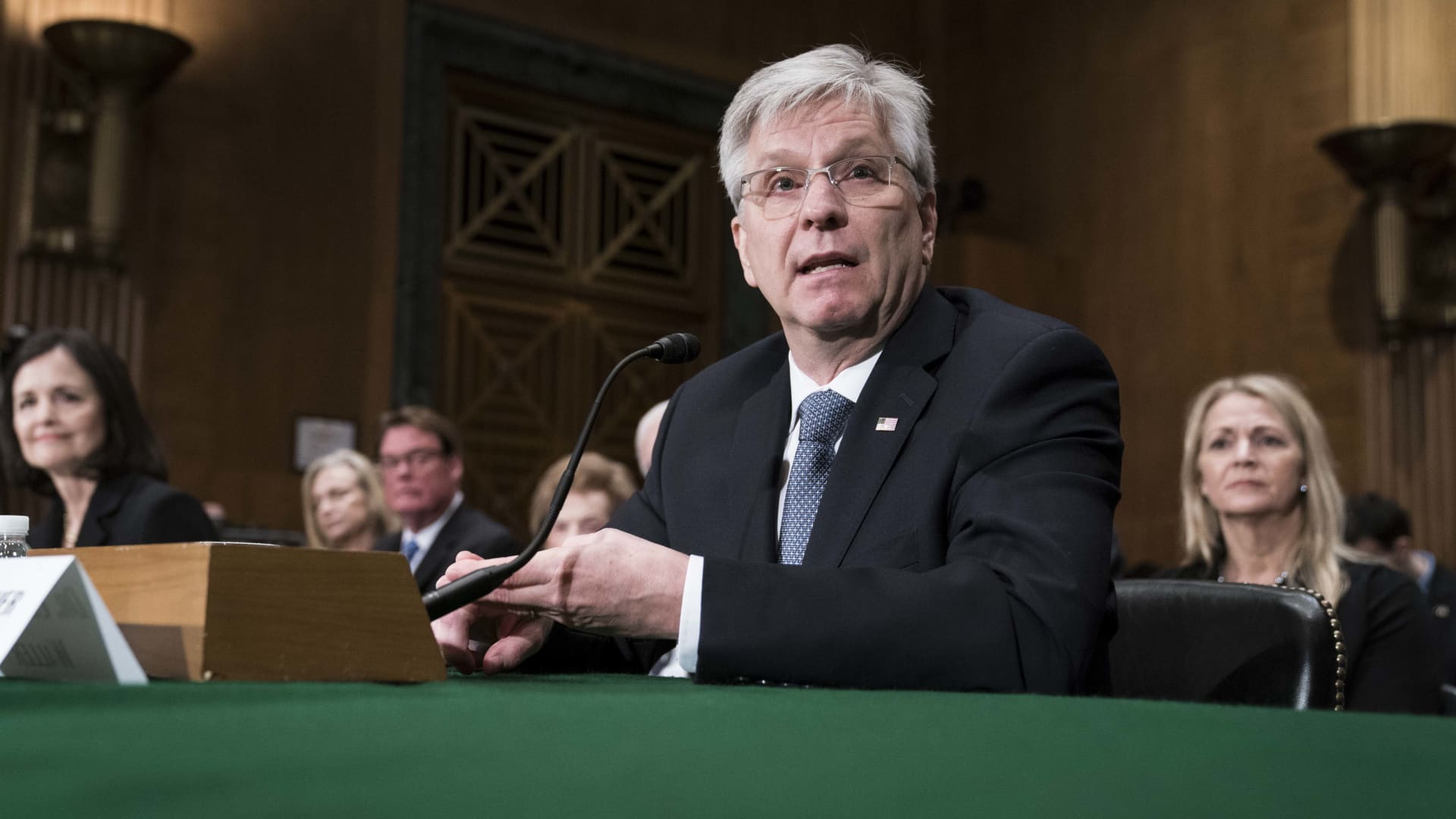

Christopher Waller testifies ahead of the Senate Banking, Housing and City Affairs Committee for the duration of a listening to on their nomination to be member-designate on the Federal Reserve Board of Governors on February 13, 2020 in Washington, DC.

Sarah Silbiger | Getty Photos

Federal Reserve Governor Christopher Waller explained Wednesday he is open to lessening the amount of curiosity rate will increase soon, so very long as the financial details cooperate.

The charge-placing Federal Open Marketplace Committee is set to fulfill Dec. 13-14. Marketplace expectations are working significant that policymakers will approve an additional fee hike, but this time opting for a .5 percentage point, or 50 foundation issue, shift. That would appear following approving four consecutive .75 percentage position raises.

“On the lookout towards the FOMC’s December meeting, the info of the past several weeks have built me much more comfortable looking at stepping down to a 50-basis-position hike,” Waller said in ready remarks for an event in Phoenix. “But I will not be creating a judgement about that until I see more data, which includes the up coming PCE inflation report and the next jobs report.”

The upcoming PCE inflation report is because of out on Dec. 1.

Traders have grown optimistic that a reduced-than-anticipated increase in October’s consumer rate index looking through is indicative that inflation is cooling. Headline CPI amplified .4% for the month and 7.7% from a yr ago, while the main reading through excluding foods and energy rose .3% and 6.3%, respectively. All the readings were being decrease than sector estimates.

The Fed favors main private intake expenditures selling prices, which rose .5% in September and 5.1% from a calendar year ago, as a gauge of soaring rates.

Waller mentioned he’ll be viewing the info intently as he stays suspect that the October CPI readings verified a new development. As a governor, he is an automated voter on the FOMC.

“While welcome information, we have to be cautious about reading far too considerably into one inflation report. I you should not know how sustained this deceleration in consumer costs will be,” he reported. “I cannot emphasize more than enough that one particular report does not make a trend. It is way much too early to conclude that inflation is headed sustainably down.”

In producing his evaluation, Waller explained he will be hunting at a few principal details factors apart from the broad inflation readings: Main goods costs, housing and non-housing solutions. He mentioned he’s observing encouraging signals on all three fronts but will need to have to see additional and vowed not to be “head-faked by 1 report.”

“Like a lot of some others, I hope this [CPI] report is the starting of a significant and persistent decrease in inflation. But policymakers simply cannot act based mostly on hope,” he claimed.

Earlier in the working day, San Francisco Fed President Mary Daly explained to CNBC that she expects at least a different share level of price will increase ahead. The Fed’s benchmark fee now sits in a focused assortment among 3.75% and 4%.