S&P 500 futures state-of-the-art Wednesday night as buyers looked outside of the newest desire price hike and commentary from the Federal Reserve.

Futures tied to the wide market index added .1%. Nasdaq 100 futures attained .7%, helped by Meta shares. Futures connected to the Dow Jones Industrial Regular ticked down 93 points.

Meta surged more than 19% in extended trading right after reporting a fourth-quarter conquer on revenue and asserting a $40 billion inventory buyback. That served investors glimpse past losses in the small business unit overseeing the metaverse.

The moves comply with a constructive working day for the 3 significant indexes. The S&P 500 reversed losses to stop the standard session with a soar of 1.05%, when the Nasdaq Composite closed 2% greater. In the meantime, the Dow eked out a slim .02% attain following dropping more than 500 details before in the working day.

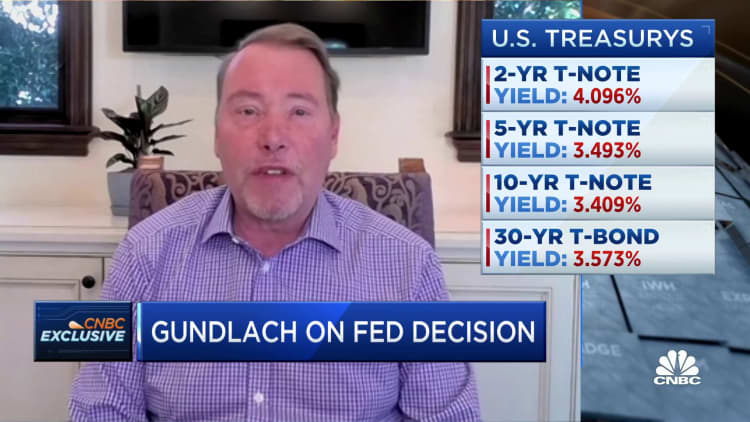

Buyers carefully watched the Fed assembly Wednesday, where a .25 percentage point desire amount hike was announced. That marked a pull back again from the .5 percentage stage enhance at December’s meeting, bolstering trader optimism that inflation is cooling enough for the central bank to acquire detect. But the financial institution gave no indicator of an upcoming pause in rate hikes.

“Traders imagine the Fed is driving the curve and that inflation menace is receding swiftly,” claimed Jamie Dutta, marketplace analyst at Vantage. “The Fed is open to shifting its intellect and may possibly have to if the overall economy loses momentum.”

Investors will view Thursday for earnings studies from home names together with Apple, Alphabet, Amazon, Ford Motor and Starbucks. They will also glimpse for knowledge on jobless statements, productiveness, labor charges and factory orders.