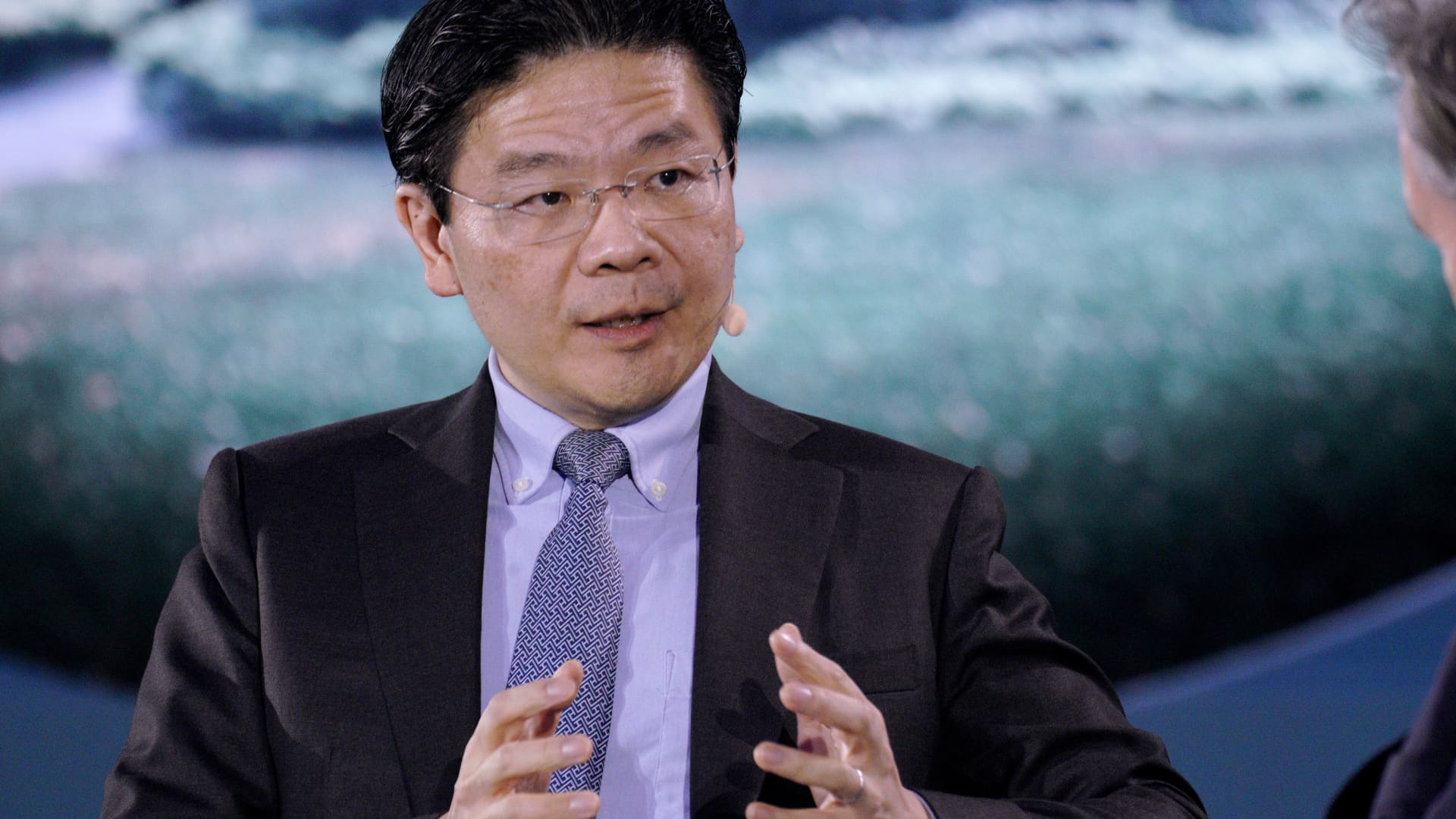

Lawrence Wong, Singapore’s finance minister, speaks through the Bloomberg New Financial system Discussion board in Singapore, on Thursday, Nov. 17, 2022.

Bryan van der Beek | Bloomberg | Getty Images

Temasek’s investment decision reduction of $275 million in the collapse of cryptocurrency trade FTX was “disappointing” and detrimental for Singapore, reported Deputy Primary Minister and Finance Minister Lawrence Wong.

Speaking in Parliament on Wednesday, Wong said that the losses Singapore’s sovereign prosperity fund endured had been “remaining taken severely.”

But the expense losses don’t indicate the governance method is not doing work, he explained. “Alternatively, it is the character of expense and threat-having.”

Temasek announced in mid-November that it will be composing down the worth of its expenditure in FTX to zero, “irrespective of the end result of FTX’s individual bankruptcy safety submitting.” Temasek also said that they at present have no direct exposure in cryptocurrencies.

What occurred with FTX thus has not only induced financial decline to Temasek, but also reputational injury.

Lawrence Wong

Deputy Prime Minister, Singapore

FTX has additional than 100,000 lenders as nicely as liabilities in the variety of $10 billion to $50 billion, according to a individual bankruptcy filing.

“What transpired with FTX therefore has not only caused economical loss to Temasek, but also reputational destruction,” Wong explained.

“Temasek acknowledges this and has issued a complete assertion to clarify its due diligence course of action and the situation foremost to its investment in FTX,” he said, adding that an inside critique is remaining conducted to study what went erroneous with the FTX deal and how to boost the approach.

He stated the government does not prescribe tips on the allocation of unique belongings or asset lessons, irrespective of whether for cryptocurrencies or other assets.

Ultimately, the federal government retains the boards and administration teams liable for formulating investment decision techniques in accordance with the government’s over-all risk tolerance, he said.

“What is critical is that our financial commitment entities just take classes from each failure and achievements, and keep on to get perfectly-judged dangers in purchase to realize very good all round returns in the prolonged term,” Wong claimed in reaction to Users of Parliament’s thoughts.

“In this way, we can proceed to include to our nationwide reserves and provide a secure earnings stream to fund govt systems for a long time to arrive.”

He pointed out that even with the composing off of the FTX financial investment, Temasek’s early-stage portfolio, as of March, created an internal rate of return in the mid-teens around the very last ten years — greater than the market ordinary.

The FTX decline will also not impact the internet investment returns of Singapore’s reserves, which are “tied to the over-all anticipated prolonged term returns of our investment decision entities and not to individual investments.”

The minister explained that going ahead, the Financial Authority of Singapore — the country’s financial regulator and central financial institution — plans to introduce some fundamental investor protection actions for digital payment token service providers which are licensed in Singapore.

Immediately after getting business and community responses, MAS will finalize the proposals and carry out proper regulatory actions.

But he cautioned that even with these measures, the financial authority will not be equipped to protect against crypto services vendors from failing.

“Individuals who trade cryptocurrencies ought to be organized to get rid of all their price. No quantity of regulation can eliminate this danger,” he warned.