CNBC’s Jim Cramer on Wednesday offered investors a list of stocks that he believes could be great additions to portfolios.

“We only want … stocks if they’re reasonably valued because this market has very little patience for anything expensive,” he said.

Here is his list:

Earnings season kicks into high gear Friday with reports from major banks and airlines, and Cramer said he’s worried that analysts’ earnings estimates for 2023 seem too high given the state of the economy.

“I’m betting many companies will give conservative forecasts, and the analysts will have to slash their full-year estimates if they’re worried about a Fed-induced recession caused by multiple rate hikes,” he said.

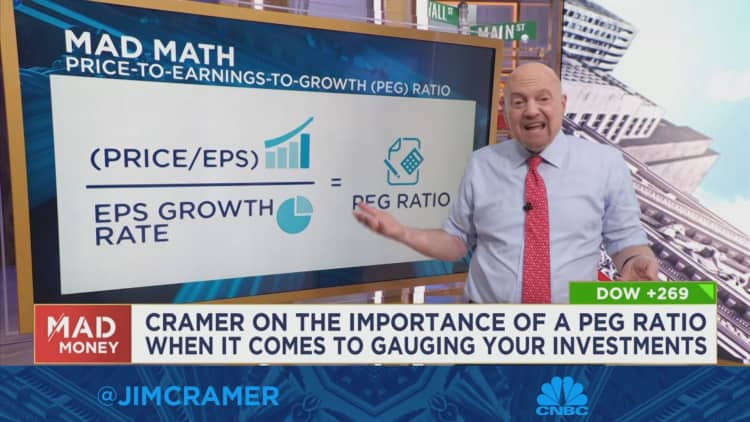

As a result, he decided to focus on stocks’ price-to-earnings-to-growth ratio when compiling his picks. “That tells you whether a stock is cheap or expensive relative to its own growth, which is what really matters,” he said.

Cramer’s stock screen methodology

To come up with his list, Cramer first took all the stocks in the S&P 500 and eliminated those that don’t have meaningful analyst coverage. Then, he took out the companies that are expected to lose money or have negative earnings growth in 2023.

From this consolidated list, he eliminated companies expected to have less than 5% earnings growth. Stocks with “nosebleed” price-to-earnings multiples were also axed.

“This market hates anything with a high price-to-earnings multiple, so anything trading at more than 30 times earnings — out,” Cramer said. He also cut out stocks trading below 10 times earnings, since “a low multiple is a signal that Wall Street simply doesn’t believe the earnings estimates.”

After he then got rid of all the stocks with a dividend yield of less than 2%, he was left with 77 names. Finally, he ran a PEG ratio screen on the stocks, crossing off stocks where the price-to-earnings multiple was more than twice the earnings growth rate. Left with 40 names, he picked his top five.

Disclaimer: Cramer’s Charitable Trust owns shares of Morgan Stanley.