The DXY has fallen a lot more than 10% in the earlier 3 months, Refinitiv information confirmed — and is a couple details absent from erasing virtually all its gains that it’s observed in the past calendar year, right before the Federal Reserve embarked on its journey of curiosity price hikes to tame inflationary pressures.

Kacper Pempel | Reuters

The U.S. dollar index ongoing to slump on Thursday as the Federal Reserve opted for a more compact curiosity fee hike of 25 foundation factors.

The DXY fell .3% throughout Asia’s morning session to 100.91, hovering at the lowest concentrations that it is witnessed because April 2022, according to Refinitiv facts.

The index fell right away to hit a session small of 101.036 just after the Fed Chair Jerome Powell acknowledged the central bank’s endeavours to tame inflation is seeing some development — even with offering little indication that it is nearing the close of its hiking cycle anytime shortly.

Asian currencies noticed relative strengthening with the transfer, with the Japanese yen strengthening by .4% to trade at 128.43 in opposition to the U.S. dollar.

The Korean gained also strengthened .3% to stand at 1,218.6 from the greenback. The onshore Chinese yuan, likewise, strengthened .43% to trade at 6.7115 in opposition to the dollar.

The DXY has fallen additional than 10% in the past three months, Refinitiv facts showed — and is a couple of details away from erasing nearly all its gains that it truly is viewed in the earlier year, prior to the Federal Reserve embarked on its journey of curiosity rate hikes to tame inflationary pressures.

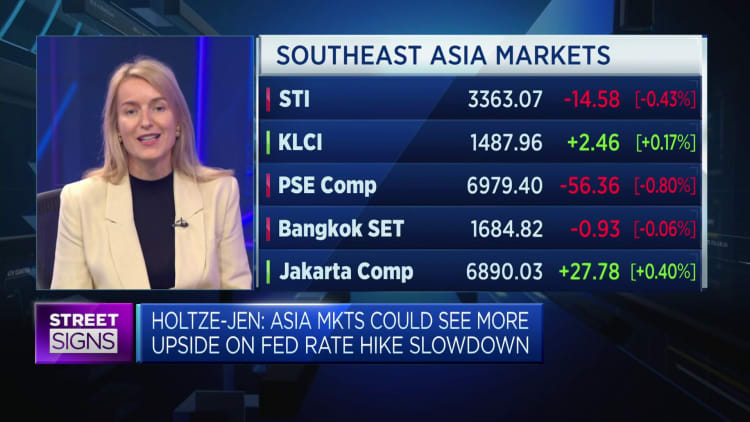

The turnaround in the dollar index will profit currencies in the area, claimed Deutsche Bank International Personal Bank’s Asia-Pacific main investment officer, Stephanie Holtze-Jen.

“The relentless greenback strength, we will see an conclude to it,” Holtze-Jen explained to CNBC’s “Avenue Symptoms Asia.”

“[A] robust greenback had curtailed trader sentiments going in below in phrases of the marketplaces in the Asia-Pacific, for the reason that it’s put a dent on the returns on the asset classes,” she stated, adding that rising marketplaces are set to gain from a reversal of the index.

She added that the U.S. greenback-Chinese yuan will be an “essential part to enjoy” in currency trades in gentle of China’s reopening and dollar weak spot.

Extra information in advance

Conventional Chartered Bank’s controlling director Steven Englander said Friday’s work info will be in concentration for the greenback index. He said a reading in line with expectations will prompt it to go on its fall.

“If unemployment arrives in on the very low end, the dollar go will proceed and the market place will say yeah, we had been ideal,” he mentioned.

“If the numbers go on to aid the narrative, there’s nevertheless pretty a little bit of space for the greenback to slide,” he stated.

The U.S. Bureau of Labor Statistics is scheduled to publish its depend of nonfarm payroll development for the thirty day period later this week. Economists surveyed by Dow Jones hope to see expansion of 187,000 in that report.