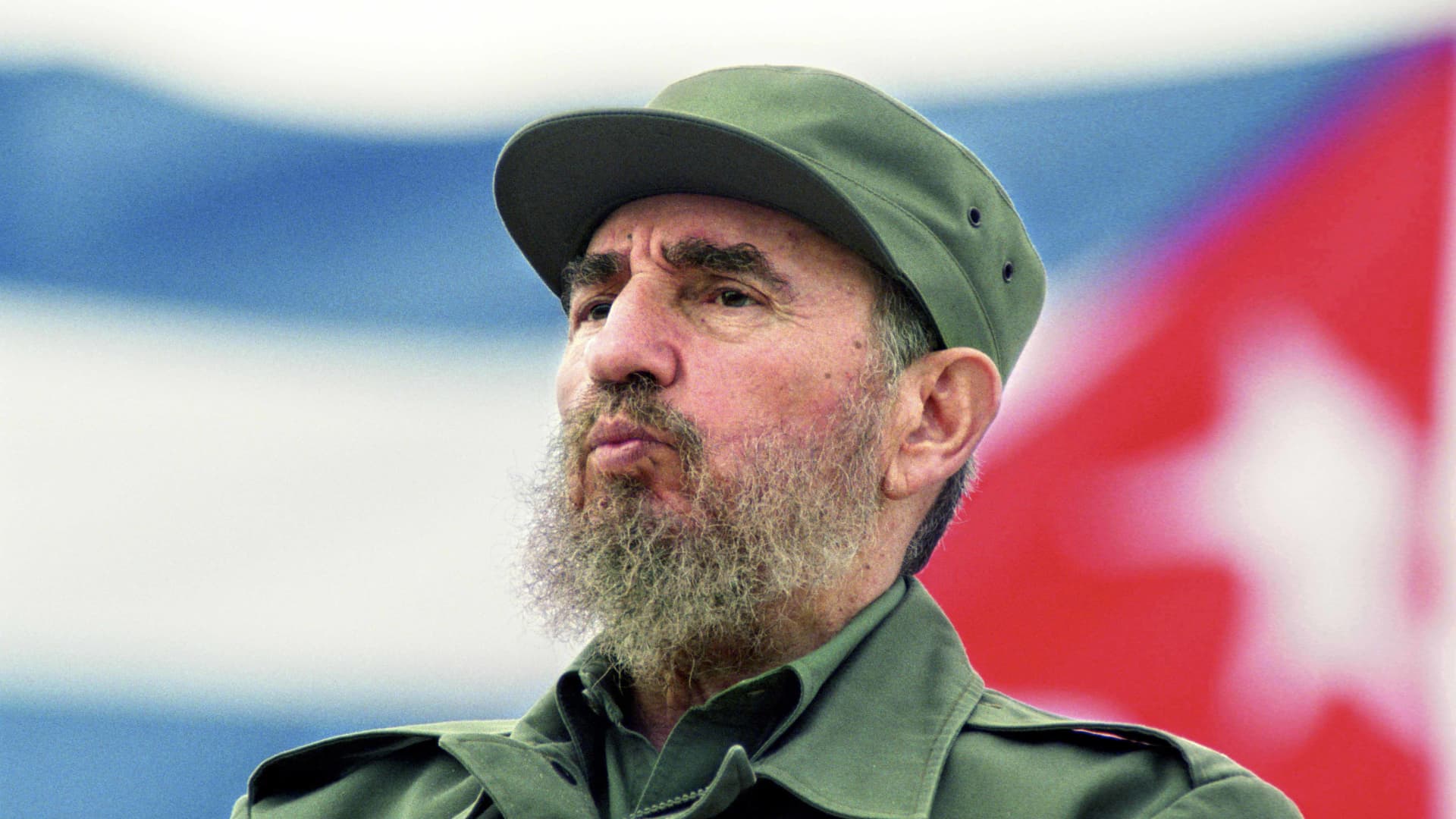

Fidel Castro observes the May Day parade at the Revolution Square in Havana, Cuba May 1, 1998.

Sven Creutzmann | Mambo Photography | Getty Images

Can the Cuban government be sued for unpaid debts from the early 1980s – debts so old they are denominated in a currency that no longer exists?

That’s the question before a judge at the UK High Court after a seven-day trial marked by chaotic protests, a bribery accusation and remote testimony from an imprisoned Cuban banker.

The trial ended last week, but it could be months before the judge, Sara Cockerill, renders judgement in the case of CRF vs Banco Nacional de Cuba & Cuba. Her decision is central to whether Cuba may finally be forced to pay back billions of dollars in unpaid debts.

The trial is seen as a test case. CRF1, formerly known as the Cuba Recovery Fund, owns more than $1 billion in face value of European bank loans extended to Cuba in the late 1970s and early 1980s, when Fidel Castro still ruled the island. Cuba defaulted on the debt in 1986.

CRF1, which began accumulating the position in 2009, is suing Cuba and its former central bank over only two of the loans they own for more than $70 million dollars. If CRF wins on this small slice of Cuba’s total outstanding commercial debt, which is estimated at $7 billion, it could lead to further lawsuits from other debt holders, with claims against Cuba rising into the billions.

While the most dramatic testimony has focused on an accusation of bribery, much of the trial has focused on the arcana of Cuban and English law.

Were there enough signatures from Cuban bank officials on the paperwork when the loans in question were “reassigned” or transferred to CRF? Was the paperwork stamped with a dry-pressure seal or a wet-ink stamp and did they use the correct blue security paper? At one point the barrister for CRF cited a British property case regarding the lease of a fried fish shop.

The question before the judge is of whether the fund has the right to sue Cuba. Still, experts said she could issue a summary judgement in which she rules not only on jurisdiction but also on substance, meaning not just whether CRF can sue, but also whether Cuba must pay.

Throughout the trial, representatives of the fund have repeatedly stated that they did not want to sue Cuba but did so only as a “last resort” after the government ignored their requests to negotiate for 10 years.

“Even at this late date, in a case where we expect to prevail, CRF is willing to settle,” David Charters, chairman of CRF, said at the conclusion of the trial.

During testimony, CRF representatives said they made more than one offer to the Cuban government that would not drain the island’s current cash flow and would help improve its economy. They described offers of long-duration non-coupon bonds and debt for equity swaps, neither of which would force Cuba to come up with cash in the near term, or even the long term, depending on the deal.

The Cubans have argued that it was always CRF’s intention to sue and has described them as a vulture fund taking advantage of an impoverished country.

No matter how the judge rules, the Cuban government will still owe the money. And they will not be able to borrow on the international capital markets until they have settled all their past debts. Cuba hasn’t been able to borrow in the markets since 1986, when the country defaulted. Since then, Cuba has survived on the largesse of other countries such as the former Soviet Union and, more recently, Venezuela and China.

Cuba is not a member of the IMF or the World Bank, institutions that would typically be involved in helping an impoverished country restructure its debts and reemerge into the international financial system.

The Cuban government did not respond to requests for comment.