CNBC’s Jim Cramer on Monday warned investors to brace for market turbulence ahead by consolidating their portfolios.

“The charts, as interpreted by Carolyn Boroden, suggest that the incredible rally in the S&P 500 might be running out of steam,” he said, adding, “She’s not necessarily saying we’re headed for a brutal near-term decline, but you might want to pull in your horns for the next few weeks.”

related investing news

Stocks fell on Monday as investors took profits after the stock market’s strong start to the year. The S&P 500 is up more than 7% this year.

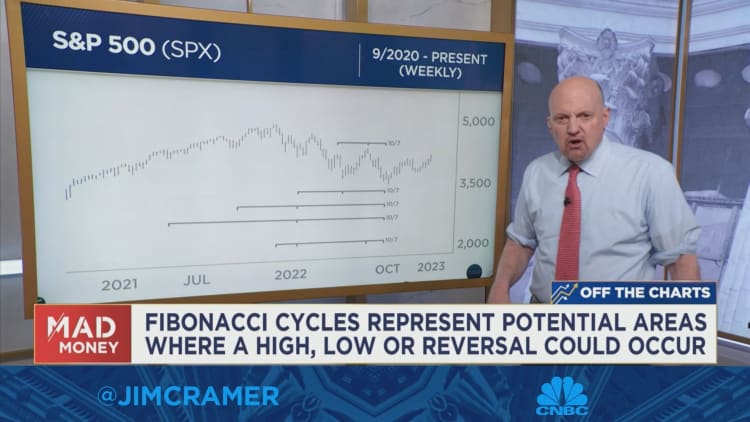

Cramer first explained that Boroden measures past swings in a stock or index and determines key levels by running them through Fibonacci ratios, which technicians use to spot patterns that can signal when a stock or other security could shift directions.

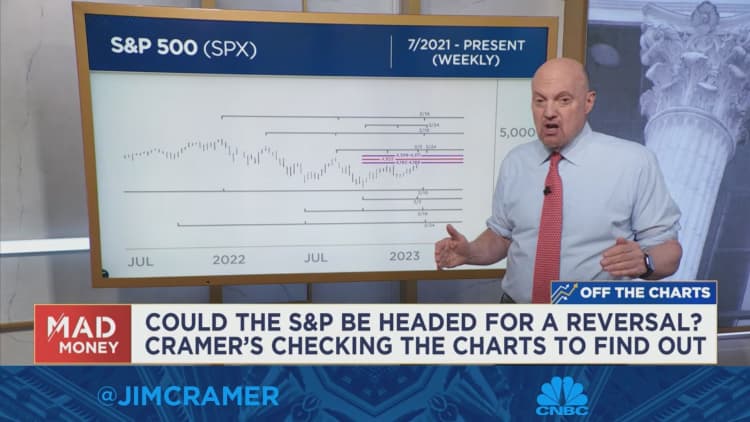

A cluster of Fibonacci timing cycles clustered together is a sign that “something big” could happen, he added. To explain Boroden’s analysis of the S&P 500, Cramer examined the weekly chart of the index going back to July 2021.

She sees six Fibonacci time cycles coming due in this week, which means the odds of a bearish reversal are higher than she’d like, according to Cramer. He added that there are three more timing cycles coming due near the end of the month, in the week ending on Feb. 24.

“Boroden also says that when you look at the daily chart, you’ve got similar timing cycles that are forecasting the same thing … a meaningful pullback,” Cramer said.

He said that while these signs don’t guarantee a reversal, Boroden does believe that investors should prepare themselves for the possibility that February could be a tough month for the market.

“She recommends watching for any sell signals so you can ring the register and protect your profits,” he said.

For more analysis, watch Cramer’s full explanation below.