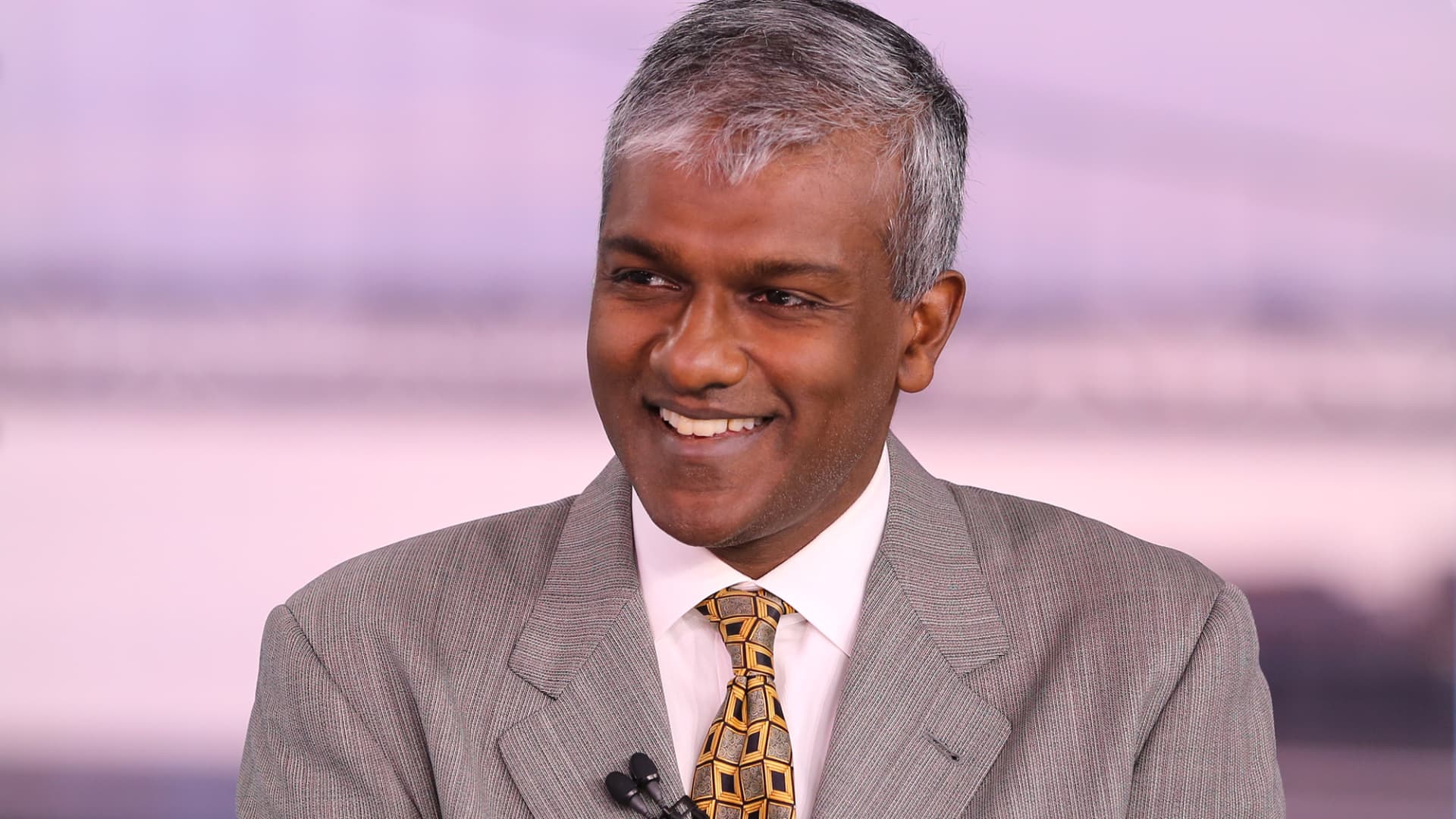

It can be been a rough yr for the stock market place, but investors who are hoping that the worst is more than could be in for a surprise, in accordance to hedge fund manager Dan Niles. He thinks the S & P 500 will see a Santa Claus rally right before hitting a new small in 2023. “Immediately after acquiring digested new gains above the class of this earlier week which we predicted, we feel the S & P 500 will then carry on to rally by means of year-stop,” the Satori Fund founder and senior portfolio supervisor explained to CNBC’s “Avenue Signs Asia” Friday. But he painted a grim photo for investors seeking ahead. “Why are we bearish for a longer period-phrase and believe that the S & P will strike a new low in 2023?” Niles requested in notes to CNBC Friday. His respond to: sticky inflation, earnings cuts, even now-significant valuations and anticipations of further desire fee hikes ahead. He is also expecting the U.S. economic system to slide into a economic downturn in 2023. ‘Don’t struggle the fundamentals’ Niles is no stranger to bear marketplaces, and when numerous traders have been remaining deep in the pink, he mentioned the Satori Fund has outperformed. Niles explained the U.S.-centered prolonged-brief fairness fund is up this 12 months, beating the S & P 500, which has declined close to 17% in the same time period. He did not disclose his fund’s specific overall performance. “Our fund is up for the year, up in December and is at its highs for the calendar year now by owning a prolonged-expression damaging watch on the S & P coming into the yr, but also by catching bear industry rally chances like the most current a person from October,” Niles told CNBC. Important to its outperformance is the tactic of pairing short positions with extensive types, Niles mentioned. Shorting is a system where buyers wager the selling price of a stock will slide. Conversely, buyers choose on lengthy positions with the expectation that the inventory will increase in price. Niles said his strategy was: “Be brief some thing that we imagine is extremely high priced, be very long one thing that we assume has absent down but has a elementary cause to adjust, and then test to have those people two factors near. And I believe that’s what you happen to be heading to see later on this calendar year.” He also stressed that traders should not “combat the fundamentals.” “We have produced income for the very first 11 months of the yr thanks to our shorts,” he mentioned, including that he thinks earnings estimates can continue to slide a further 20% from recent ranges as the financial system hurtles towards a economic downturn. The Satori Fund has brief positions in tech shares with advertising publicity, these as Google dad or mum Alphabet . That is amid looming levels of competition from streaming expert services Disney and Netflix , which have declared ideas to present reduced-priced membership tiers that occur with adverts. While tech stocks have bought off deeply this 12 months, it really is not all doom and gloom for the sector. Niles sees Meta Platforms and video clip gaming company Just take-Two Interactive as probable opportunities within just the house. He referred to “falling knife tech” — where by values have speedily dropped — as an location he could most likely pair with shorts in tech which have additional draw back possibility “Also, a more difficult stance toward TikTok below a distinctive U.S. govt would enable a lot of of the U.S. social media names. Interest by bigger tech businesses in the gaming room should really assist established a flooring for valuation,” he added.