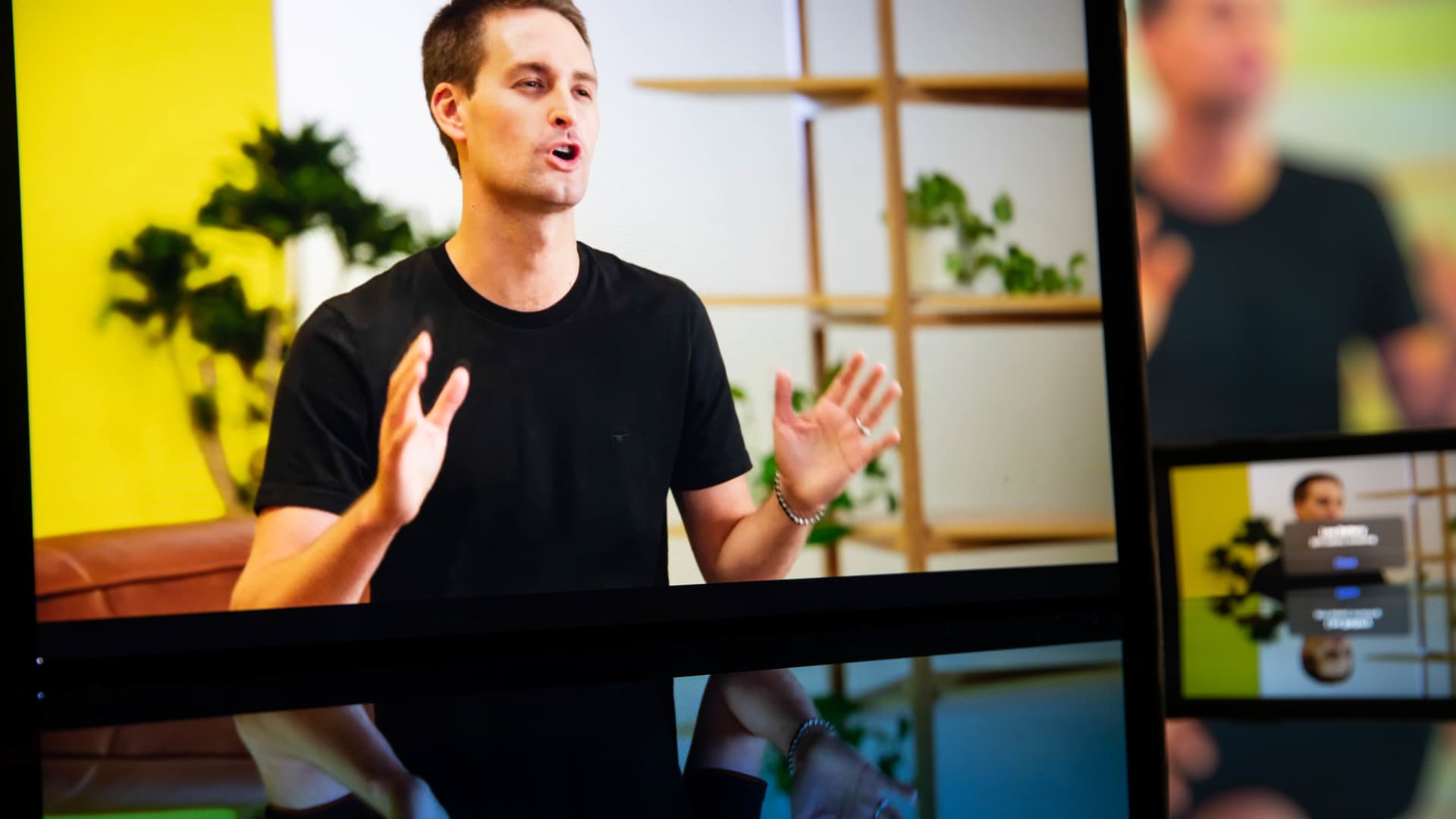

Evan Spiegel, co-founder and chief govt officer of Snap Inc., speaks in the course of the virtual Google Pixel Drop Start occasion in New York, on Tuesday, Oct. 19, 2021.

Michael Nagle | Bloomberg | Getty Images

Shares of Snap tumbled 10% on Wednesday, a day soon after the enterprise introduced a disappointing quarterly report for the third quarter in a row.

In a letter to buyers, Snap known as it a “hard 12 months” that was marked by “macroeconomic headwinds, platform coverage alterations, and amplified competitors.” Earnings in the company’s fourth quarter was up a bit from a year earlier.

Like social media peers Meta and Twitter, Snap experienced a tough 2022 as a slowing overall economy led businesses to slash their electronic ad budgets at the very same time that Apple’s iOS privacy update minimal targeting capabilities.

UBS analyst Lloyd Walmsley downgraded Snap from buy to neutral, citing elevated competition from other social media organizations these as Meta, TikTok and YouTube. Walmsley reiterated a cost goal of $10, which implies draw back of 13.5% from Tuesday’s close, and trimmed his 2023 earnings outlook on Snap.

“Specified the magnitude of competitors and Snap’s comparatively subscale nature, we see risk to income acceleration,” he wrote in a be aware Wednesday.

Analysts at JPMorgan stated that even though Snap is becoming affected by broader problems in the sector and the macroeconomic ecosystem, it is also facing major firm-unique challenges. The analysts mentioned the organization is observing a ongoing drop in engagement with Pal Tales, and even though it is really generating some advancements in promoting, they will be disruptive to advertisers and earnings.

“It truly is unclear how speedily Snap’s products will modify to these variations, & it may just take advertisers some time to figure out the gains & change their bids/shelling out accordingly, especially in a weaker macro

environment,” they wrote in a note Tuesday.

The JPMorgan analysts maintained their underweight rating on the stock.

Jeffries analysts claimed Snap’s fourth quarter was disappointing, and they lowered their fiscal 12 months 2023 estimate by 2%.

“We are involved that SNAP’s challenges are intensifying, as modern advertisement platform modifications further tension rev progress and depth of engagement on mate tales once more lowering y/y,” the analysts wrote in a notice Wednesday.

— CNBC’s Jonathan Vanian and Michael Bloom contributed to this report.