David Zaslav

Anjali Sundaram | CNBC

The advertising and marketing market is at the moment weaker than at any point during the coronavirus pandemic slowdown of 2020, Warner Bros. Discovery Chief Executive David Zaslav mentioned at an expenditure conference Tuesday.

If the advertisement sector isn’t going to improve next yr, “it is going to be challenging” to hit the firm’s $12 billion earnings forecast for 2023, Zaslav explained at RBC’s International TIMT Conference in New York.

Zaslav’s reviews sign a improve in rhetoric from large traditional media executives who usually claimed this summer time that promoting slumps were not considerable for them even as electronic media gamers noticed a pullback. Advertisers have reduced paying out as the Federal Reserve has raised interest fees to cool inflation, pressuring equities which includes media companies’.

Things got “a great deal even worse” for the duration of the past number of months, Zaslav mentioned.

Warner Bros. Discovery has experienced its valuation lower in fifty percent this calendar year. Other firms reliant on promotion, this sort of as Snap, Meta and BuzzFeed, have all fallen additional than 65% this yr.

Merging Discovery with WarnerMedia previously this calendar year has brought a sequence of unforeseen troubles for the reason that some assets had been “unexpectedly even worse than we considered,” Zaslav reported.

HBO went from producing more than $2 billion in 2019 to shedding about $3 billion past calendar year as material paying out surged, in accordance to Zaslav. The CEO has improved class for HBO Max as it gets established to merge with Discovery+ up coming year, including removing very low-rated demonstrates and larger finances movies created only for the streaming services.

“It truly is messier than we considered, it is substantially even worse than we assumed,” Zaslav explained. He included, on the other hand, that he failed to want to get a firm “that was seriously well operate” for the reason that it would have constrained the upside of the merger. Zaslav has been reducing prices because the offer shut in April and programs to lay off in excess of 1,000 additional employees before the finish of the calendar year, CNBC reported final thirty day period.

Athletics rights

Zaslav also claimed Warner Bros. Discovery would continue to be disciplined when NBA legal rights renewal conversations accelerate following yr.

“We you should not have to have the NBA,” Zaslav stated. The corporation has loads of sports choices without it, he extra.

Even now, Zaslav reiterated he’d like to do a deal with the NBA. He a short while ago renewed star broadcaster Charles Barkley’s contract for 10 many years, nevertheless the contract incorporates a clause the place Barkley could leave if Warner Bros. Discovery does not renew its carriage agreement. The NBA’s national Television set contracts expire immediately after the 2024-25 year.

Any NBA deal will need to be long run-seeking, explained Zaslav, incorporating both the firm’s streaming services and sporting activities assets, including Bleacher Report, which arrive at more youthful audiences.

Shares of Warner Bros. Discovery rose extra than 3% on Tuesday.

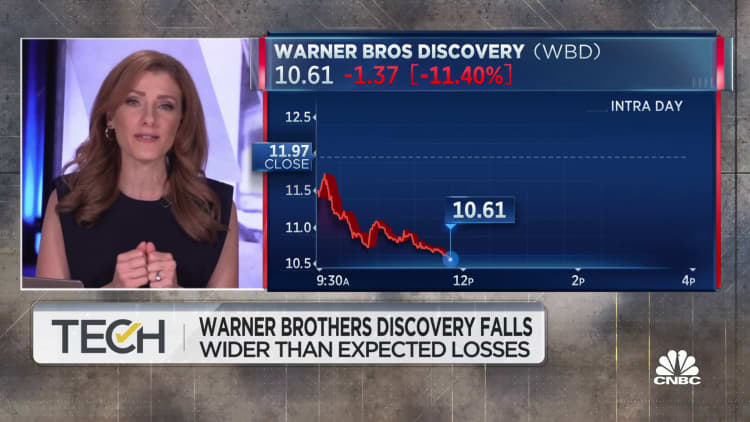

Watch: Warner Bros. Discovery surprises marketplaces with large losses