Selling prices of fruit and veggies are on exhibit in a store in Brooklyn, New York Town, March 29, 2022.

Andrew Kelly | Reuters

International marketplaces have taken coronary heart in the latest weeks from information indicating that inflation may have peaked, but economists alert against the return of the “transitory” inflation narrative.

Stocks bounced when October’s U.S. purchaser price index arrived in under anticipations earlier this thirty day period, as traders commenced to guess on an easing of the Federal Reserve’s intense interest rate hikes.

Even though most economists count on a sizeable standard drop in headline inflation costs in 2023, lots of are doubtful that this will herald a fundamental disinflationary trend.

Paul Hollingsworth, chief European economist at BNP Paribas, warned investors on Monday to beware the return of “Crew Transitory,” a reference to the university of assumed that projected mounting inflation premiums at the start out of the year would be fleeting.

The Fed by itself was a proponent of this watch, and Chairman Jerome Powell sooner or later issued a mea culpa accepting that the central lender had misinterpret the condition.

“Reviving the ‘transitory’ inflation narrative may well feel tempting, but fundamental inflation is probable to continue being elevated by earlier expectations,” Hollingsworth stated in a analysis notice, including that upside threats to the headline fee up coming 12 months are even now current, including a potential recovery in China.

“Huge swings in inflation emphasize a single of the crucial options of the worldwide routine change that we believe that is underway: larger volatility of inflation,” he included.

The French bank expects a “historically significant” slide in headline inflation costs up coming year, with almost all locations observing reduced inflation than in 2022, reflecting a mix of foundation results — the adverse contribution to annual inflation amount occurring as thirty day period-on-month changes shrink — and dynamics involving supply and demand change.

Hollingsworth famous that this could revive the “transitory” narrative” subsequent calendar year, or at the very least a hazard that investors “extrapolate the inflationary developments that arise upcoming year as a indicator that inflation is quickly returning to the ‘old’ ordinary.”

These narratives could translate into formal predictions from governments and central banking institutions, he prompt, with the U.K.’s Workplace for Spending plan Accountability (OBR) projecting outright deflation in 2025-26 in “striking distinction to the present-day marketplace RPI fixings,” and the Lender of England forecasting appreciably under-goal medium-expression inflation.

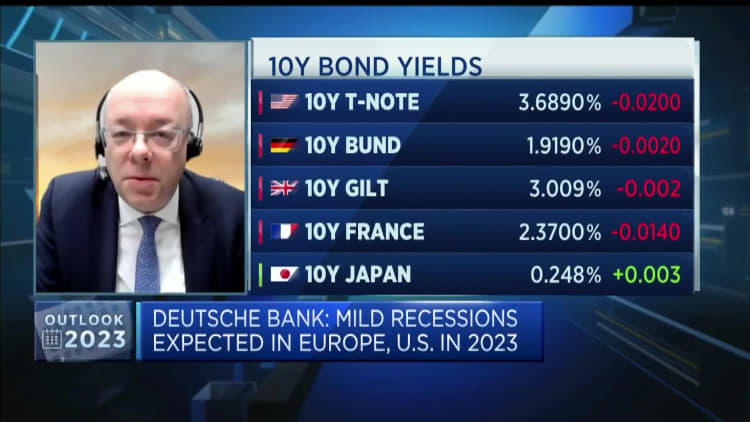

The skepticism about a return to regular inflation concentrations was echoed by Deutsche Lender. Main Investment Officer Christian Nolting advised CNBC previous week that the market’s pricing for central financial institution cuts in the second 50 % of 2023 have been untimely.

“Hunting as a result of our versions, we assume certainly, there is a gentle economic downturn, but from an inflation stage of perspective,” we consider there are 2nd-round results,” Nolting explained.

He pointed to the seventies as a equivalent period of time when the Western globe was rocked by an electricity crisis, suggesting that second-spherical effects of inflation arose and central banks “slash also early.”

“So from our perspective, we assume inflation is going to be reduced following yr, but also greater than when compared to prior many years, so we will stay at higher levels, and from that perspective, I consider central financial institutions will continue to be put and not minimize quite rapidly,” Nolting added.

Good reasons to be cautious

Some considerable rate increases through the Covid-19 pandemic have been commonly regarded not to truly be “inflation,” but a outcome of relative shifts reflecting distinct provide and need imbalances, and BNP Paribas believes the exact same is correct in reverse.

As these kinds of, disinflation or outright deflation in some places of the overall economy must not be taken as indicators of a return to the old inflation routine, Hollingsworth urged.

What is actually extra, he proposed that organizations may possibly be slower to alter costs downward than they had been to maximize them, specified the influence of surging expenses on margins over the past 18 months.

While goods inflation will probable slow, BNP Paribas sees providers inflation as stickier in part because of to underlying wage pressures.

“Labour markets are traditionally limited and – to the extent that there has probable been a structural factor to this, especially in the U.K. and U.S. (e.g. the improve in inactivity because of to extensive-expression illness in the British isles) – we expect wage advancement to remain fairly elevated by previous standards,” Hollingsworth explained.

China’s Covid coverage has recaptured headlines in current days, and shares in Hong Kong and the mainland bounced on Tuesday immediately after Chinese well being authorities claimed a new uptick in senior vaccination charges, which is regarded by gurus as essential to reopening the economic climate.

BNP Paribas assignments that a gradual peace of China’s zero-Covid plan could be inflationary for the relaxation of the earth, as China has been contributing small to international provide constraints in current months and an easing of limitations is “unlikely to materially improve offer.”

“By contrast, a much better recovery in Chinese need is most likely to set upward force on worldwide desire (for commodities in individual) and so, all else equivalent, gas inflationary pressures,” Hollingsworth stated.

A even more contributor is the acceleration and accentuation of the tendencies of decarbonization and deglobalization brought about by the war in Ukraine, he included, due to the fact both equally are probable to heighten medium-expression inflationary pressures.

BNP maintains that the change in the inflation regime is not just about exactly where price boosts settle, but the volatility of inflation that will be emphasized by large swings about the up coming a person to two several years.

“Admittedly, we feel inflation volatility is nonetheless most likely to slide from its present extremely high concentrations. On the other hand, we do not hope it to return to the sorts of concentrations that characterised the ‘great moderation’,” Hollingsworth said.