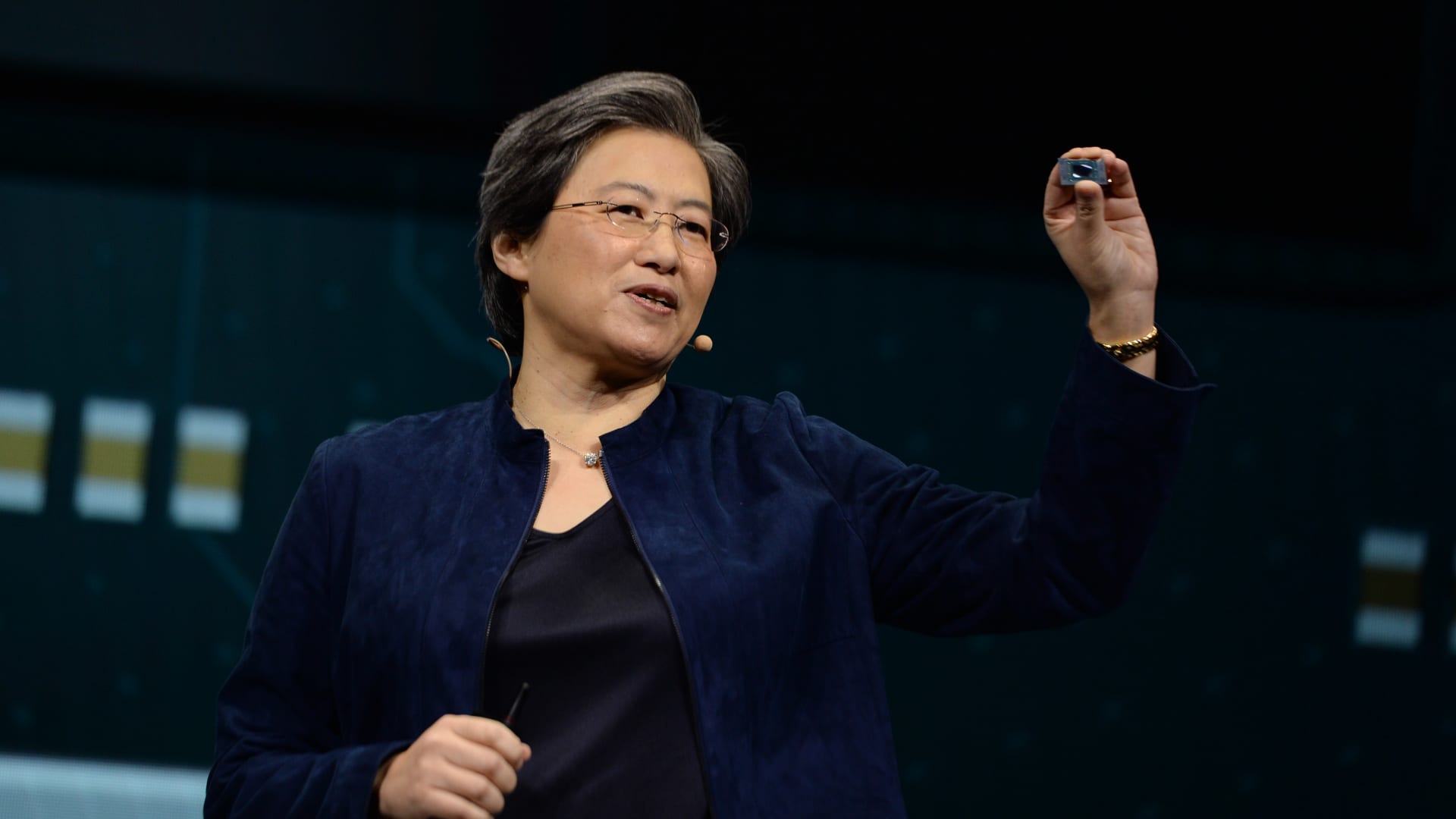

Lisa Su, president and main govt officer of Highly developed Micro Equipment Inc. (AMD).

Bridget Bennett | Bloomberg | Getty Images

AMD and Intel are fierce competition in a complicated marketplace for chips, but one has a much brighter small-phrase outlook than the other. Though Intel is anticipating declines across the board, AMD’s knowledge center business enterprise is increasing with the introduction of a new chip, and its pandemic-period acquisition of specialty chip-maker Xilinx is also contributing development.

On Tuesday, AMD reported it expected $5.3 billion in revenue in the March quarter, which would be a 10% 12 months-about-yr decline in product sales.

That is not a rosy outlook, but it really is substantially more powerful than Intel’s guideline for the March quarter. Last 7 days, Intel claimed it anticipated about $11 billion in profits, which would be a 40% calendar year-above-year drop.

Neither chipmaker gave whole-yr guidance, citing economic uncertainty. “We want to be cautious definitely heading into the yr just provided the macro setting,” AMD CEO Lisa Su advised analysts on the company’s earnings call.

But the inventory industry is reflecting how the two firms are diverging.

Soon after Intel’s report very last week, it fell above 7% in extended buying and selling. AMD rose below 2% after its earnings report on Tuesday.

Both of those organizations are experiencing a slump in Computer industry, following two decades of elevated profits in the course of the Covid pandemic, as persons bought new desktops to operate or go to faculty from residence.

AMD’s Pc chip group profits declined 51% on a year-over-year foundation in the fourth quarter. Intel’s declined 36%, but from a larger base. Over-all, AMD CEO Lisa Su explained on Tuesday that it expects the total Laptop market place to be down 10% in 2023, but claimed that AMD in fact obtained market share in the fourth quarter.

“It’s fair to say that we imagine supplied exactly where we are with the client stock levels, the 1st 50 % will definitely be lessen. We assume some advancement in the next fifty percent,” Su explained.

The companies diverge extra radically when it comes to knowledge centre chips.

Revenue for Intel’s datacenter team fell 33% from the preceding 12 months to $4.3 billion, partly due to the fact of a late launch of its hottest server chip family, Sapphire Rapids.

AMD’s details center enterprise is increasing strongly, however, up 42% on an yearly foundation to $1.7 billion. AMD produced its most recent facts centre chips, the fourth-technology Epyc processors, in November. AMD expects its details heart organization to develop this calendar year although Laptop chips and graphics processors for gaming decline.

AMD’s information centre small business faces hard macroeconomic situations way too, but on Tuesday, Su signaled to buyers that its gains would arrive at Intel’s expense.

“In our Embedded and Information Center segments, we feel we are perfectly positioned to improve profits and get share in 2023 based mostly on the power of our aggressive positioning and leadership,” Su explained.

AMD also experienced accomplishment with its 2020 acquisition of Xilinx, which it bought for $35 billion. Xilinx, which tends to make processors that accomplish specialised duties like encryption or online video compression, was the principal contributor to $1.4 billion in gross sales for AMD’s embedded division, an once-a-year enhance of 1,868%, according to the enterprise.