CNBC’s Jim Cramer said Tuesday that investors should gear up to buy oil next month, relying on charts analysis from Carley Garner.

“She thinks there could be one last washout from this week, possibly early through December, and that washout could take crude down to the low $70s, or even the mid-$60s. Once we get there, she believes that could be the mother of all buying opportunities,” he said.

related investing news

West Texas Intermediate crude futures, the U.S. benchmark for oil, saw wide swings this week after the Wall Street Journal reported Monday that OPEC members were considering an increase of up 500,000 barrels per day for OPEC+’s December meeting. Saudi Arabia later denied the report. News about Covid-related deaths in China over the weekend also added to oil’s volatility.

WTI crude futures settled at $80.95 a barrel on Tuesday.

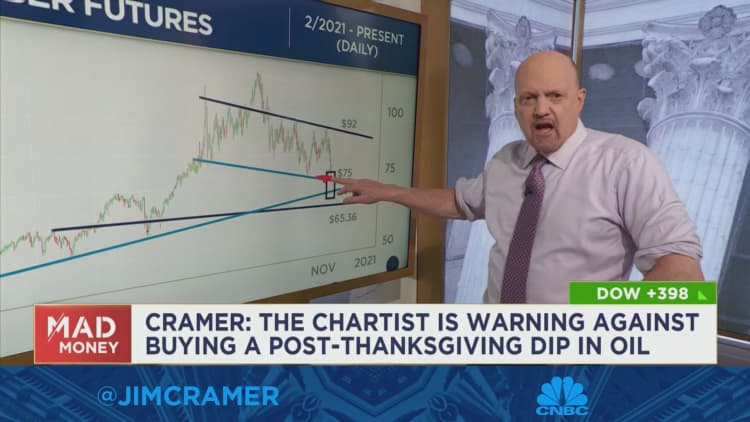

To explain Garner’s analysis, Cramer first examined a chart of the seasonal pattern in WTI crude.

This chart shows how oil tends to behave at different points during the year and reveals that the week of Thanksgiving tends to be ugly for oil, according to Cramer. “Historically, some of the most devastating oil declines have occurred on or about Thanksgiving day,” he said.

The chart shows that oil futures fell $10 on the Friday after Thanksgiving in 2021. Crude tumbled 10% during Thanksgiving week in 2018 and declined nearly 14% in 2014, he added.

Garner’s explanation for why Thanksgiving tends to bring such pain for oil is that the week includes the last trading day for December oil futures and that there’s always an OPEC meeting in late November or early December.

“Throw in the fact that holiday weeks tend to have very light volume, that means any moves tend to get blown out of proportion because it doesn’t take [as] much to move a commodity — or a stock frankly — during these lighter periods,” Cramer said.

For more analysis, watch Cramer’s full explanation below.