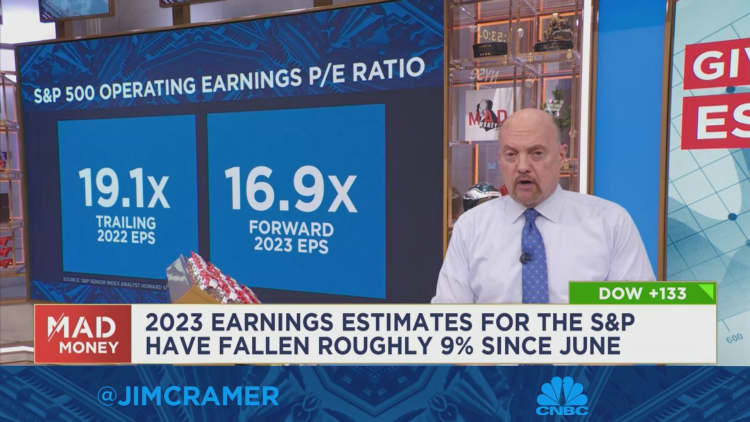

CNBC’s Jim Cramer on Wednesday offered investors a selection of stocks that he believes will do well this year.

To come up with his picks, he examined the best- and worst performers in the S&P 500 from last year and chose five potential 2023 winners from each list.

“One of the easiest traps to fall into is simply sticking with winners. And it works for a long time – right until it doesn’t,” he said.

Here are the best-performers from 2022 that Cramer believes could continue to see gains this year:

Halliburton

- Cramer predicted that the stock has a multi-year rally ahead of it.

Constellation Energy

- The company will likely be a big beneficiary of funding from the Inflation Reduction Act, he said, adding that he believes Constellation Energy is the best operator of nuclear plants.

Enphase Energy

- Calling it the “renewable golden boy,” Cramer said the solar energy technology company is a profitable, solid business.

McKesson

- Stocks of drug distributors like McKesson tend to work well during an economic slowdown, he said.

Northrop Grumman

- The company’s stock could be the best defense contractor to own as the war between Russia and Ukraine continues, according to Cramer.

Here are the worst performers from 2022 that he believes could mount a comeback this year:

Netflix

- “I believe Netflix has turned itself around because they were so confident on that last conference call. You know, for almost two years, their conference calls were funereal, even when Squid Game took the world by storm,” he said, adding, “And lots of growth-oriented money managers want to find improving franchises, and that fits Netflix to a tee.”

Stanley Black & Decker

- Investors interested in the stock should start a small position here and gradually buy more on the way down, he recommended.

VF Corp

- Cramer said that while VF Corp stock had a “horrendous performance” last year, he’s betting that new interim CEO Benno Dorer will help the company return value to shareholders in 2023.

Meta Platforms

- Cramer said that while the stock has been a “disaster,” he believes that the metaverse will either take off or fizzle out this year. The former scenario would be good news for the company, while the latter would mean the company could divert its metaverse budget to other segments like Reels and WhatsApp, he said.

Advanced Micro Devices

- He said that while AMD stock has been battered by waning demand in personal computers this year, he’s still a believer of CEO Lisa Su and the company’s underlying business.

Disclaimer: Cramer’s Charitable Trust owns shares of Halliburton, Meta Platforms and Advanced Micro Devices.