Wholesale prices increased less than expected in October, adding to hopes that inflation is on the wane, the Bureau of Labor Statistics reported Tuesday.

The produce price index, a measure of the prices that companies get for finished goods in the marketplace, rose 0.2% for the month, against the Dow Jones estimates for a 0.4% increase.

related investing news

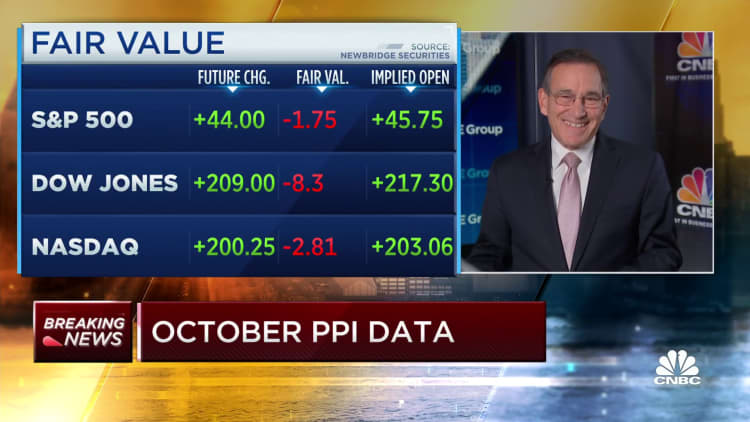

Stock futures tied to the Dow Jones Industrial Average were up more than 400 points shortly after the release, reflecting market anticipation that cost of living increases not seen since the early 1980s were easing if not receding.

On a year-over-year basis, PPI rose 8% compared to an 8.4% increase in September and off the all-time peak of 11.7% hit in March. The monthly increase equaled September’s gain of 0.2%.

Excluding food, energy and trade services, the index also rose 0.2% on the month and 5.4% on the year. Excluding just food and energy, the index was flat on the month and up 6.7% on the year.

One significant contributor to the slowdown in inflation was a 0.1% decline in the services component of the index. That marked the first outright decline in that measure since November 2020. Final demand prices for goods rose 0.6%, the biggest gain since June an traceable primarily to the rebound in energy, which saw a 5.7% jump in gasoline.

The deceleration came despite a 2.7% increase in energy costs and a 0.5% increase in food.

The index is generally considered a good leading indicator for inflation as it gauges pipeline prices that eventually work their way into the marketplace. PPI differs from the more widely followed consumer price index as the former measures the prices that producers receive at the wholesale level while CPI reflects what consumers actually pay.

Hopes that inflation is at least slowing spiked last week when the CPI showed a monthly gain of 0.4%, lower than the 0.6% estimate. The 7.7% annual gain was a deceleration from a 41-year peak of 9% in June. Markets also soared following Thursday’s CPI release.

Federal Reserve officials have been raising interest rates in hopes of bringing down inflation. The central bank has hiked its benchmark borrowing rate six times year for a total of 3.75 percentage points, its highest level in 14 years.

Vice Chair Lael Brainard said Monday she expects the pace of hikes soon will slow, through rates are likely to still go higher. She said the Fed can move to a more “deliberate” posture as it watches the impact of its rate hikes, which have included four straight 0.75 percentage point increases, are having on financial conditions.

In other economic news Tuesday, the New York Fed’s Empire State Manufacturing Survey for November registered a reading of 4.5%, an increase of 14 percentage points on a monthly basis and much better than the estimate for a -6% reading. The index measures the difference between companies reporting expansion vs. contraction.

However, both the prices paid and received components saw increases, rising 1.9 points and 4.3 points respectively.