Investors who want to capitalize on the struggles of large-cap technology stocks should remain patient, CNBC’s Jim Cramer said Monday, citing technical analysis from Carolyn Boroden.

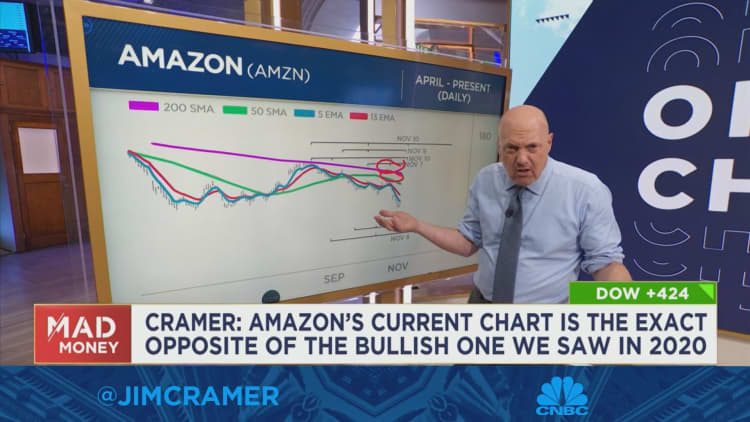

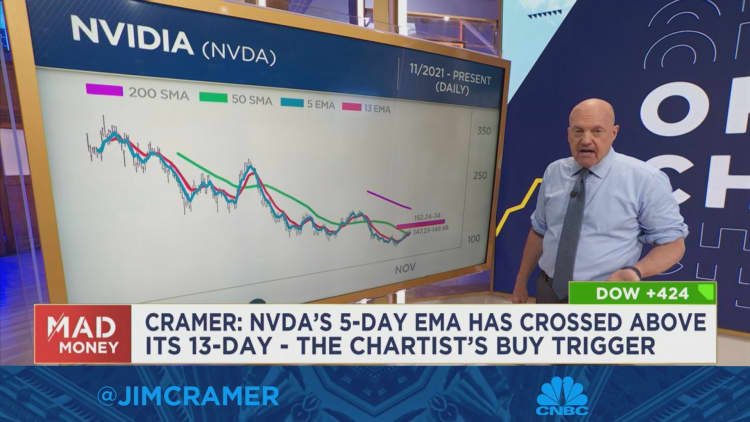

“The big tech stocks have been hammered from their highs, but the charts, as interpreted by Carolyn Boroden, suggest it probably isn’t safe to start bottom fishing, even if those charts begin to improve a bit,” the “Mad Money” host said. “Amazon and Alphabet simply aren’t in buy-the-dips situations.”

To illustrate the point, Cramer presented a chart from Boroden — a technical analyst whose work is often discussed on the program — that shows Alphabet shares below their 200-day and 50-day moving averages.

Carolyn Boroden’s latest technical analysis on shares of Alphabet.

Mad Money with Jim Cramer

“It’s got a general pattern of lower lows and lower highs,” Cramer said, which is a “very, very negative” sign for technical analysts. “The five-day exponential moving average is below the 13-day,” he added, noting that is Boroden’s “personal sell signal.”

In general, Cramer said Boroden believes Alphabet — along with other tech giants with downtrodden stocks this year — will not be able to return overnight to bullish trading patterns that defined 2020 and much of last year, too.

“Of course, she thinks it’s possible we could get some oversold rallies here,” Cramer said. However, he added, “the stock has a lot of resistance on the way up, though. You’ve got a bunch of ceilings running from $88 to $93. … Given the lack of anything bullish in this chart, Boroden wouldn’t bet on Alphabet breaking through this ceiling.”

For more analysis, watch Cramer’s full explanation below.